Have you been told you need to set up an IOLTA but aren’t even sure where to begin?

Or worse…are you worried you are going to do it incorrectly, not understanding IOLTA account rules, and be met with legal consequences without even realizing it?

If you are trying to set up an IOLTA for your law firm, it’s important you understand what is an IOLTA account, what purpose it serves, and why it’s vital you follow the appropriate protocol to ensure you’ve done it legally.

Practicing law has plenty of complexities, regardless of what area you specialize in.

Trying to navigate the accounting and bookkeeping tasks for your IOLTA checking account on top of that can be overwhelming and a huge waste of your valuable – and billable – time.

Even more concerning can be when an accounting procedure is done inappropriately and may even result in legal consequences, causing trouble for you or your law firm.

One big area of concern for many law firms is the setting up and maintaining of an IOLTA trust account. If not done correctly, your firm could face serious penalties and could even end in the disbarment of one or more attorneys within your practice. Educating yourself on what is an IOLTA account and what the requirements are for your state are vital first steps.

The good news for your law firm is this.

With the right accounting software and proper management, establishing and understanding the IOLTA meaning is not difficult, and maintaining it can be even easier, once you’ve got the appropriate procedures and people in place to ensure that everything is tracked properly and running smoothly.

Let’s learn more about what is IOLTA account, what purpose this type of trust account will serve, and what the best way is to establish and monitor the IOLTA for your law firm.

What is an IOLTA?

To begin answering the question what are IOLTA accounts you need to know what does IOLTA stand for? IOLTA stands for Interest on Lawyers Trust Accounts.

IOLTA was first established in the United States in 1980 when federal banking laws that surrounded attorneys’ checking accounts began to be changed.

Up until 1980, it was customary for law firms to hold clients’ money in non-interest-bearing checking accounts.

Often, when a client retains an attorney, they give them a set “retainer fee” that the attorney then uses to pay for the expenses billed to the client. A client trust account is simply money that is to be used for firm expenses related to that client’s case.

Schedule a demo

The reason that clients’ retainers were put into non-interest-creating bank accounts was that the government had decided it was unethical for attorneys to receive any sort of interest or financial benefit from a client’s money they were holding for them.

It was also illegal for commercial banks to allow checking accounts to collect interest.

But, with the passing of federal regulations that allowed checking accounts to be able to pay out interest to their customers, a new challenge was realized for law firms’ accounts.

When a law firm is holding a client’s retainer funds, what should be done with any interest accrued? And what should be the rules governing this type of trust account?

This is where IOLTA came into existence and became customary for handling each client’s trust account.

With the creation of these trust accounts, attorneys could now deposit their client’s retainer funds into an interest-bearing trust account where the money would be held and used to pay their legal fees as needed.

Each state has its own rules and regulations that surround its IOLTA program for law firms practicing in their state. So if you’re curious about a New Jersey IOLTA account or you’re interested in an IOLTA account Texas-based, you’ll need to consider the specific requirements for IOLTA NJ.

While many states manage their IOLTA accounts through the state bar’s charitable organization, some states have set up an entirely separate institution to regulate and administer interest funds that are created from the dollars held.

What Happens with the Interest Generated from an IOLTA Bank Account?

Since it is illegal (and would be unethical) for an attorney to benefit from any interest that is earned on their client’s retained funds, the money that is generated from an IOLTA is instead used for various charitable endeavors throughout each state.

Though many states have established different protocols around interest that is generated from these trust accounts, certain similar statutes tend to apply.

Most states use the interest earned from their IOLTA for services such as paying for legal aid for people who are low-income or have other limitations when it comes to retaining legal representation, providing grants for certain non-profit organizations in their state, establishing law scholarships at local universities for students who can’t afford law school, and supporting other civil legal services as deemed necessary.

By participating in their state’s IOLTA, law firms can comfortably count on their client trust accounts being safe, secure, and regulated as their specific states have required.

But it is imperative that law firms do their due diligence when setting up these accounts.

Are IOLTA Accounts the Same as Other Bank Accounts?

Though IOLTA accounts will differ from your regular bank account, you can usually open one for your law firm with the same institution you currently have your regular business banking accounts.

In order to know whether or not your banking institution can open an IOLTA account for your law firm, you will first need to find out if they are eligible to do so.

Each state has specific criteria surrounding an IOLTA account and great care is taken to ensure that a financial institution meets the rules and regulations that have been established. If you’re a firm in New Jersey, you’ll need to understand the NJ IOLTA requirements.

Once you’ve confirmed with your bank that they are eligible to set up an IOLTA trust account for your law firm, you will then need to make sure the account is either set up with you (or your law firm) set as the designated owner, but that the lawyer’s trust fund of your state is designated as the entity that will receive any interest that is created on the account.

Make sure – under no circumstances – that any interest earned on the IOLTA account is deposited into any business or operating account that is held by your law firm.

One way to guarantee that all interest is being paid to the IOLTA in your state is by making sure the bank knows that this account must use the tax identification number (TIN) of the IOLTA in your state.

Your banking institution probably has this TIN on file, assuming they have already set up these types of accounts for other law firms in your state.

You will now receive statements from this account as you would any other. Ensuring that the appropriate funds are being sent to the IOLTA program is an imperative part of every law firm’s accounting system since this fund is government regulated and if the interest is not being administered properly, you could find yourself paying some significant penalties or even face legal action.

Schedule a demo

Just remember – setting up your firm’s IOLTA account needs to be done with care.

Government regulations surrounding the interest earned on clients’ money are very specific and it can be a serious matter if it’s found that your firm handled these funds inappropriately.

Law firms are carefully regulated for any misuse of the IOLTA funds even if it was unintentional.

What Are Some Definite “Don’t Dos” When Operating an IOLTA?

Most law firms have a clear understanding of how important it is to have a well-established and carefully managed IOLTA set up for their firm.

After all, few people understand the law better than an experienced and educated attorney!

That said, no one is above making a mistake, even the smartest and most thoughtful of us out there. Usually, a mismanaged IOLTA is from ignorance, not intent.

But – it can still result in harsh penalties and possible disbarment if the situation is serious enough.

To avoid such problems, it’s important that you are aware of what sort of actions could result in dire consequences if your IOLTA is found to not be meeting the government requirements that were established by your state.

Some of the most common areas that law firms find themselves in trouble when it comes to their IOLTA accounts is surrounding poor bookkeeping or not having adequate law firm accounting software.

Oftentimes this is not intentional, just negligent.

Making sure that your firm is never borrowing money from your IOLTA account is crucial. It’s also important that you make sure there is no connection between your business banking accounts and your IOLTA account.

You will also need to make sure that when you record a client’s retainer into your IOLTA account, you make sure that the retainer has not been recorded as income into your firm. This is a major difference in managing the IOLTA account vs escrow account management.

It can be tempting to want to record retainers as income when you enter it into your accounting software, just because it is faster and seems more simple.

But – it will not be simple in the long run. In fact, recording these retainers as income can end up leading to a big mess down the road.

Think about it this way…when a client gives your law firm a retainer deposit, they are providing you with money that is to be used for future services. In essence, those funds still belong to your client and therefore, can’t be recorded in your books as income you’ve already earned. This goes back to the fundamental IOLTA account meaning and must be remembered!

Good law firm accounting software can help you to rectify this issue and make it much easier for you to record each transaction separately and as it should be.

Not only will this keep you out of trouble with federal regulators, but it will also make things much simpler and straightforward when it comes time to complete your state and federal business taxes at the end of the year.

Is There Law Firm Accounting Software that Can Help with My IOLTA?

Much of this might sound extremely complicated and not the type of work you want to be spending your days doing.

Let’s face it – your firm’s operating account does not increase when you aren’t creating billable hours. And dealing with bank accounts, government regulations, legal accounting software, operating accounts, and your law firm’s money is probably not necessarily the best use of your time.

This is where 3-way trust reconciliation comes in to play.

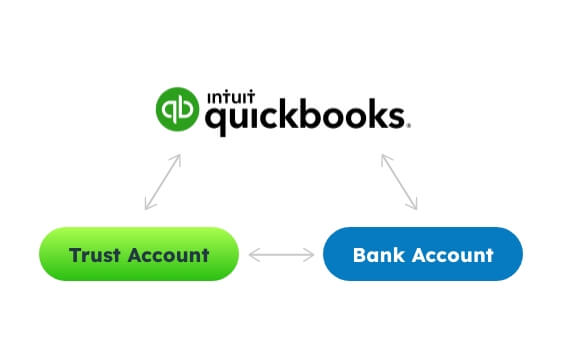

Using a law firm accounting software program like LeanLaw will allow for your firm’s bank accounts, trust accounts, and QuickBooks Online accounting software to synched with one another and always have the most up-to-date information available across all three platforms.

This means that you will have to spend much less time on your monthly reconciliations for each account, as a good deal of the accounting heavy lifting will have already been done for you.

Even if you have an excellent accounting department, keeping all the accounting functions moving in a smooth and efficient manner can be challenging without the right accounting software to help.

And – not just any accounting software is going to work for a busy law firm.

In fact, because of the nature of your firm’s work, you may find that some accounting software will actually be more problematic for you or your staff to use than not having the accounting software at all.

The way in which a law firm must track billable hours, record each trust account, keep track of each interest-bearing trust account, and provide client invoices means that very specialized law firm accounting software should be considered in order for your law firm to operate efficiently and effectively.

The good news is that this type of accounting software is available and can serve your law firm in a way that has not been possible before. We can take you from writing an IOLTA check to the digital age!

What’s the Best Legal Accounting Software for My Law Firm?

Though there are several different law firm accounting software programs available, there are a number of reasons that LeanLaw stands out from the rest.

LeanLaw was created by an attorney. For other attorneys.

After practicing law for over 25 years, our founder recognized the need for better practice management that would start with better legal accounting software.

The vision was simple.

Lawyers do best when they are not consumed with the everyday tasks of operating their business.

Though every good lawyer understands the importance of good legal accounting software, they also know that their time is best spent focusing on clients’ cases.

They went to law school to become lawyers. Not accountants.

They don’t want to have to worry about their firm’s operating account, client funds, lawyer trust accounts, or trying to track invoices.

A good lawyer will appreciate the importance of these tasks when it comes to running a strong and profitable business. But he or she will also be happier and more successful if they have the best accounting software to do the majority of this for them.

Our founder realized all of this and more.

Lean Law is now run by a team of passionate individuals who understand the practice of law and all the nuances that come with it. And they are skilled at helping you achieve the best legal accounting software on the market.

From helping your law firm establish how to collect credit card payments, online payments (or good old fashioned checks!), to setting up an operating account and IOLTA accounts, our company can do as much or as little as your firm needs to get the most out of your practice management systems and run a successful and profitable law firm.

Small law firms and mid-sized law firms will benefit the most from our services, as we can take on the job that an in-house accounting department or bookkeeping service would normally provide.

We can help with your document management and teach your team from what is IOLTA accounting to the best practices for ensuring that our law firm accounting software is being used to the best of its ability and you are getting back the investment you have put in.

Let us help your firm do what it does best…practice law in a way that is good for your clients and profitable for your business.