For any law firm trying to obtain a clear understanding of its various accounting needs, understanding what is an IOLTA account and why they are important is going to be a crucial step to your accounting success.

Oftentimes a law firm will have client funds that are held for services not yet performed. These funds are typically referred to as a retainer, or retainer fee.

Sometimes a client will have a retainer fee that is significant enough to warrant being held in its own separate account established solely for that individual or organization.

In this case, a firm will open a bank account specifically for this client. These are referred to as lawyers trust accounts.

But – it is also quite common for a law firm to have a fair number of clients that don’t need their very own bank account.

This is usually the case when a law firm is representing an individual or organization for one specific case, and not necessarily establishing a long-term relationship.

When a firm has retainers from clients such as these, they will still need to make sure these funds (retainers) are held in an account that is separate from the firm’s operating account.

It is absolutely imperative that a client’s funds never – under any circumstances – be held in a firm’s operating account.

So – how does a firm hold these smaller retainers without having to open numerous accounts, or worry that they aren’t being held appropriately?

This is where an IOLTA account comes in.

The History of IOLTA Accounts

In the 1980s, legislation was passed to establish what is now known as IOLTA accounts, which stands for Interest on Lawyer Trust Accounts.

These are accounts were set up as a way for attorneys to be able to hold client funds while not allowing them to be held with their own operating funds.

Schedule a demo

It was also a way that these client funds could be held in banking account that was also earning interest.

Clearly, an attorney or their law firms can’t benefit financially from interest earned on client funds.

The interest earned on IOLTA accounts quickly became an innovative method of raising money that was then used to help fund civil legal services for low-income people.

Through the use of the interest earned on these lawyer trust accounts, states are able to help offset costs associated with civil legal services in each state.

Each state IOLTA program is set up independently and is organized by that specific state.

Many states’ IOLTA programs are managed by the state bar association and not only help pay for civil legal aid but may also be used to fund scholarships for underprivileged students looking to go to law school, fund grants through various not-for-profit organizations in the state, or may be used to provide civil legal services in other areas that the program deems necessary.

The important part for a law firm to remember when handling short term client funds in IOLTA accounts is this:

Regardless of how your state’s IOLTA program uses and distributes interest generated on these funds, it is incredibly important that you have the right interest bearing trust account set up to keep these funds separate from any of your operating accounts.

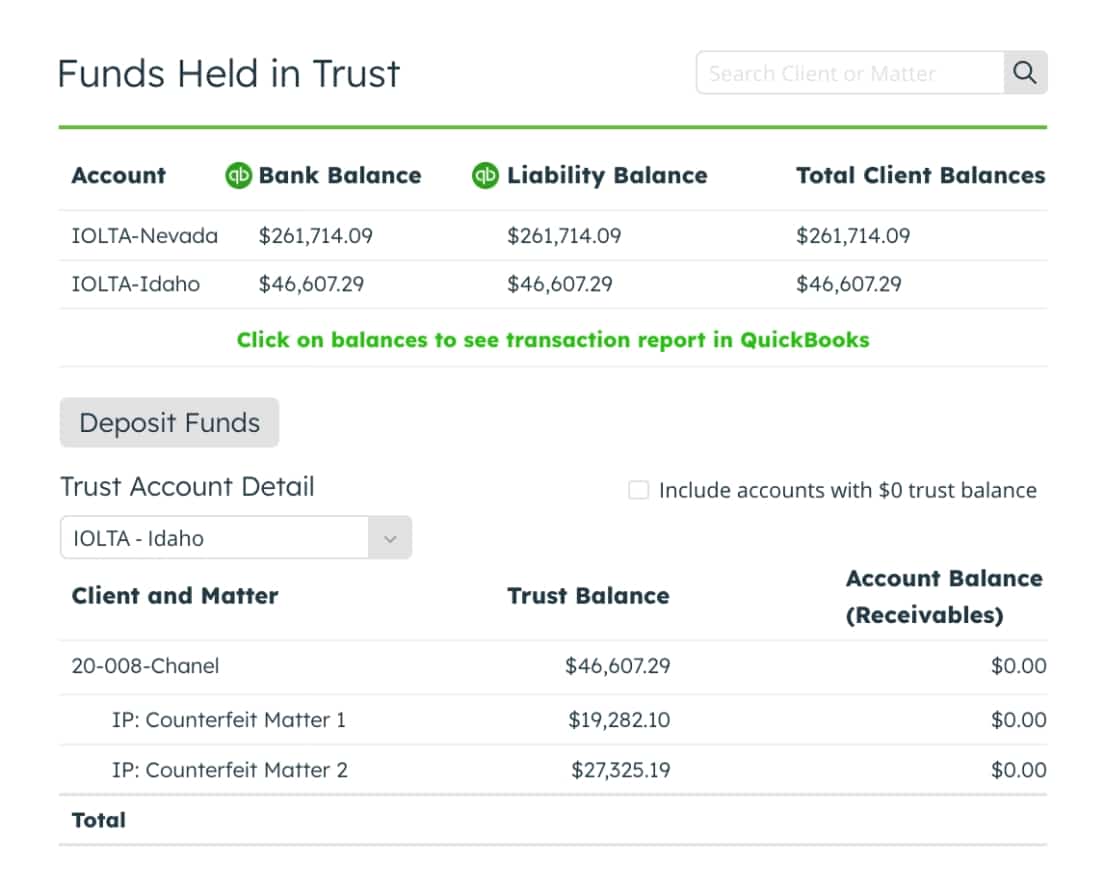

You also need to make sure that your accounting software is capable of tracking all deposits, withdrawals and interest earned from all your firm’s various accounts, so that there is never a question about a transaction… especially those made to or from your firm’s IOLTA account.

Not only can a firm end up being fined if there is reason to believe that interest on lawyers trust accounts were mismanaged, but even disbarment is a potential consequence in cases where IOLTA funds have been poorly allocated or accounted for.

Not Sure Where to Start?

For many attorneys today, having accounting software that is specifically designed for the unique operation of a law firm is going to go a long way in not only helping you keep track of your different accounts, but in plenty of other ways as well.

The right legal accounting software is going to do so much more than just keep track of your billing hours, accounts receivable, or accounts payable…obviously all necessary factors to running a successful law firm.

But the best legal accounting software will give you even more.

LeanLaw is accounting software that has been designed by attorneys for attorneys. From keeping track of how funds are flowing in and out of trust accounts, operating accounts, and IOLTA accounts – to making budgeting accounts with our three-way reconciliation process – LeanLaw has quickly become a leading resource for law firms everywhere.

If you value having the most accurate, transparent and streamlined accounting practices possible, consider LeanLaw for your firm’s accounting software needs.