Anyone who has ever had to set up an IOLTA account for their law firm knows that – though the steps may seem quite easy, the process can be more complicated than it looks.

Every good law firm knows the importance of having a secure account specifically established for client funds.

This account must be separate from the law firm’s other operating accounts and will be set up as an interest-bearing trust account.

And, it can often be set up at the banking institution where your firm’s other accounts are already established.

So far this all sounds pretty straightforward, right?

Even if accounting isn’t your strong suit, setting up and managing bank accounts probably doesn’t sound that difficult but it does require understanding IOLTA meaning, laws and details.

But here’s where things can change.

An IOLTA account must follow very specific rules and regulations, and many of those can differ depending on which state you are in.

The American Bar Association takes client funds and IOLTA accounts very seriously, as will your local and state government, your financial institution, and your clients.

Violating the rules and regulations associated with your state’s IOLTA program can find you and/or your law firm being penalized, or possibly even disbarred.

And – even if the mismanagement or misappropriation of an IOLTA account was just a bookkeeping mistake, you may find yourself having a hard time proving that.

So…what exactly is an IOLTA account, and how do you go about setting one up?

The American Bar Association takes client funds and IOLTA accounts very seriously, as will your local and state government, your financial institution, and your clients.

Violating the rules and regulations associated with your state’s IOLTA program can find you and/or your law firm being penalized, or possibly even disbarred.

Schedule a demo

And – even if the mismanagement or misappropriation of an IOLTA account was just a bookkeeping mistake, you may find yourself having a hard time proving that.

So…what exactly is an IOLTA account, and how do you go about setting one up?

The History Behind the IOLTA

It wasn’t until the 1980s when federal regulations changed, allowing banks to offer their customers interest-bearing checking accounts, that the concept of establishing IOLTA accounts came to fruition.

Shortly after the Florida Bar Association launched the first of our country’s IOLTA programs, the majority of the rest of the states followed suit.

An IOLTA account is one where a law firm deposits retainers that have been paid to them by clients, for services that have not yet been provided.

Typically, an IOLTA program holds short-term client funds – money that will be used relatively quickly to help settle a specific case.

This allows lawyers to be able to draw from the client’s retainer when hours are billed, without having to maintain a large accounts receivable chart of accounts.

IOLTA stands for Interest on Lawyer Trust Accounts and is a state-regulated bank account that serves as a client trust account for each law firm.

These client trust accounts not only hold the client’s retainer amounts but will also bear interest on those dollars.

Since it would be unethical for an attorney to benefit from interest earned on a client’s funds that are not yet appropriated to the law firm, the interest on an IOLTA is then transferred to the state’s IOLTA program.

Once the interest is transferred, the state then uses these funds for a variety of programs, which can differ from state to state.

Usually, these funds are used for civil legal services for those who can’t afford legal services in that particular state.

Civil legal services can also be things like setting up scholarship funds for law students and giving grants to local charities.

It is imperative that each law firm has an established IOLTA for their client funds under the laws of that state.

Law firms that don’t abide by this law, or mismanage the interest earned on these accounts can find themselves in trouble with their state bar association.

How Do I Set Up an IOLTA Account in My State?

To set up an IOLTA, most law firms will contact the firm’s banking institution to find out if they participate in the state’s IOLTA program.

If not, most likely your state bar association will have a list of financial institutions that participate in the program.

Once you’ve determined where you want to set up your firm’s IOLTA account, there are a number of forms that will need to be filled out.

Again, a reputable bank that understands the regulations surrounding your state’s IOLTA program should be able to help you accomplish this.

After the account is open, this is where the trickier part starts.

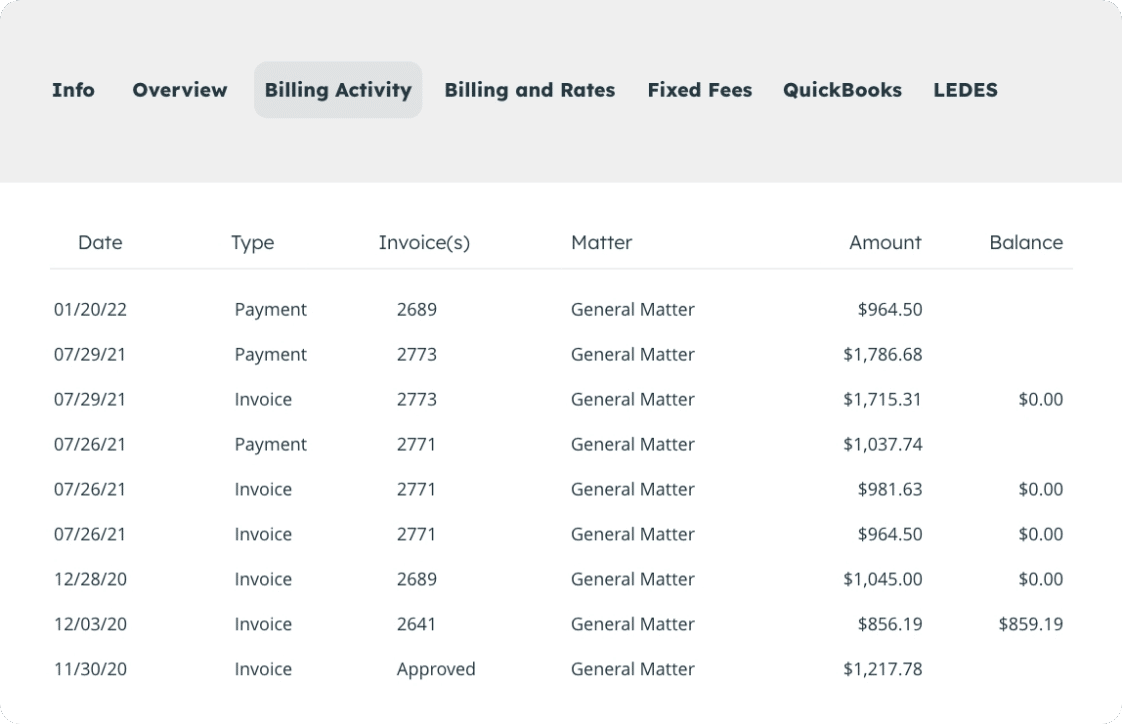

As client retainer funds are placed into that IOLTA account, you will want to be very clear in your accounting process as to who those funds belong to and how and when they are disbursed into your operating account.

You will also need to have a system that is able to correctly itemize each disbursement and be able to track interest earned and show the transfer of that interest to the state’s IOLTA program.

Failing to have clear reconciliation records of each of these transactions is what can result in dire consequences when and if your firm is asked to present records or balance sheets on any of these accounts

Even an innocent error can lead to penalties for your firm.

Worse, a state may decide your errors or negligence were concerning enough to end in disbarment.

The good news is that all of this can be prevented by having a solid law firm accounting software system that is designed to work with the specific specifications needed for law practices.

Because of the nature of legal work, the majority of accounting software programs are going to fall short of being able to perform many of the specific tasks that are needed.

From appropriately tracking billable hours to appropriately tracking client funds, every law office needs to know that the accounting software they are using is efficient, effective, and easy to use.

Whether your firm deals with personal injury law, estate law, or anything in between, you can not underestimate the importance of accounting software that keeps your finances in order and allows everyone in your firm to work smarter, not harder.

Working with LeanLaw’s law firm accounting software will take the guesswork out of correctly establishing, maintaining, and reporting on your lawyer trust accounts, your client trust accounts, and your overall software system.

By using real-time, three-way reconciliation between your financial institution and your accounting software, Lean Law can give you the peace of mind that your accounts are in sync, your data is accurate, and your law firm is in compliance with your state bar’s rules.