For any law firm that is going to be receiving client funds, it’s important to familiarize yourself with the various ways these funds need to be accounted for, what are IOLTA accounts and what sort of options you have for handling them.

It’s common for law firms to receive and handle clients’ money on a relatively regular basis, usually for billable hours and services that haven’t yet been performed.

These types of client funds are referred to as a retainer fee. And, though a retainer fee doesn’t necessarily cover the total cost of the services that are expected to be rendered, it will serve as a way to secure a certain amount of an attorney’s time and resources in the future.

Sometimes a retainer fee can be quite large. In instances where this is the case, it’s normal for a law firm to have a separate trust account set up for that individual client.

And – because it is vitally important that a law firm never mix a client’s funds with their operating account, a completely separate trust account will be set up for that specific client.

It is also common for law firms to have a number of clients who give them a retainer that is not large enough to warrant its own trust account.

This is often the case when an attorney is working with a client on one specific case, but does not necessarily have an ongoing, long-term relationship that may necessitate larger sums of money to be held in its own trust account.

In a situation such as this one, it is most prudent to place that client’s funds into a bank account with other such retainers that are only meant to be held for a short period of time.

Short term client funds will be put into client trust accounts which are usually referred to as lawyer trust accounts, or IOLTA accounts.

What is an IOLTA Account?

IOLTA – which stands for Interest on Lawyers Trust Account – are accounts that were established in 1981, after legislation passed that allowed client funds to be held in an interest bearing trust account until needed.

Before this legislation, client funds could not be held in banking accounts that were set up to bear interest.

With the passing of this legislation, it was also decided that the interest earned on these types of lawyer trust accounts would be used for charitable purposes, since a law firm can not benefit from any interest earned on their client’s money.

IOLTA accounts must be set up through a banking institution that participates in following the guidelines on these types of trust accounts.

It is very important that – when setting up an IOLTA account – you remember that since these are interest bearing trust accounts that hold client funds, they will always need to be separate from any operating account held by the law firm.

What Happens to the Interest Earned in an IOLTA account?

Each state has its own rules and regulations for IOLTA accounts and most of the interest generated is used for civil legal services for those who can’t afford legal representation in that state.

In addition to civil legal aid, sometimes the interest on lawyer trust accounts is also used to fund scholarships for underprivileged students wanting to become involved in providing legal aid to others, or it may even be used to help fund grants for specific not-for-profit organizations around the state.

But as stated earlier, the interest earned on IOLTA accounts should never be used to the financial benefit of the law firm.

In fact, most states have strict guidelines for setting up and maintaining an IOLTA account and – without the proper management – an attorney can end up with a hefty fine or even face disbarment from the state bar for the mismanagement of these types of client trust accounts.

How Do I Know If I Need an IOLTA Account?

For any law firm that is holding short term client funds, you’ll need to set up an IOLTA account with a local financial or banking institution in your area.

Not all banks participate in IOLTA programs but finding one that does should not be difficult.

Once you’ve set up your account, you’ll want to make sure you maintain proper accounting records, showing all transactions that occur between the IOLTA account, the state IOLTA program, and your firm’s operating account.

Schedule a demo

Having the appropriate accounting software is going to make this process much more transparent for your banking institution and your law firm.

Good accounting software will also make this process much easier for you as well.

Where do I Find the Accounting Software to Help Me Keep All of This Straight?

As the top-rated legal app in the QuickBooks online marketplace, LeanLaw can help your firm make sure that all of your legal accounting is done with accuracy, efficiency, and in a way that makes sense to its users.

Since trust account tracking can be incredibly complicated (and cause legal problems if not done correctly!) you need an accounting product that eliminates the possibility for errors and gives you a clear understanding of how to manage the movement of money from each of your different accounts.

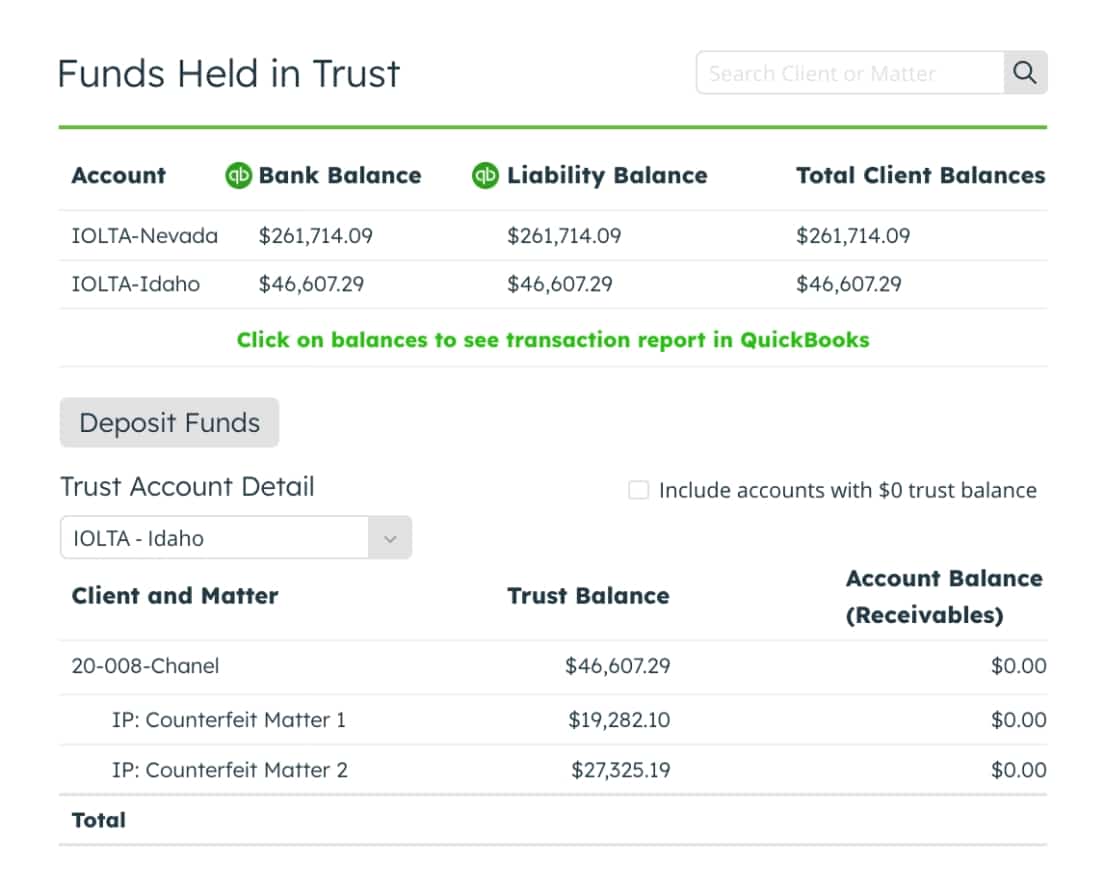

LeanLaw’s integrative accounting software program works to keep track of these movements electronically and is always in sync with your various bank accounts as well as your QuickBooks online software so that whatever numbers you are looking at, you know they are accurate in real-time.

Our accounting software also uses three-way reconciliation, which means that you’ll never have to worry as to whether your IOLTA accounts are reconciled correctly.

Lean Law software is designed to keep track of any potential red flags that may cause an account to not reconcile properly and will never let an account be out of sync with the others.

If you are ready to stop wrestling with and worrying about your law firm’s accounting system, take a look at what Lean Law can offer you. Once you book a live demo, we think you’ll be surprised you hadn’t done so sooner!