For any law firm that collects client funds, there are going to be some very specific rules and regulations around the way that money is handled and what needs to be done when reporting it.

Though each state may be different, it is widely known that – no matter where you are practicing law – client funds must be handled in some very particular ways.

Why is this the case?

It is important to remember that any money that a lawyer or law firm collects from a client before services are rendered can not be placed into a law firm or lawyer’s operating fund.

Usually referred to as a retainer, it is common practice for clients to pay their lawyer ahead of time for work that has not yet been done on their behalf.

Schedule a demo

Retainers make it easy for an attorney or their support staff to be able to work on a client’s behalf without having to constantly send out invoices or bills.

It’s also a way for a client to guarantee to their law firm of choice that they can and will be able to pay for services as they are provided.

But again – the money that is given as a retainer still belongs to the firm’s client until it is earned by the attorney or used for expenses pertaining to their case.

If the entirety of the retainer is not used, then it must be returned to the client.

How is a Client’s Retainer Held?

In order to make sure that a client’s retainer is not used for operating expenses before the client is invoiced, law firms will need to set up separate banking accounts for these funds.

Under no circumstances should a client’s money ever be deposited into a firm’s operating account until services have been rendered and an invoice has been sent to the client.

If a client has given a firm a particularly large amount of money in their retainer, these funds may be deposited into a lawyer trust account that is specifically earmarked for that client.

Most lawyer trust accounts are opened at the bank or financial institution where the lawyers already have opened other accounts.

But oftentimes a law firm will have clients whose retainers are not substantial enough to warrant their own bank accounts.

In cases like this, it is common practice for the firm to open an account where all client funds under a certain amount will be placed together.

IOLTA Accounts: How to Hold a Client’s Funds

In order to properly care for a client’s retainer before the money is used, law firms will set up what is referred to as an IOLTA account for the client funds that are pooled together.

IOLTA stands for Interest on Lawyers Trust Accounts are bank accounts that will earn interest on the money deposited until that money is withdrawn to pay an invoice for services provided.

Florida was the first state to establish the first IOLTA programs in the early 1980s and shortly thereafter, the rest of the states followed suit.

What Happens to the Interest Earned on the IOLTA Accounts?

One of the most unique aspects of IOLTA accounts is that the interest earned on these accounts is then used by individual states to provide civil legal services to those who need them.

Though each state has slightly different rules and regulations around how these funds are distributed, most states use the interest earned in IOLTA accounts to fund programs for underserved residents, provide legal aid to those who can’t otherwise afford it, and to fund various grants and scholarships that serve to help provide additional civil legal services of their own.

When pooled together, the interest earned from clients’ money throughout a state can make a substantial impact on helping provide legal services to those who need it most.

The Consequences of Not Setting Up an IOLTA Account

Because the interest earned on an IOLTA account is not considered a law firm’s earned money, it is imperative that a firm makes sure that any interest earned on these accounts is properly distributed to the state’s IOLTA program.

Failure to do this can result in a firm or an individual attorney having to deal with some serious consequences.

Depending on the severity of the mismanagement of the IOLTA trust account funds, a firm may be issued a warning, a fine, or – in some extreme cases – be faced with disbarment from the state’s bar association.

The good news is this.

Any firm that has taken the time to:

a) correctly set up their IOLTA account, b) has taken the right steps in place to ensure that client funds are not deposited into their operating account, and c) that interest earned on those funds is distributed to the states IOLTA program will not risk being out of compliance with the rules and regulations that govern these types of lawyer trust accounts.

What Is the Right Way to Start My Firm’s IOLTA Account?

You understand the purpose of establishing an IOLTA account…now the question is, how do you do it in a way that follows the appropriate protocol for your state?

Luckily, setting up an IOLTA account should not be too difficult.

There are hundreds of banks across each state that understand the rules governing IOLTA trust accounts. They know that certain types of documentation and reporting are required and they are also aware of the consequences if this does not happen.

Schedule a demo

Most firms will start with the bank or financial institution with which they already have an established relationship.

If your bank does not have the ability to help you set up an IOLTA account, they may be able to direct you to one that can.

Most state bar associations also have a list of banks and financial institutions in your state that understand IOLTA accounts and IOLTA programs and are equipped to open them for you.

Again, though every state is different, most banks will ask for the following information in order to set up and manage your IOLTA account:

If You’re Looking for Help with Your IOLTA Account, Look No Further Than LeanLaw

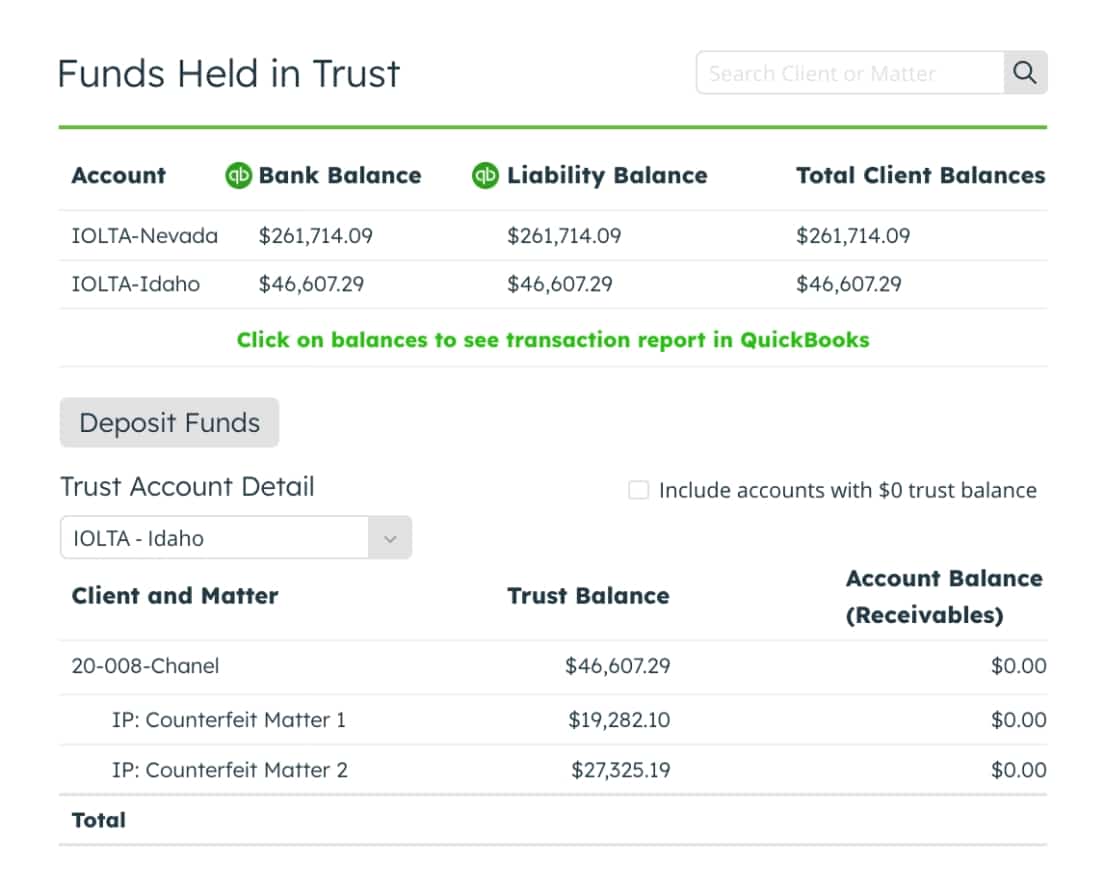

For many law firms, keeping track of IOLTA account balances and transfers can be a daunting task and one that is not time or cost-effective for the firm.

Not only that, but failure to keep accurate records can end up costing a firm in fines and possible disbarment, even if there was no ill-intent on the part of the law firm or bank.

LeanLaw is accounting software for law firms that was specifically designed with these sorts of issues in mind.

Our skilled team of legal experts know the challenges that many attorneys face when it comes to recordkeeping and balancing accounts since we are also experts in trust accounting billing and all the complexities that go into it!

And we know that your time is more valuable than that.

From accurate recordkeeping to three-way account reconciliation, LeanLaw’s accounting software can help your firm stay in compliance with all state rules and regulations while also giving your staff the tools they need to run your firm effectively.

In fact, our current clients rave about our IOLTA trust accounting workflows and how much they’ve helped simplify their tasks once they have moved to LeanLaw software.

Why risk doing IOLTA manually?

Instead, use a software like LeanLaw to simplify it and stay compliant.

Want to see what LeanLaw can do for you? Reach out to us today for a free demo and discover how much easier and efficiently LeanLaw can make your practice run.

Accurate accounting is an important part of your law firm’s success. LeanLaw can make it become a simple task, not a constant burden.