Managing a law firm is no easy feat. From hiring employees to handling clients, there are hundreds of tasks that need to be completed, kept up with and carefully thought through.

One of the biggest challenges for any law firm’s practice management team is understanding the intricate and sometimes complex legal accounting practices that must be followed, many of which will apply to any law firm, regardless of their size, location, or area of law.

IOLTA accounts fall into this category of legal accounting.

The more you know about IOLTA accounts, the better you will be able to understand why they were created, how they work, and what you need to do to stay in compliance with the rules and regulations that surround the IOLTA program in your state.

What Does IOLTA Stand For?

Put simply, the term IOLTA stands for Interest on Lawyers Trust Accounts and are lawyer trust accounts that are set up by law firms to hold client funds until a firm has billed for a service.

An IOLTA account is an interest bearing trust account and what is done with that interest we will discuss in more detail. Just know that it is highly important that the interest generated from an IOLTA account is accurately accounted for and used appropriately.

The History of IOLTA Accounts

Up until the early 1980s, it was common for lawyers and law firms to place individual client funds into non-interest-bearing lawyer trust accounts.

Schedule a demo

Whether these funds were in the form of a retainer that the client provide the firm for future services or whether they were settlement funds received on the client’s behalf, any client money that was nominal or short-term in nature and came into the law practice was put into a joint checking account with other client funds.

The reason these types of accounts were non-interest-bearing is that up until the early 1980s, banks weren’t allowed to pay interest on checking accounts.

After 1981, however, those banking laws began to change.

Having already filed a petition in the late 1970s regarding the establishment of the first IOLTA program, the Florida Bar Foundation launched the first state’s IOLTA program in 1981.

It wasn’t long before Idaho, California, Maryland and eventually others followed suit.

Though first approved as a voluntary program that states could choose to participate in if they wished, IOLTA programs were eventually adopted by all 50 states and the District of Columbia.

How Does an IOLTA Program Work?

The idea behind an IOLTA program is pretty straightforward, but the actual mechanics are a bit more complicated when put into practice.

Since a lawyer or law firm can not benefit from any interest earned on their client’s money, they must make sure that interest is kept separate from their operating accounts.

With larger or long-term clients, often a separate bank account is set up in which to deposit their funds. Any interest generated on that money is then credited to them.

For smaller cases or short term client funds, it is not prudent for a firm to constantly be opening banking accounts for short periods of time. Instead, this is where an IOLTA account comes into play.

When a firm establishes an IOLTA account, they can then pool their short term client funds together. Any interest generated from an IOLTA account is then transferred to the state’s IOLTA program which is then used for various purposes as established by each individual state.

Most states IOLTA programs are designed to fund and support programs that provide civil legal services to low income residents of that particular state.

They are also designed to fund initiatives that support scholarships for those who can’t afford to further their education as well as fund grants for programs that focus on domestic violence, early youth intervention, and other civil service needs that may be specific to their state.

In fact, according to the American Bar Association, the interest generated from IOLTA accounts has resulted in tens of millions of dollars annually to be used to support legal aid groups and to help fund civil legal services for the traditionally underserved in communities across the United States.

How to Stay in Compliance with Your State’s IOLTA Program

Clearly, IOLTA accounts are a great benefit for the communities they serve. They also are helpful to law firms in that they allow short period client funds to be pooled together, instead of having to continuously open new trust accounts for each new client.

That said, an IOLTA account also creates an enormous amount of accounting work for a firm.

Because there are strict and specific rules and regulations surrounding the operation and management of IOLTA accounts, a law firm needs to be diligent in ensuring that accurate record-keeping is done for every transaction associated with an IOLTA account.

Failure to comply with a state’s mandated IOLTA rules can result in a lawyer or law firm facing some severe penalties and even potential disbarment, if the offense is deemed serious enough.

Even a well-meaning law firm can find themselves in an ethics violation if their IOLTA account records are not well-maintained.

This is where the right legal accounting software can make an enormous difference for your firm.

LeanLaw is software designed for the specific needs of law firm accounting and management.

Created by legal professionals, LeanLaw will help to keep your practice running smoothly with less effort than you’ve been previously spending.

Schedule a demo

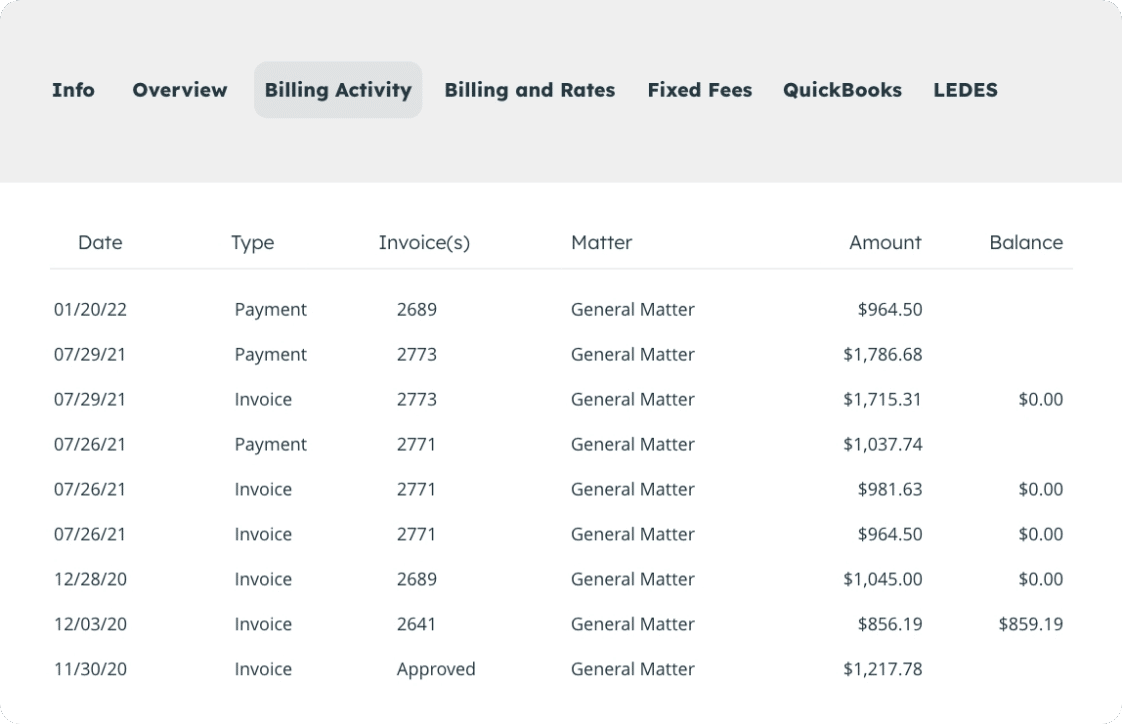

From invoice preparation to three-way bank statement reconciliation, LeanLaw will take the guesswork and frustration out of your day-to-day activities, while also keeping your firm in compliance with all federal and state rules surrounding such programs as IOLTA accounts and more.

In today’s ever-changing world, a law office must stay up to date on all the latest best practices while also keeping costs low and receivables in check.

Using a Quickbooks-powered, cloud-based software like LeanLaw is going to be the simplest and most affordable way for you to do just that.

Want to see a demo? Request one today!