Have you been researching how to set up your law firm’s IOLTA account, but are still struggling to fully understand the rules and regulations surrounding it?

Perhaps you still need more clarification on what is IOLTA account and what purpose it is going to serve.

Practicing law can certainly be rewarding but dealing with the intricacies of the business side can sometimes feel cumbersome and overwhelming. But – you know that if you don’t do things a certain way, there could be consequences later on.

Setting up and managing your firm’s IOLTA account can often fall into this category.

Let’s take a closer look at what an IOLTA account is and how best to ensure that your law firm is following the correct practices and procedures to manage yours correctly.

What is an IOLTA Account?

It is common practice for a law firm to ask for a sum of money when they are hired to represent a new client.

Most firms refer to this money as a retainer, and it is considered payment for services not yet rendered.

When a law firm asks for a significant amount of retainer from a client, they usually will hold those funds in a trust account established specifically for that client.

But when a law firm has a number of smaller short term client funds, they will typically choose to hold all those dollars in one checking trust account together.

Though this can be managed with good accounting software, it is vitally important that the law firm make sure that none of these retainer dollars be used for any sort of expenses that the firm is incurring, outside of payment for services for the client who originally gave them those funds.

Remember…these retainer dollars are not part of a firm’s income until after hours have been billed on behalf of that particular client.

To add to the complexity, a law firm can’t benefit from any interest bearing trust account that holds client funds.

And this is where the creation of IOLTA programs came into play.

IOLTA stands for Interest on Lawyer Trust Accounts and is a unique and innovative way to ensure that client trust accounts are not being used inappropriately and create a way to help increase access to civil legal services in a specific community.

Each state has its own IOLTA programs and rules around how they are to be used and managed.

Most IOLTA programs are run by the state bar association and mandate that any interest earned on client funds must be set aside into an interest-bearing lawyer trust account.

This interest is then used to provide civil legal services for people throughout the state who may not otherwise have access to good civil legal aid on their own.

Some states also use the money generated from these lawyer trust accounts to help fund scholarships for underprivileged students pursuing a career in law or to award grants for different charitable purposes within their communities and states.

An IOLTA program can be beneficial in many ways.

But for the law firm that must establish and oversee one, making sure that all rules and regulations are followed according to each state’s IOLTA program can at times be burdensome.

If a firm is found to have mismanaged the interest on client funds, there can be severe penalties invoked that may range from heavy fines to even disbarment.

Ignorance of the rules around the interest earned on a client’s money is not usually allowed as an excuse. Mixing a client’s funds with a firm’s operating account is never allowed, and can cause huge issues, even if it’s done with no mal-intent.

It is, therefore, very important that you understand the IOLTA program in your state and set up your law firm IOLTA account appropriately.

How Do I Set Up and Manage My IOLTA Account?

Understanding the meaning of an IOLTA account and what purpose it serves is one thing.

Knowing how to correctly establish one is another.

The first thing that needs to be done is to set up a separate trust account with a reputable bank or financial institution that handles IOLTA accounts and is well-versed in how to set them up appropriately.

Most law firms will start with the financial institution that already holds their other accounts. It’s important to make sure the IOLTA account you establish uses the double-entry accounting method, which will not only keep track of where short term client funds come from, but also where the interest generated needs to go.

Schedule a demo

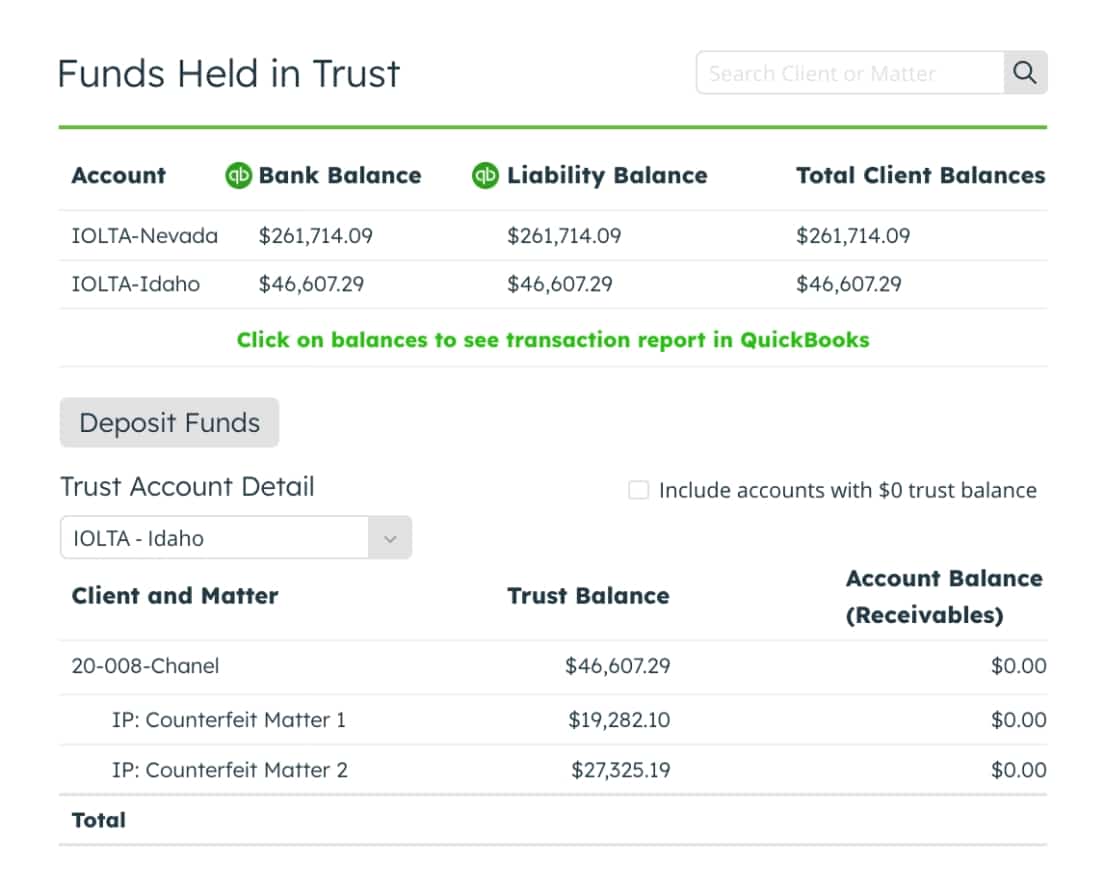

An IOLTA account must also comply with three-way reconciliation.

This means that not only should the IOLTA account balance match the ledger for the trust account, but it needs to match the ledger for the client funds balance as well.

Though this three-way reconciliation doesn’t have to be complicated, it will need high attention, since any errors can end up creating concern about whether or not your law firm is managing its IOLTA account appropriately.

How Can I Get Help Managing My IOLTA Account?

Anyone who is trying to manage their law firm’s business side knows that having the right accounting software can make a huge difference in helping to run the practice efficiently.

They also know that staying compliant with local, state, and federal regulations is tantamount to running an effective practice and making sure that everyone involved is happy with the firm’s performance.

This is where LeanLaw can help.

LeanLaw is a financial operating system that is built for lawyers and their administrative staff to make the business of running a successful law firm easier.

From accounting to time tracking, LeanLaw covers any service your firm may need to keep your firm running as efficiently and effectively as possible.

We know the complexity of establishing and managing client trust accounts and can help establish the necessary three-way reconciliation to ensure that any interest generated on these accounts is being recorded and delivered to your state IOLTA program correctly.

When your firm needs a smart and straightforward operating system, take a closer look at what LeanLaw can offer you.