Any law firm that collects a retainer fee from their clients will find themselves having to do a few different things with these client funds.

It’s important to note that client funds should never be put into a law firm’s operating account.

Lawyer trust accounts are special bank accounts where client funds are kept safe until it is time to withdraw those funds to be used to pay for time or services rendered.

Whether they are called lawyer trust accounts or client trust accounts, using these types of trust accounts is an important business practice for lawyers and law firms who are holding money on behalf of their clients for any period of time.

As mentioned earlier, every law firm has a fiduciary responsibility to keep client money separated from their law firm’s operating funds until that money has been earned.

Some clients have retainers that are large enough to warrant depositing that retainer into their own, separate trust account.

This way not only can that client’s funds be easily accounted for, but they can also be held in an interest-bearing trust account that will benefit the client.

These types of client trust accounts are usually set up for clients who either have sizable retainers, or tend to do frequent, ongoing business with the law firm.

But…when a client’s retainer is not significant enough to make opening a separate bank account a reasonable option, this is when an IOLTA account comes into play.

What Is an IOLTA Account?

So what is an IOLTA account and what does it stand for? IOLTA is an acronym for Interest on Lawyer Trust Accounts.

First started in 1981, an IOLTA account is an account that is set up by a law firm to hold those client funds that are not large enough – or won’t be held for long enough – to justify having their own separate trust account.

While multiple client funds can be held in a law firm’s IOLTA account, the interest that is earned on this type of trust account is then directed to a state’s IOLTA program.

Schedule a demo

State IOLTA programs are usually managed by the state bar association, though this can vary depending on which state you live in.

Most states’ IOLTA programs then use the interest earned and collected to help fund things like civil legal services for those who can’t afford to retain legal assistance.

The interest generated on IOLTA accounts is also often used to help fund scholarships for students who wish to pursue a career in law but can’t afford tuition, as well as help fund grants for other types of legal services provided by non-profit organizations in various states.

Where Can I Set Up an IOLTA Account?

IOLTA accounts are a great way to keep client funds separate from your operating accounts without having to open a new trust account every time your firm acquires a new client.

As long as your accounting department can keep track of whose funds belong to whom, IOLTA accounts will save you time and resources while also keeping your banking needs to a minimum.

That said, IOLTA accounts come with some very specific rules and regulations as to how they are managed and run.

First, it’s imperative that you make sure the financial institution you choose for your IOLTA account understands the rules and regulations around how they must be operated and maintained.

Most law firms will be able to set up their IOLTA account at the same bank or financial institution where they have their other accounts.

Check with yours to find out if they are in compliance with the federal banking laws that are unique to IOLTA accounts. If they are, it is then it is simply a matter of completing the paperwork to open your IOLTA account.

How Do I Make Sure I Manage My IOLTA Account Properly?

Though opening an IOLTA account is fairly straightforward, making sure that it’s being managed correctly is a bit more of a challenge.

As mentioned earlier, it’s extremely important that funds that are deposited into an IOLTA account are never deposited into an operating account until after the client has been invoiced for a service rendered.

Additionally, making sure that the interest earned on the IOLTA account is being properly transferred to the state IOLTA program is also critical for accurate accounting to take place.

Law firms and lawyers who do not follow the stringent guidelines of the IOLTA program protocol of their state are at risk for receiving large fines and even possible disbarment if inappropriate accounting practices are discovered.

Here is a quick rundown of how funds should be distributed between a law firm’s various accounts:

Making sure that each of these transactions are properly and accurately recorded can be time-consuming and tedious for you or your accounting department.

But many attorneys have found themselves in unpleasant situations with their state bar association when all the appropriate steps have not been taken to ensure that money is appropriately transferred to the state IOLTA program.

LeanLaw Is the Best Tool for All Your Accounting Needs

Though understanding the operations of an IOLTA account is important for every law firm, there is accounting software designed to make this whole process easy to manage and simple to do.

LeanLaw is a financial operating system that is built specifically for law firms.

Designed by a team of passionate legal practitioners, engineers and communicators, the team at LeanLaw has created a product that will allow for your firm to ensure that everything billable is being captured correctly, that money is flowing through each account properly and that reports, and invoices are accurate and easy to print and prepare.

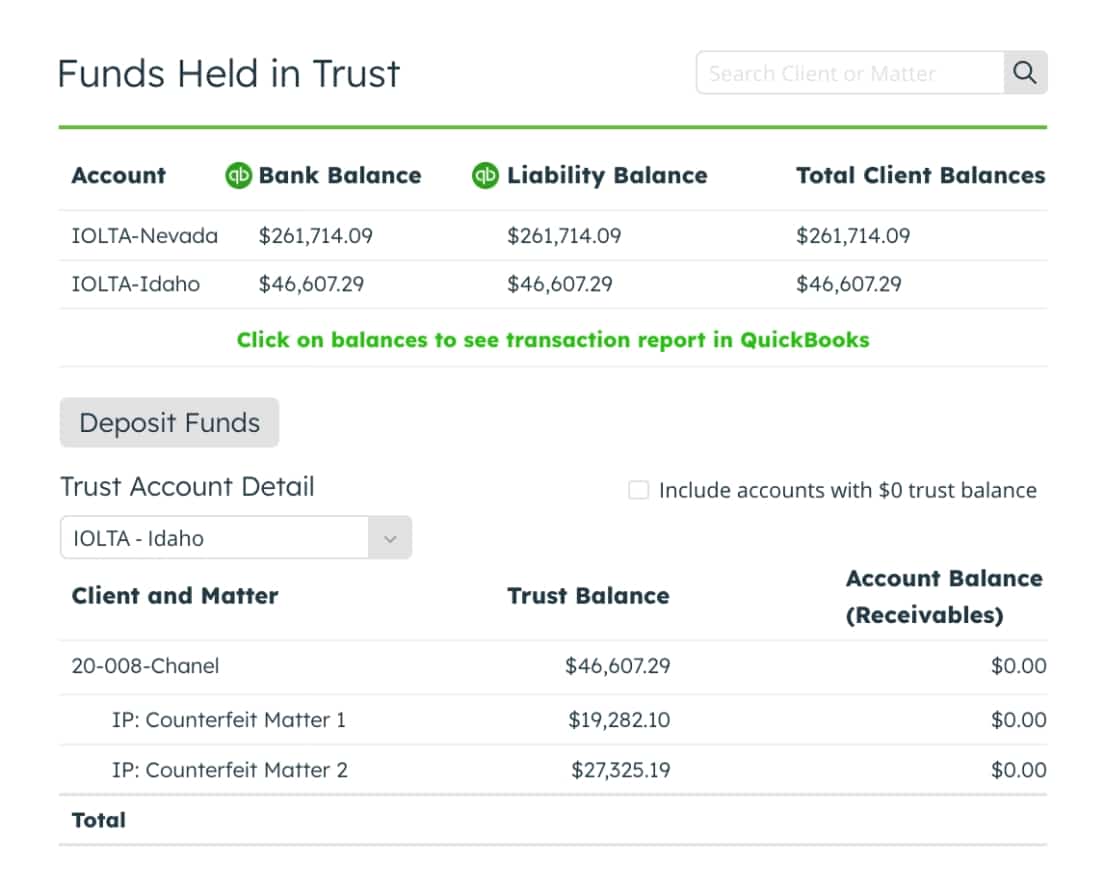

Using the QuickBooks Online platform, a firm can rest assured that all of their bank accounts and trust accounts are in continuous sync and compliant with each state bar’s standards.

Because of this, your accounting department will never have to worry as to whether or not your accounts are well positioned for weekly or monthly three-way reconciliation. And everything can be done online, and in real-time.

If you are curious about taking your firm’s accounting to the next level this year, take a look at our website and see what services our software can offer you.

Let LeanLaw make paperwork less grueling and give you the financial peace of mind you need!