If you are the person tasked with a law firm’s accounting needs, you may have some questions regarding the difference between the various types of accounts and when to use which ones.

It’s quite common in the field of law to hear some of the following terms be used: IOLTA accounts, escrow accounts (or client trust accounts), and operating accounts when it comes to setting up and managing various bank or financial institution accounts that are necessary for a law firm to be in business.

But knowing the difference between each of these types of accounts is crucial for your law firm’s success. Each serves a different purpose and mismanaging them can result in some dire consequences.

For example, one basic rule that every law firm needs to be aware of is that client funds should never be mixed into funds that are used for operating expenses until after those client funds have been invoiced and a service has been provided.

This may sound obvious, but there are circumstances where a firm may decide to borrow from a client trust account in order to cash flow a purchase, make payroll, or use it for some other type of operating expense.

There may be every intent to repay that client trust account quickly, as soon as there is more cash on hand.

Making a decision like this one, even if it seems completely reasonable at the time, is not a good idea and will be seen as an ethics violation. This type of action can end in serious fines, or even the possibility of disbarment from the state bar association in certain cases.

The bottom line is this: knowing the names of different types of accounts that your law firm has in place is critical to running your business, and knowing what each of them are for is even more so.

What Are the Accounts My Firm Should Have in Place?

When establishing a law firm, one of the most important, seemingly behind-the-scenes departments will be accounting.

The accounting department – whether it be one person or several – will be key to your firm’s overall reputation, transparency, efficiency and success.

Establishing the appropriate business and banking accounts is going to be an integral part of the accounting department’s job.

Schedule a demo

Let’s look at what those different accounts are and what they are each used for.

Operating Accounts

An operating account, as its name aptly implies, is used to hold the money that will then be used to run the firm. It is standard for this type of account to be a checking account.

Whenever a client invoice is paid, the operating account is where that money will be deposited.

The operating account is also the bank account from which all expenses are paid, such as salaries, rent or mortgage payments, insurance, utility bills, and anything else that is an expense incurred to run the business.

Operating accounts are usually set up through local banks or other types of financial institutions and may also be established as an interest bearing account.

Making sure that all your business expenses flow through this account is important and accurate record-keeping will be crucial to your monthly reconciliation being accurate as well.

Some law firms may also choose to set up a savings account in addition to a checking account. Just remember to be diligent in recording what income and what expenses are flowing into and out of each.

Escrow Accounts (Client Trust Accounts)

An escrow account, or client trust account, is a banking account that is set up by a law firm for a client when a large retainer is given for services that have not yet been provided.

Most law firms will ask for a specific amount of client funds up front, before they’ve begun to work on the case. This money is often referred to as a retainer and will ensure that the client has the appropriate funds to begin their case.

Retainers are also beneficial because they allow the client to budget their expenses ahead of time and they allow the law firm to be able to utilize funds that are already deposited to pay invoices and not wait for payment before they continue to work on the case.

Client trust accounts, or escrow accounts, are set up for clients or businesses who have large cases or may be ongoing clients with a specific law firm.

In a situation like this, where a client trust account is established for one client only, it makes sense for a firm to open a separate interest bearing trust account for that particular client, so that their retainer money can continue to earn interest, even while being held by the law firm.

Any interest earned will be held in that account for the client and should never be transferred to the firm’s operating account.

IOLTA Accounts

IOLTA stands for Interest on Lawyers Trust Accounts and is a term widely used in the practice of law for a very specific type of account, and one that needs to be managed very carefully.

Like an escrow account or a client trust account, an IOLTA account is also used to hold client funds before services have been rendered and the client has been invoiced for them.

But unlike a trust account that is set up in the name of one particular client, an IOLTA account will hold money that has been retained from a number of different clients.

The reason for this is that it would be inefficient and burdensome for a firm to have to open a separate account for every client, particularly when the case is small or the client will not be with the firm for a lengthy period of time.

By putting a client’s money into a banking account with other client’s money, a law firm will have fewer bank accounts to keep track of.

But fewer bank accounts does not mean less paperwork.

In fact, it is going to be imperative that a law firm keeps a very good record of each client’s money and invoices each individual client appropriately.

Another difference between an IOLTA account vs escrow account is that any interest earned on an IOLTA account will not be distributed back to the clients.

Instead, interest earned on IOLTA accounts is transferred to the state’s IOLTA program and is then used for various civil legal services, as dictated by the state bar association.

Because of changes made to federal banking laws in 1980, the first state IOLTA programs were created in 1981. (Florida being the first state to do so, with every other state eventually following.)

These federal banking law changes require a law firm to set up a pooled interest bearing account for any client funds that are small enough to not warrant their own separate interest bearing account, or for client funds that are expected to be held for a short period of time.

Though IOLTA programs were voluntary at first, it is now a requirement that all eligible lawyers and law firms participate in their state’s program.

And, because of the specific rules and regulations that surround each state’s IOLTA program, a lawyer or law firm can find themselves in a troublesome situation if the interest earned on an IOLTA account is not handled properly.

Remember, the interest earned on a firm’s IOLTA account is not the firm’s money. This interest was generated by client funds and must be transferred to the state’s IOLTA program in the ways set forth by that particular state’s bar association.

Failure to comply with the rules set forth can result in a lawyer or law firm being faced with fines or even disbarment, depending on the severity of the situation.

Law Firm Accounting can be Tricky…Let LeanLaw Make it Easy

Knowing the differences between your firm’s various banking accounts will be an important step toward being able to manage them effectively.

But knowing the rules that govern each one and how to make sure they are being followed correctly can be much more challenging, not to mention time-consuming, for any firm.

Even though escrow accounts and IOLTA accounts deal with client funds, an IOLTA account will have additional recordkeeping needed in order to abide by the rules that govern it.

This additional recordkeeping can best be done when your firm has the best legal accounting software in the industry today.

Schedule a demo

LeanLaw is that software.

Based on years of their own experience, LeanLaw was created by legal professionals who know firsthand the importance of accounting accuracy, particularly when it comes to handling client funds and IOLTA accounts.

By eliminating the possibility for errors in trust fund accounting, LeanLaw can save your firm countless hours of lost productivity while making sure you’re always in compliance with state bar standards.

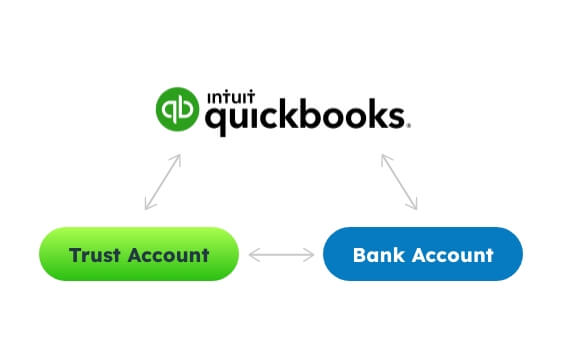

And, because LeanLaw accounting software is always in sync with QuickBooks Online and all of your firm’s bank accounts, your three-way reconciliation is always going to be accurate and easy to complete.

Are you ready to take your law firm’s accounting to a better, more accurate, and more productive level? Then reach out to the experts at LeanLaw today!