If you are a law firm that is practicing in the state of New Jersey, knowing the specific laws surrounding IOLTA accounts in this state will be vital to your firm’s overall financial accountability.

Though there are federal guidelines set forth for state IOLTA accounts, each may have slightly different rules and regulations surrounding them.

What is an IOLTA Account?

IOLTA accounts are set up by law firms in order to hold client funds in an interest bearing account that is separate from their business or operating account.

Typically, when an attorney receives a smaller retainer from a short-term client, there is no need to open a separate account for these funds. Thus, they can be pooled together with other client funds and managed accordingly.

Any interest earned on a New Jersey IOLTA fund can not be used by an attorney or their law firm for operating or business purposes. Federal laws have been established to make sure that this is the case, and severe penalties can be imposed if these laws are not followed.

This means that all the interest earned on IOLTA lawyers’ trust accounts will be transferred to each state’s IOLTA program.

Once transferred, these funds can then be used to benefit legal services programs in that state that help underserved populations receive legal aid when needed.

Schedule a demo

Some states also use these funds to create scholarship programs for underprivileged students or even provide grants to certain organizations that need them.

How these monies are used will vary from state to state, but one thing for all states is clear: managing and accounting for money generated from interest earned on an IOLTA account must adhere to state and federal guidelines that have already been established.

The Bar of New Jersey IOLTA Program

In the state of New Jersey, the IOLTA program is run by the bar of New Jersey.

Any attorney practicing in New Jersey must establish and retain an IOLTA trust account as set forth by the bar of New Jersey, regardless of whether or not they are a sole practitioner or a member of a larger firm.

When setting up an IOLTA fund, an attorney must make sure that the account is in the name of the attorney themselves, or in the name of the partnership. They will also want to make it clear to their financial institution that this is in an IOLTA account, so that the financial institution understands the rules governing it.

In New Jersey, there are hundreds of banking institutions that are capable of helping set up an IOLTA account. Most attorneys will request about setting up an IOLTA account with the bank that already holds their other accounts, such as their operating account or other clients’ funds.

Any IOLTA lawyers trust accounts in New Jersey must be registered each year by the attorney or law firm that holds them, so it’s in a firm’s best interest to make sure that any IOLTA fund is being managed and tracked properly.

There are strict recordkeeping requirements for an IOLTA fund and an attorney or law firm that does not comply with the regulations can find themselves penalized by the bar of New Jersey or even the state or federal government.

How Can LeanLaw Help Your Law Firm with an IOLTA Account

Because of the strict nature of the laws governing an IOLTA fund, it is imperative that a firm’s accounting department be well-trained to avoid any issues with these accounts.

LeanLaw is accounting software that has been specifically designed for law firms and their unique accounting needs.

From managing accounts receivable to managing client funds, our software is designed to help your firm run efficiently and effectively, while complying with industry best practices and all state and federal laws.

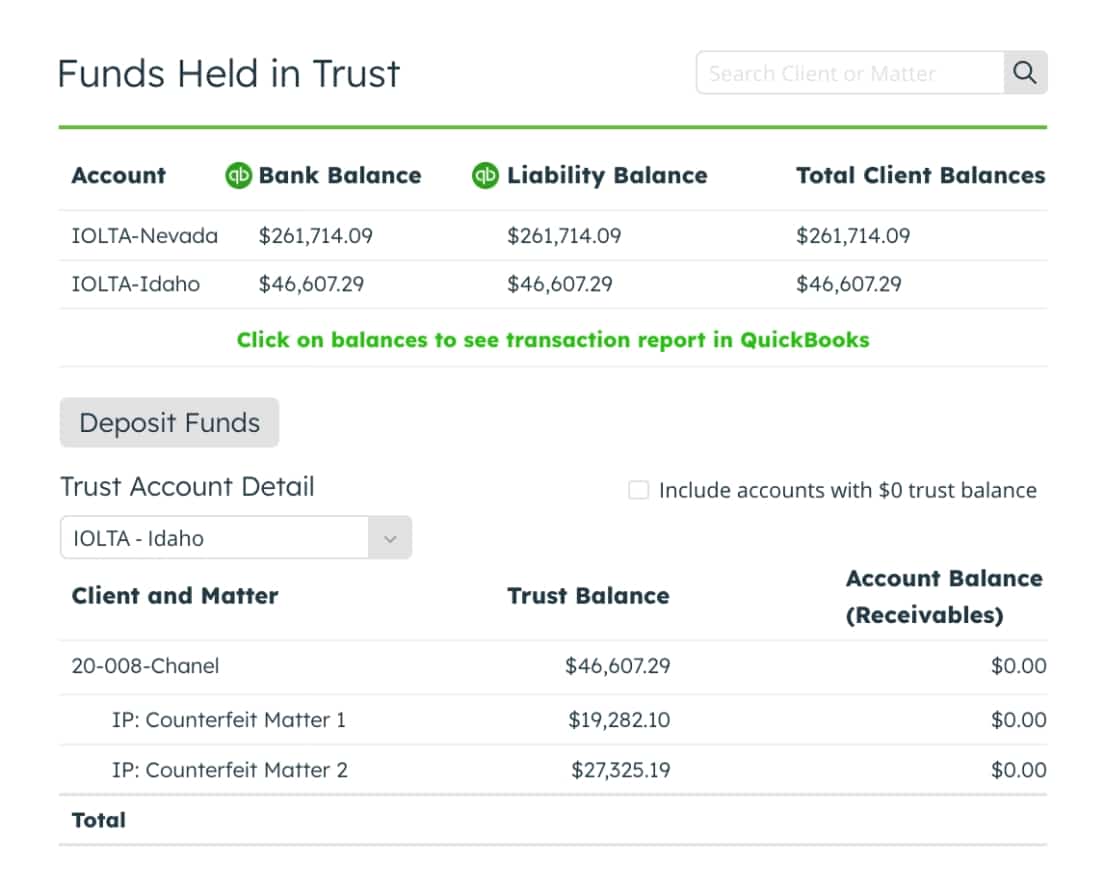

Our three-way reconciliation process makes sure that all of your bank accounts, trust accounts, and QuickBooks Online are in continuous sync with each other and that you will never have to worry that you or your firm are not in line with state bar standards.

If you want to find ways to streamline your accounting and recordkeeping, while also maintaining the highest level of integrity and transparency for your clients and community, consider LeanLaw for your firm’s accounting and compliance needs.