If you are an attorney practicing in the state of New Jersey, you know there are specific rules and regulations surrounding your practice that must be adhered to.

Whether you are a sole practitioner or working for a multi-attorney law firm, lawyers have a set of rules around professional conduct and strict recordkeeping requirements around how they operate their business that they are expected to follow.

Some of these rules and regulations are set by the American Bar Association. Others are established by each state and may not pertain to another.

For example, a regulation that may be relevant to a community in New Mexico may not be relevant or necessary in New Jersey.

Does Every State Have an IOLTA Fund Program?

In the United States, every state has adopted an IOLTA program, but not every state makes it mandatory for an attorney or law firm to participate in the program.

Though many of the rules around an IOLTA account are set by the American Bar Association, each state has the option to adjust and amend these rules as they see fit for the practice of law in their specific state.

Some of the areas in which a state may have differences in the management and operation of an IOLTA program are based on how certain funds and deposits need to be handled, how the accounting and record-keeping need to be shared, and how often reporting must be done.

Because the rules around an IOLTA program can vary, it’s important for an attorney and/or their administrative team to thoroughly understand the laws around an IOLTA trust account for their specific state.

If you are an attorney practicing in the state of New Jersey, it will be imperative that you know the specifics of your state’s IOLTA program and how to properly set up and manage your own IOLTA fund for your firm and your clients funds.

Let’s look more closely at the New Jersey IOLTA accounts program and make sure your law firm complies with the laws governing it.

How Do I Know If I Have to Set up a New Jersey IOLTA Fund?

In the state of New Jersey, an attorney or law firm must have an IOLTA fund established as a separate account assuming the following are all true:

- You are a sole practitioner (running your own law firm.)

- You are part of a law firm with other attorneys (even if you are not a partner or a signer on any of the bank accounts.)

- You are practicing law full-time or part-time.

Schedule a demo

On the other hand, you don’t need to participate in New Jersey’s IOLTA fund program or have an IOLTA account set up if any of the following are true:

- You are practicing law for a government agency.

- You are part of in-house counsel for one specific client or corporation.

- You are currently not practicing law or employed by any law firm in the state of New Jersey (even if you’ve passed the bar of New Jersey.)

It is important for any attorney or law firm administrator to make sure that – if they choose not to set up an IOLTA fund – they are confident that it is not required for their law firm to be practicing law in the state of New Jersey.

How Do I Set Up an IOLTA Account for My Law Firm?

Once you understand the IOLTA account meaning and confirmed that you will need an IOLTA account established for your firm, the process of setting one up is quite straightforward, though you’ll need to follow certain steps to make sure you do it properly.

First, you’ll want to find out what financial institution in your area is capable of handling an IOLTA account.

Most attorneys will begin by inquiring at their local bank or financial institution where they already have established accounts.

If a financial institution participates in the state IOLTA fund program, it will be able to instruct you as to what must be done in order to open and manage your IOLTA account throughout the year and beyond.

Since most IOLTA accounts are set up as interest bearing accounts, it’s important to know that the banking institution you have chosen understands how the interest earned distributions are then transferred to the state’s IOLTA program.

What is Done with Interest Earned in My IOLTA Interest Bearing Account?

Because an IOLTA account contains client funds, an attorney or law firm is not privy to these dollars, nor are they redistributed to the clients.

Instead, interest earned on the client funds placed in IOLTA accounts will be passed on to the bar of New Jersey’s IOLTA fund program to then be used to fund grants that allow for free legal aid to low-income people with civil legal problems in the state of New Jersey.

They are also often used for improvements in the administration of justice and education about New Jersey law.

How these funds are ultimately used is decided by the governing trustees of the New Jersey IOLTA administration.

Help for Your Firm…From Your IOLTA Trust Accounts and Beyond

Taking care of the endless and sometimes complex tasks of managing your law firm’s accounting and record keeping can sometimes feel overwhelming.

Not only that, but these tasks also take time…sometimes time you don’t necessarily have or could be used in a more effective and efficient way.

LeanLaw is accounting software that has been created for lawyers, by lawyers.

Our software focuses on the most important aspects of your firm’s business and helps law firms get paid faster with invoice delivery and online payments.

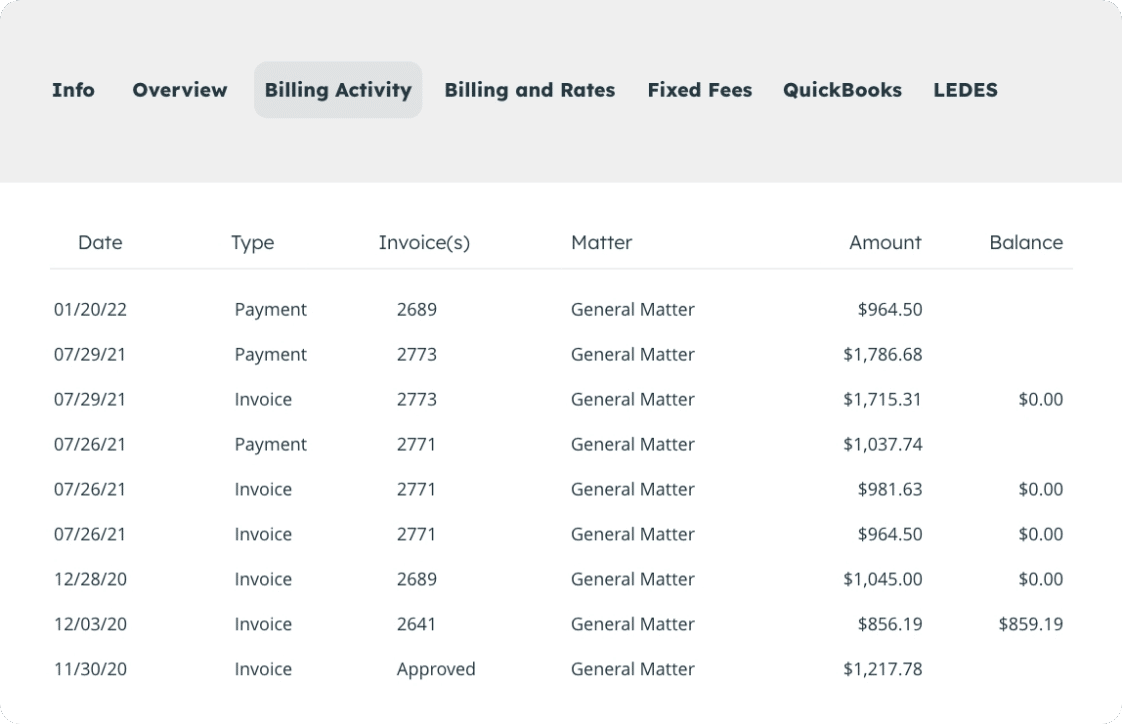

LeanLaw software is created to understand the complexities of running a law firm and the importance of client fund management and transparency. With LeanLaw software, your firm’s accounting department can assign trust accounts and bank accounts for each of your client funds as needed and keep track of how each is being distributed.

It is also designed to help your firm track profitability by each attorney, client, or specific matter and keep your firm in compliance with all state and federal rules and regulations surrounding your practice.

From helping manage your firm’s IOLTA fund to helping manage your AR reports, LeanLaw can make running your law firm much easier for everyone involved.

If you’d like to learn more about how LeanLaw accounting software can help your law firm request a demo from our website today.

Let LeanLaw make your life easier and your practice run smoother in the year to come!