Have you found yourself overwhelmed by the intricate world of trust accounting?

Do you worry about staying compliant with the ever-changing regulations and rules that govern the handling of client funds?

Are you tired of focusing more of your time on trust accounting rules than actually doing what you went to law school to do…practice law?

Key Takeaways

- Trust accounting can be a burdensome and time-consuming part of practicing law, but it is vital to a firm’s operations, reputation and success.

- Though trust accounting rules and regulations vary depending on your jurisdiction, there are a few that are universally accepted as being an important part of the overall process.

- Trust accounting does not have to be as laborious as some think, particularly if you have the correct trust accounting software in place.

Whether we like it or not, trust accounting is a critical aspect of running a law firm and understanding its complexities is essential to maintaining the trust and confidence of your clients.

That said, learning and then staying up-to-date with all the rules and regulations that govern client trust accounts can be frustrating (at the least) but can also lead to severe legal consequences as well.

Knowing the key rules that every law firm should be well-versed in when it comes to trust accounts is going to go a long way in helping you to stay ahead of the game.

And, learning all you can about the right type of trust accounting software is going to help your firm adhere to these rules and will ensure the financial integrity of your firm.

Are you ready to unlock the secrets of effective trust accounting? With LeanLaw, it’s easier than you think.

What is Trust Accounting?

Trust accounting is a fundamental component of financial management for law firms.

Trust accounting refers to the specific set of accounting practices and procedures that govern the handling of client funds entrusted to a law firm. It involves the proper management and record-keeping of these funds to ensure compliance with legal and ethical obligations.

What is the Purpose of a Client Trust Account?

Trust accounts, also known as client trust accounts or escrow accounts, are separate bank accounts where law firms hold client funds for specific purposes.

Unlike a firm’s operating account that is used for expenses and profits related directly to the law firm, a client’s trust account holds client money that is not the law firm’s money, but the law firm is holding it on the client’s behalf.

Trust accounts may include client retainers, settlement funds, or other trust account funds that the law firm receives on behalf of their clients.

The purpose of trust accounts is to keep client funds separate from the law firm’s funds, ensuring they are safeguarded and used only for authorized purposes.

Legal and Ethical Obligations of Law Firms: Know the Rules, Know the Key to Success

Regardless of their size, location or even specialty, all law firms have strict legal and ethical obligations when it comes to trust accounting. These obligations can often vary by jurisdiction but will usually include things such as:

1. Separation of Funds: When it comes to legal trust accounting, law firms must separate trust account client funds from their own operating funds by maintaining a separate bank account for each separate account.

A major legal and ethical violation would be to commingle any of the client’s funds with the firm’s operational funds. This is the biggest priority in trust accounting compliance.

2. Accuracy and Transparency: Law firms must maintain accurate and detailed records of all transactions involving client funds. This includes detailed records of deposits, withdrawals, transfers, and any interest earned on trust accounts. Transparency in the financial reporting of a trust account ensures accountability and helps prevent discrepancies or unauthorized use of funds.

3. Prompt Disbursement: Law firms have an obligation to promptly disburse client funds when properly authorized, assuming the trust account balance is accurate. Any delays in disbursing funds can result in legal and ethical consequences.

4. Reconciliation and Reporting: Regular reconciliation of trust account bank statements is essential to ensure that the recorded balances on the books match the actual amount of client funds held. Not only that, but law firms must provide clients with periodic statements detailing the status of their trust funds.

When you are adhering to these legal and ethical obligations, your firm will be able to maintain the trust and confidence that your clients deserve and respect, while also upholding the integrity of the legal profession as a whole (and your reputation in your community!)

Step-By-Step Process for Attorneys & Law Firmsto Buy Law Firm Software

Understand who needs what and prioritize features as you investigate new software. Download Buyers Guide eBookWhat are the Most Important Best Practices for Legal Trust Accounting?

We know that effective trust accounting management is crucial for law firms to ensure compliance, accuracy, and transparency in handling client funds.

And we also know that it can sometimes be a challenge to define “effective” since each jurisdiction has its own set of rules and regulations when it comes to managing and reporting each trust account.

But having a good list of best practices for legal trust accounting is going to help your firm maintain trust, mitigate risks, and streamline the entire financial processes.

Here are some key best practices for effective trust accounting management:

1. Always segregate client funds: Keep client funds separate from the law firm’s operational funds by maintaining separate trust accounts. Commingling client funds with operational funds can lead to serious legal and ethical consequences.

2. Be sure to maintain accurate records: Keep detailed records of all transactions involving client funds, including deposits, withdrawals, transfers, and any interest earned. Accuracy in record-keeping is essential for transparency and accountability.

3. Get in the habit of reconciling trust accounts regularly: Conduct regular reconciliations to ensure that the recorded balances in trust accounts match the actual funds held. This helps identify any discrepancies or errors and ensures the accuracy of trust account balances.

4. Implement strong internal controls: Establish internal control measures to safeguard client funds and prevent unauthorized access or use. This includes limiting access to trust accounts, implementing approval processes for disbursements, and conducting periodic audits.

5. Adhere to regulatory requirements: Stay updated on the trust accounting rules and regulations in your jurisdiction. Comply with reporting requirements, filing deadlines, and any specific trust accounting guidelines mandated by legal authorities.

6. Train staff on trust accounting best practices: Provide training and education to staff members involved in trust accounting to ensure they understand their roles and responsibilities. This includes educating them on ethical obligations, accurate record-keeping, and proper handling of client funds.

7. Use the most up-to-date and accurate trust accounting software possible: Leverage trust accounting software solutions like LeanLaw or trust accounting QuickBooks Online that are specifically designed for legal accounting. These tools streamline trust accounting processes, automate calculations, and provide real-time visibility into trust account balances.

8. Take the time to conduct regular audits: Perform internal audits of trust accounting processes and records to identify any weaknesses or areas for improvement. External audits by independent professionals may also be necessary to ensure compliance and gain an objective assessment of trust accounting practices.

9. Always make clear communication with your clients a priority: Communicate openly and transparently with clients regarding their trust funds. Provide regular statements and updates on trust account activities to maintain their trust and confidence in your firm.

10. When in doubt, seek professional guidance: Consult with legal and accounting professionals who specialize in trust accounting to ensure that your firm is following best practices and complying with all applicable regulations.

When you make implementing trust accounting best practices a priority, your law firm will be able to greatly enhance how trust accounting is handled.

And – implementing the right software will help you see that trust accounting doesn’t have to be the nightmare that it’s proven to be in the past.

Schedule a demo

Why LeanLaw?

When it comes to trust accounting needs, LeanLaw stands out for many practices as an exceptional solution.

With its specialized features and intentional focus on legal accounting, LeanLaw offers law firms an easy-to-use and reliable platform for trust accounting management.

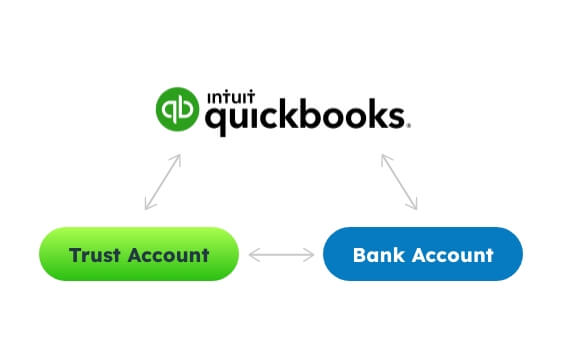

LeanLaw’s software seamlessly integrates with QuickBooks Online, providing a comprehensive solution that combines the power of legal-specific functionalities with the financial capabilities of QuickBooks.

With LeanLaw, law firms can streamline their trust accounting processes, ensure compliance with trust accounting rules, and enhance accuracy and transparency in managing client funds.

Why LeanLaw? Let us show you! Our free demo can show you exactly how LeanLaw works.

Check it out and start your firm on a path to trust accounting that makes sense for everyone.