Almost every lawyer has at some point had to familiarize themselves with the basic rules and regulations of trust accounting.

Even those who have joined a larger law firm or are still relatively new to the practice of law are more than likely aware of some of the big “do’s and don’ts” when it comes to how to manage client’s funds and the importance of ensuring that client and business accounts are always kept in a separate account from each other.

That said, trust accounting for lawyers can still be a complex and intimidating part of practicing law and lead to large consequences if it’s not done correctly.

Key Takeaways

- Attorney trust accounting is a key component of a well-managed law firm, but many lawyers and their staff find trust accounting to be overwhelming and intimidating, given the nature of the process and the rules that surround it.

- Maintaining good trust accounting procedures is crucial to a firm’s long term success and not complying with the rules and regulations that have been set forth in your jurisdiction can lead to serious consequences for your attorneys and firm.

- One of the best ways to ensure that your trust accounting is the best it can be is to invest some time into researching whether or not your legal accounting software is robust enough to handle it accurately and appropriately.

When it comes to trust accounting, lawyers have an inherent responsibility to handle client trust accounts with the utmost care and integrity. But navigating the complexities of trust accounting can be challenging, and even small mistakes can lead to serious consequences.

To ensure compliance and protect both clients and the firm, it’s never a bad idea to spend some time reviewing what trust accounting is while also exploring some of the most common trust accounting mistakes as well as the ways that your firm can avoid them.

What is Trust Accounting and Why is it Important to Law Firms?

Trust accounting is a term that’s widely used throughout the practice of law.

Sometimes also known as “attorney trust accounts” or “lawyer trust accounts” it refers to the specific accounting practices and procedures used by law firms to manage any client funds that are held in trust.

Holding a client’s funds (or clients money) “in trust” means that money that is either provided by or is for a client that is entrusted to a lawyer or law firm for a specific purpose will be cared for in a certain way and in accordance with specific rules and regulations that “trust” the client’s money is being handled appropriately.

Throughout the profession of law, it is considered a legal and ethical obligation for lawyers to hold these funds separate from their own firm’s operating account and to manage them responsibly.

This concept of holding funds in trust is based on the fiduciary duty that lawyers have towards their clients. This means that an attorney and/or a law firm has the ethical and legal charge to always act in the best interests of their clients and to handle their trust funds with the utmost care and integrity.

When a client provides funds to a lawyer, such as an advance payment, a retainer fee, or funds for a settlement, those funds are typically deposited into a trust account.

Sometimes these trust transactions are put into a pooled trust account, particularly if they are for smaller amounts or only being held for the short term. (See more articles on IOLTA accounts and IOLTA programs here.)

Other times lawyers trust accounts will be set up independently, specifically for one client.

But regardless of how the client funds are being held, if a payment is made on a client’s behalf – such as a settlement – a law firm may need to hold those funds for a period of time and thus those monies will also be place into a lawyers trust account on the client’s behalf.

By placing any of these types of received funds in a client trust account, the lawyer or law firm acknowledges that the funds do not belong to them and that they have a legal obligation to manage and disburse the funds appropriately when necessary.

Though all law firms should familiarize themselves with the trust accounting rules in their jurisdiction, this will be much more important – necessary even – for firms that frequently handle client funds for various purposes, such as advance payments for services not yet rendered by the law firm, settlement funds, or client retainer fees.

The importance of trust accounting to law firms cannot be overstated. Let’s look at some key reasons why trust accounting is so vital:

Ethical Responsibility: Lawyers have an ethical responsibility to act in the best interests of their clients. This includes handling client funds with the highest level of care, integrity, and transparency. Good trust accounting ensures that client funds are managed separately from the law firm’s operating funds, preventing any unauthorized use or commingling of funds.

Trust Accounting Compliance with Legal and Regulatory Requirements: Law firms are subject to strict legal and regulatory requirements when it comes to managing client funds. Failure to prioritize the correct rust accounting compliance can lead to disciplinary action, legal consequences, and damage to the firm’s reputation.

Protection of Client Assets: Trust accounting safeguards client funds from loss, misappropriation, or misuse. By maintaining accurate records, conducting regular reconciliations, and implementing internal controls, law firms can minimize the risk of errors, theft, or fraudulent activities.

Transparency and Client Trust: Strong attorney trust accounting practices promote transparency and accountability. Clients entrust their funds to law firms with the expectation that their money will be handled responsibly. By maintaining clear and accurate client trust accounting records and providing regular communication and reports to clients, a law firm can enhance not only their client’s trust and peace of mind, but it will also maintain their strong standing and reputation in the community.

Effective Financial Management: Trust accounting provides law firms with a clear overview of their financial position and helps them manage their cash flow effectively. By tracking client funds separately, law firms can accurately assess their available funds for disbursements, expenses, and fees, ensuring financial stability and sound business practices.

Avoidance of Legal and Ethical Issues: Incorrectly handling client funds can result in serious legal and ethical consequences. Making sure that your firm is engaging in the best trust accounting practices will help your firm avoid issues such as misappropriation, unauthorized use of funds, or failure to properly account for client transactions. By maintaining proper trust accounting procedures, law firms can mitigate these risks.

Solid trust accounting is essential for law firms in order for them to be able to uphold their ethical responsibilities, comply with legal and regulatory requirements, protect their client assets, promote transparency, good communication and their client trusts, ensure effective financial management, and avoid any legal and/or ethical issues that could result otherwise.

By prioritizing attorney trust accounting and making sure that your firm has the best accounting software to help, your firm will be able to maintain the highest standards of professionalism, integrity, and client satisfaction.

7 Things to Avoid When it Comes to Trust Accounting

Knowing why lawyer trust accounts are so important is one thing…understanding where the problems can arise is another.

It’s just as crucial that a law firm knows where there can be pitfalls with trust accounts as it is that they know how they operate and why.

Here are the 7 biggest pitfalls that can happen with trust accounting and how you can best avoid them:

1. Commingling Funds: Mixing personal or business funds with client funds is a grave error that can lead to ethical and legal repercussions. It’s essential to maintain separate trust accounts and never use client funds for personal or business expenses.

2. Failure to Reconcile Trust Accounts: Neglecting regular reconciliations of trust accounts can result in inaccuracies, discrepancies, and the inability to identify errors or missing funds. Reconciling trust accounts on a monthly basis is critical to maintaining accurate records.

3. Inadequate Record-Keeping: Poor record-keeping practices can lead to missing or incomplete information, making it challenging to demonstrate compliance during audits or investigations. Accurate and detailed trust account balance records should always be maintained for all client transactions, including deposits, disbursements, and fees.

4. Improper Withdrawals or Disbursements: Withdrawing funds from a client’s trust account without proper authorization or without a valid reason is a serious violation. All withdrawals or disbursements must be supported by appropriate documentation and authorized by the client.

5. Failure to Communicate with Clients: Lack of transparency and failure to provide timely and accurate updates to clients regarding their trust account balances and transactions can erode trust. Regular communication and providing clear, understandable statements are essential.

6. Insufficient Trust Accounting Training: Inadequate understanding of trust accounting principles and regulations can lead to errors and non-compliance. Lawyers and staff involved in trust accounting should receive proper training and stay updated on any changes to rules or requirements.

7. Non-Adherence to Jurisdictional Rules: Each jurisdiction may have specific trust accounting rules and regulations. Failing to comply with these rules can result in disciplinary actions or penalties. It’s crucial to understand and follow the trust accounting guidelines specific to your jurisdiction.

By being aware of these common trust accounting pitfalls and implementing preventive measures, law firms can maintain the highest standards of trust accounting and ensure compliance with ethical and legal obligations.

Remember that your attorneys and staff’s attention to detail, diligent record-keeping, and ongoing education are key to avoiding trust account mistakes and making sure that you can provide your clients with every reason to have the utmost confidence and respect in the way your lawyer trust accounts are being managed.

How LeanLaw Can Make Accurate Trust Accounting Work for Your Firm

If you have been thinking of upgrading your legal accounting software to one that has stronger trust accounting features then look no further than LeanLaw, the legal profession’s key to the best attorney trust accounting that is available to law practice’s today.

Schedule a demo

LeanLaw is a powerful tool that can quickly streamline and simplify the process of trust accounting for your law firm while bringing more accuracy, more transparency and more accountability to all your legal accounting needs at the same time.

With its specialized features and intuitive interface, LeanLaw enables you to efficiently manage and track client funds held in trust.

It automates the recording of transactions, generates accurate and detailed records and reports, and ensures compliance with trust accounting regulations.

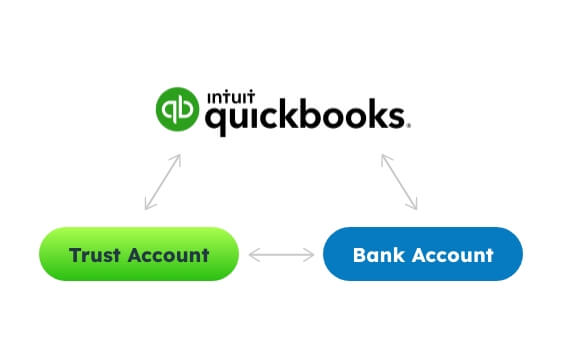

By integrating seamlessly with QuickBooks Online, LeanLaw offers a continuous flow of data between your trust accounting and general accounting systems, giving your firm total confidence in the accuracy of your trust accounting records, your compliance, and your ability to enhance the trust and confidence of your clients.

Ready to see what LeanLaw can do for you? Request a demo today!