It’s no secret that the role of technology is vital to our everyday existence.

And – in the legal industry – this is becoming increasingly clear.

From automated billing to artificial intelligence, law firms are learning to use technology to streamline their operations, enhance client services, and stay competitive in a rapidly evolving legal landscape.

One area that technology has played a key role for law firms is in trust accounting and the software that has been designed to help manage it correctly.

Key Takeaways

- As legal practice management software has evolved from all-in-one law practice management software systems to customized tech stack solutions, more law firms are seeing the benefit of choosing their own software for their firm’s various needs.

- Having a strong trust accounting system in place is important to a law firm’s success and finding the right legal trust accounting software for your tech stack will be a big part of that.

- Though there are many factors that a law firm must consider before choosing a legal trust accounting software system, certain ones stand out above the rest.

With the complexities of managing client trust accounts, lawyers are turning to trust accounting software to streamline their financial processes, enhance accuracy, and ensure compliance with rules for trust accounting.

However, with a multitude of options available, finding the right software for your law firm can be a daunting task.

What is Trust Accounting Software?

Trust accounting software is a specialized tool designed to help law firms manage and maintain accurate records of client trust accounts.

It provides the necessary functionality to track and monitor funds held on behalf of clients, ensuring compliance with legal and ethical obligations.

Trust accounting software streamlines various aspects of trust accounting, including depositing client funds, recording disbursements, reconciling bank statements, generating reports, and maintaining proper documentation.

One of the key features of trust accounting software is its ability to segregate client funds from the firm’s operational funds, ensuring proper handling and safeguarding of client assets.

It allows law firms to create separate client trust accounts and tracks the inflow and outflow of funds for each client matter. This segregation helps maintain transparency and prevents commingling of client funds with the firm’s own finances.

Trust accounting software also incorporates built-in checks and balances to help prevent errors and maintain accuracy.

Good trust accounting will be able to automate many of the routine (and highly necessary!) tasks that are associated with managing your client trust funds.

From tracking interest accruals to generating detailed reports, the right trust accounting software will streamline financial processes like these and make everything related to your legal trust accounting easier.

Step-By-Step Process for Attorneys & Law Firmsto Buy Law Firm Software

Understand who needs what and prioritize features as you investigate new software. Download Buyers Guide eBookThis level of automation not only saves time but also reduces the risk of manual errors, ensuring compliance with trust accounting rules and regulations.

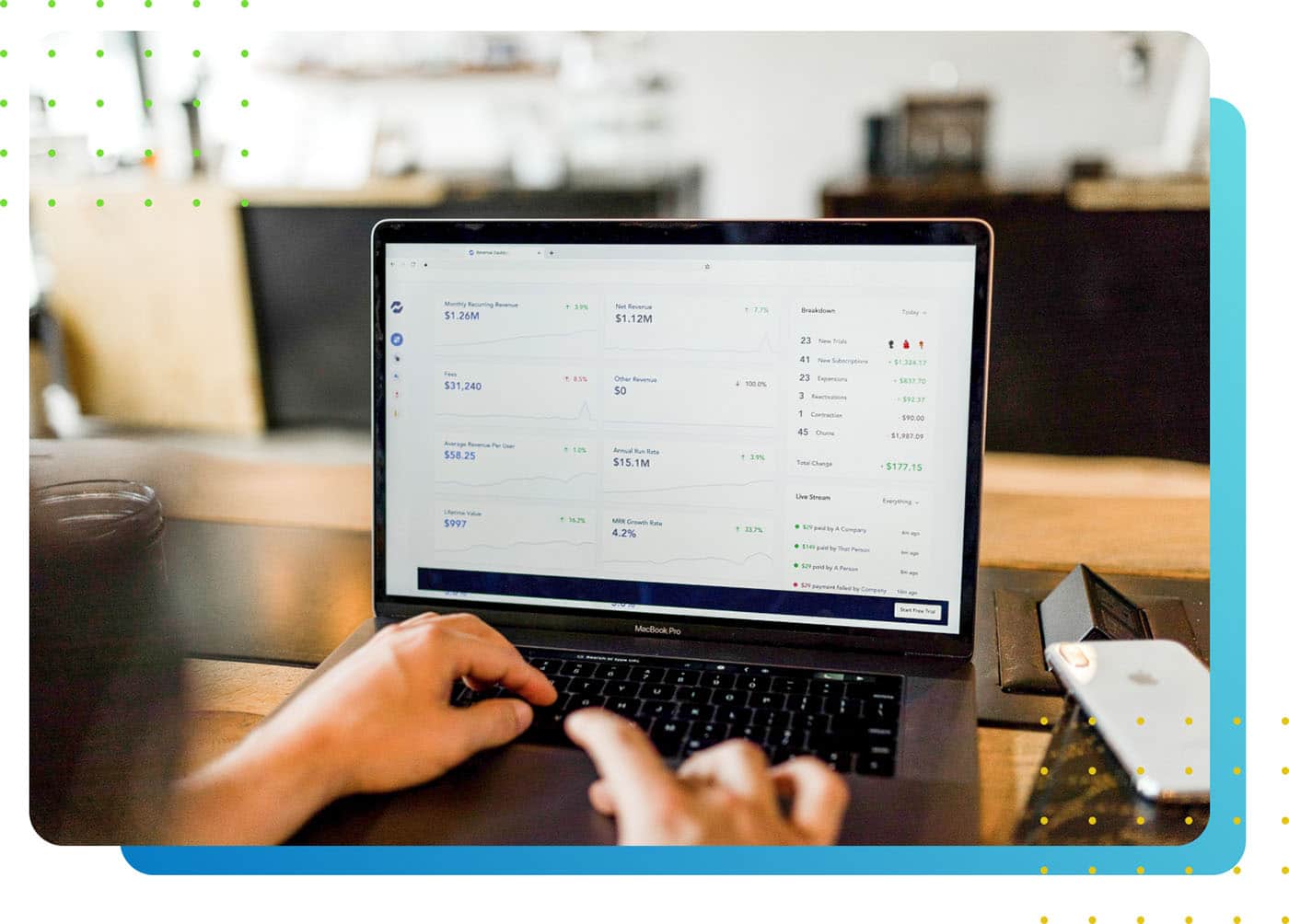

The right trust accounting software can also integrate with other essential tools that your law firm uses, such as your regular legal accounting software and your timekeeping systems.

This integration allows for seamless data sharing and eliminates the need for duplicate entries, enhancing overall efficiency and reducing administrative burdens.

How do I Know if My Firm Needs Trust Accounting Software?

Determining whether your law firm needs trust accounting software depends on various factors, including the size of your practice, the number of client matters, and the complexity of your trust accounting requirements.

Here are some indicators that will help you decide if your firm could benefit from implementing trust accounting software:

- Handling client funds: If your firm frequently handles client funds, such as retainers, settlements, or escrow payments, trust accounting software can help you manage these transactions accurately and securely. It provides a centralized platform to track the movement of funds, maintain detailed records, and generate reports as needed.

- Compliance requirements: Law firms are subject to strict regulatory and ethical obligations when it comes to handling client funds. Trust accounting software offers the necessary tools to ensure compliance with these rules, such as generating compliant ledgers, reconciling accounts, and producing audit-ready reports.

- Increased efficiency: If your firm is currently using manual methods or outdated systems to manage trust accounting, you may experience inefficiencies and potential errors. Trust accounting software automates many routine tasks, saving time and reducing the risk of mistakes. It streamlines workflows, enhances productivity, and allows your staff to focus on higher-value activities.

- Growth and scalability: As your firm grows and handles a larger volume of client matters, trust accounting can become more complex. Trust accounting software provides scalability and flexibility to accommodate your expanding needs. It can handle multiple client accounts, generate customized reports, and adapt to the changing dynamics of your practice.

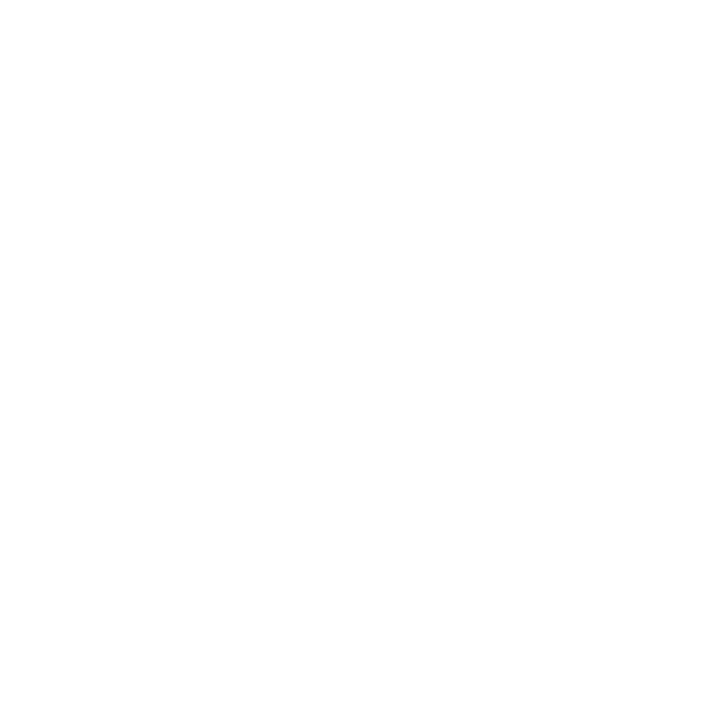

- Enhanced financial visibility: Trust accounting software offers real-time insights into the financial health of your client trust accounts. With accurate and up-to-date information at your fingertips, you can make informed decisions, identify potential issues early on, and maintain transparency with clients.

How Do I Find the Best Trust Accounting Software for My Law Firm?

Step 1: Assess Your Firm’s Requirements

Before embarking on the search for trust accounting software, it’s crucial to identify and assess your firm’s unique requirements. Consider the size of your practice, the number of trust accounts you manage, and the specific features and functionalities you need. Evaluate your current workflows and any current challenges to determine what you expect from the software. This introspective analysis will serve as a foundation for making an informed decision.

Step 2: Research Trust Accounting Software Providers

Once you have a clear understanding of your firm’s requirements, it’s time to research trust accounting software providers. Look for reputable companies that specialize in legal accounting software and have a proven track record in the industry. Read customer reviews and testimonials to gauge user satisfaction and determine the software’s reliability and performance. Take note of the features each provider offers and compare them against your firm’s requirements.

Step 3: Evaluate Key Features

As you evaluate different trust accounting software options, pay close attention to the key features they provide. Look for features such as automated transaction recording, bank reconciliation, check printing, reporting and analytics, compliance monitoring, and integration with other essential software like practice management systems. Assess the user interface and ease of use to ensure that the software will be intuitive for your team.

Step 4: Consider Security and Compliance

Trust accounting involves handling sensitive financial information and ensuring compliance with legal and ethical obligations. Therefore, it is crucial to prioritize security and compliance features when selecting trust accounting software. Look for software that provides strong data encryption, user access controls, audit trails, and built-in compliance checks. Consider whether the software adheres to industry standards and regulatory requirements to ensure that your firm’s data and trust accounts are secure.

Step 5: Request Demos and Seek Recommendations

Before making a final decision, it’s beneficial to request demos from any vendors that have made your shortlist. A live demonstration will give you a hands-on experience of the software’s functionality and allow you to assess its suitability for your firm. Additionally, seek recommendations from colleagues and other legal professionals who have experience with trust accounting software. Their insights and feedback can provide valuable guidance in your decision-making process.

LeanLaw Trust Accounting Software: How to Implement it Into Your Tech Stack

If you are ready to make the decision to add a trust accounting software system to your tech stack, LeanLaw is the best choice on the market today.

LeanLaw is legal accounting and billing software created by and for legal professionals that can greatly enhance the efficiency and accuracy of your law firm’s trust accounting needs.

Here is a snapshot at how easily LeanLaw can be implemented into your firm’s already existing stack of software:

Schedule a demo

- Assess your firm’s needs: Before integrating any software into your tech stack, it’s crucial to evaluate your firm’s specific requirements. Consider factors such as the volume of trust accounting transactions, compliance obligations, reporting needs, and integration capabilities with other existing software.

- Conduct thorough research: Familiarize yourself with the features and functionalities of LeanLaw trust accounting software. Explore how LeanLaw aligns with your firm’s requirements and how it can complement your existing tools.

- Plan for implementation: Develop a detailed implementation plan that outlines the necessary steps, timelines, and responsibilities. Identifying key stakeholders who will be involved in the process is a key to a successful implementation.

- Data migration and setup: If you are transitioning from another trust accounting system, you will need to migrate your existing data into LeanLaw. Working closely with the LeanLaw team is easy and facilitating a smooth and accurate data migration process is a strength of the LeanLaw team.

- Training and onboarding: Ensure that your staff receives proper training on using LeanLaw trust accounting software. LeanLaw offers tons of training options to help your team understand the features and functionalities.

Implementing LeanLaw trust accounting software into your firm’s tech stack of software tools will quickly help to streamline your law firm’s financial management processes.

Check out the free demo here and get started today!