Are you feeling overwhelmed by the complexities of trust accounting?

Are you trying to navigate your law firm’s trust account needs using QuickBooks but find yourself more confused the longer you look at it?

Is the whole process making you wonder why you ever decided to practice law in the first place?

Key Takeaways

- Legal accounting is an important part of practicing law and needs to be prioritized in any legal practice.

- Accounting platforms like LeanLaw and QuickBooks Online can provide a comprehensive suite of features to effectively manage your law firm’s finances.

- From the automation of financial processes to real-time data synchronization, LeanLaw and QuickBooks Online enable your team to focus on core legal tasks rather than being bogged down by manual accounting work.

Lawyers are not accountants. While good legal professionals must possess an in-depth understanding of the law, accounting principles and practices are very likely not their area of expertise.

However, smart lawyers know that they must be able to navigate the intricacies of financial management, particularly when it comes to trust accounting.

Trust accounting requires meticulous attention to detail, compliance with specific regulations, and the ability to manage client funds with utmost integrity. Failure to do any one of these things can result in lost clients, lost revenue and even legal consequences, even if the mismanagement of client funds was not intentional or seemed insignificant at the time.

This is where good trust accounting software will be a godsend to any law firm.

Thanks to advanced technology and customized accounting software, finding the right fit for your firm’s needs doesn’t have to mean hours of research and presentations by accounting software vendors.

It also doesn’t have to mean hours spent trying to master a specific platform or learn a whole new accounting language, just to get your financial books in order.

Today, most law firms who prioritize accurate trust accounting will partner a legal accounting software system like LeanLaw with QuickBooks Online for the financial management of their practice.

Combining LeanLaw and QuickBooks Online together, a law firm will find itself with a powerful and integrated solution for trust accounting.

But how to do it?

Let’s look at why these two applications can be the best solution for your law firm’s needs and answer some of the most common questions clients have when integrating them into their firm’s tech stack of practice management choices.

QuickBooks Online and LeanLaw…The Power of Two

QuickBooks Online and LeanLaw are two powerful software solutions that, when used together, offer law firms a winning combination for their financial management needs.

Both platforms bring their unique strengths and functionalities, and together they create a seamless and comprehensive solution for any practice that is seeking efficiency, accuracy, and compliance in their accounting processes.

QuickBooks Online is a leading cloud-based accounting software trusted by millions of businesses worldwide. It provides an excellent suite of features designed to streamline financial management, including expense tracking, invoicing, bank reconciliation, and financial reporting.

With its user-friendly interface and accessibility from anywhere, QuickBooks Online can be a great accounting system choice for a law firm that wants to efficiently manage its operating bank account, manage its chart of accounts, track income and expenses, and gain valuable insights into its financial performance.

Just like with any small to mid-sized business, law firms can trust their financial needs to QuickBooks Online.

LeanLaw, on the other hand, is specifically built for the legal industry.

Created by and for lawyers and their staff, LeanLaw addresses the unique needs of law firms, such as trust account management. It offers specialized features like matter-based accounting, client fund management, automated ledger entries, and compliant trust account management.

With LeanLaw, law firms can easily navigate the complexities of trust accounting, ensuring accurate bank accounts record-keeping, transparent reporting, and strict compliance with legal and ethical obligations.

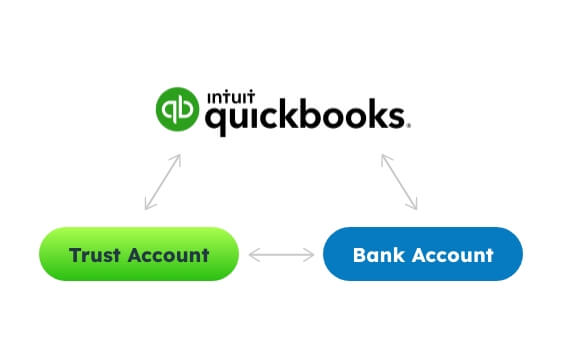

When integrated together, QuickBooks Online and LeanLaw create a powerful synergy. The integration means that data can be easily synchronized between the two platforms, eliminating the need for duplicate data entry and reducing the chances of errors.

Law firms can efficiently manage their trust accounts, accurately record financial transactions, and maintain a clear audit trail.

By leveraging the power of QuickBooks Online and LeanLaw, law firms can now gain the ability to streamline their financial management processes, while also ensuring compliance with law firm trust accounting rules, and maintaining accurate and transparent records.

Step-By-Step Process for Attorneys & Law Firmsto Buy Law Firm Software

Understand who needs what and prioritize features as you investigate new software. Download Buyers Guide eBookThe combination of these two platforms empowers law firms to focus on delivering exceptional legal services to their clients while also giving them the peace of mind they need, knowing that their financial management is handled with precision and efficiency.

QuickBooks Online and LeanLaw: Most Common Questions…Answered!

Though QuickBooks Online and LeanLaw are two platforms that work excellently together, there are still some questions you’ll want to get answers to before you commit to adding them to your tech stack.

Here are 10 of the most common:

1. What is QuickBooks Online?

QuickBooks Online is a cloud-based accounting software that helps businesses manage their finances, including invoicing, expense tracking, bank reconciliation, and financial reporting.

2. What is LeanLaw?

LeanLaw is a legal-specific accounting software designed to address the unique needs of law firms, including trust accounting, matter-based accounting, client fund management, and compliant trust account management.

3. Can QuickBooks Online and LeanLaw be integrated?

Yes, QuickBooks Online and LeanLaw can be integrated seamlessly, allowing for the synchronization of data between the two platforms. From your regular operating bank account to your client trust account, QuickBooks Online and LeanLaw can easily work together to make sure each account is always up-t0-date.

4. How does the integration between QuickBooks Online and LeanLaw benefit a law firm’s trust account practices?

The integration between QuickBooks Online and LeanLaw eliminates the need for duplicate data entry, reduces potential liability account and trust account errors, and ensures accurate financial record-keeping and compliance with trust accounting rules.

5. Can I track trust account balances in QuickBooks Online?

While QuickBooks Online provides general accounting functionalities, it may not have the specialized trust accounting features required by law firms. This is where LeanLaw comes in, providing robust trust accounting capabilities that will ensure accuracy at all times and with every trust liability account your firm is responsible for.

Schedule a demo

6. Can LeanLaw generate compliant trust account reports?

Yes! LeanLaw is designed to generate trust account reports that comply with legal and ethical obligations. Not only do these trust account reports provide law firms with the necessary documentation for audits and compliance checks, but they also ensure your clients that their trust funds are being managed correctly and in compliance with the law.

7. How does LeanLaw handle matter-based accounting?

LeanLaw allows law firms to associate financial transactions with specific legal matters, providing detailed and accurate accounting records for each case. It provides comprehensive tools and features to manage the financial aspects of each matter individually, ensuring accurate tracking of expenses, time entries, and client invoices.

8. Can QuickBooks Online and LeanLaw handle multiple trust accounts?

Yes, QuickBooks Online and LeanLaw can handle multiple trust accounts, which allows for law firms to effectively manage client funds across different accounts and make sure that a client’s trust balance is what it should be.

9. Is it easy to learn and use QuickBooks Online and LeanLaw?

Both QuickBooks Online and LeanLaw are designed with user-friendly interfaces and intuitive workflows, making it relatively easy for law firms to learn and utilize the software effectively.

10. Can I access QuickBooks Online and LeanLaw from anywhere?

Yes, QuickBooks Online and LeanLaw are cloud-based solutions, enabling law firms to access their financial data and perform accounting tasks from anywhere with an internet connection.

Best Practices for Integrating LeanLaw and QuickBooks Online into Your Law Practice

Learning LeanLaw and QuickBooks Online together may require some time and effort, especially if you and/or your staff are new to either software.

However, both LeanLaw and QuickBooks Online are known for their user-friendly interfaces and intuitive workflows, which makes the learning process much smoother and easier to understand.

Not only that, but since LeanLaw is designed to be used by law firms specifically, anyone in your office who is already familiar with terms such as “trust account”, “trust liability account”, “IOLTA bank account” and other such terms specific to law firms should be able to grasp the workflow of both these platforms relatively quickly.

That said, here are a few factors to consider that will make the integration and learning curve much easier:

- Training and Support: Both LeanLaw and QuickBooks Online provide resources to help users get up to speed. They offer training materials, tutorials, and customer support to assist with any questions or issues that may arise during the learning process. Taking advantage of these resources is an excellent way to help your attorneys and staff master both programs in no time.

- Integration: LeanLaw and QuickBooks Online are designed to work together seamlessly, with integrations that facilitate the transfer of data between the two platforms. This integration streamlines the process of syncing financial data, eliminating the need for manual entry and reducing errors. It also means that less information is accidentally lost during the training period.

- Familiarity with Accounting Principles: If you have a basic understanding of accounting principles and workflows, it will be easier to navigate both LeanLaw and QuickBooks Online. However, even if you’re not an accounting expert, the software’s user-friendly interfaces and guided processes can help simplify the learning curve.

- Dedicated Time for Training: Allocating dedicated time for training and familiarizing yourself and your staff with both platforms will enhance your learning experience. By setting aside time to explore the features, practice tasks, and review available resources, you can gain confidence in using LeanLaw and QuickBooks Online more effectively.

Remember – even though learning any new software may have its challenges, the benefits of integrating LeanLaw and QuickBooks Online for trust accounting can outweigh the initial learning curve.

With time, practice, and support from the software providers, you can become proficient in using both platforms together to streamline your law firm’s financial management processes.

Work smarter, not harder. Work with LeanLaw.

When it comes to managing trust accounting for your law firm, working smarter and not harder is your key to success.

By leveraging the power of LeanLaw and QuickBooks Online together, you can streamline your financial management processes, enhance accuracy with each liability account and bank account and ensure compliance with trust accounting rules and regulations.

With robust features, user-friendly interfaces, and dedicated support, these software solutions provide the tools you need to take control of your trust accounting tasks.

If you’re ready to learn more about adding LeanLaw and QuickBooks Online to your firm’s tech stack, check out our free demo today.

With LeanLaw by your side, you can focus on what you do best – practicing law – while leaving the complexities of trust accounting to the experts.