Anyone who is in charge of managing the finances and daily operations of a law firm knows there are plenty of acronyms that are specific to the practice of law.

IOLTA is one of those terms.

The term, IOLTA, stands for Interest on Lawyer Trust Accounts.

Every state in the United States has established an IOTLA program that is seen as a mechanism for funding legal aid for low-income citizens of that state.

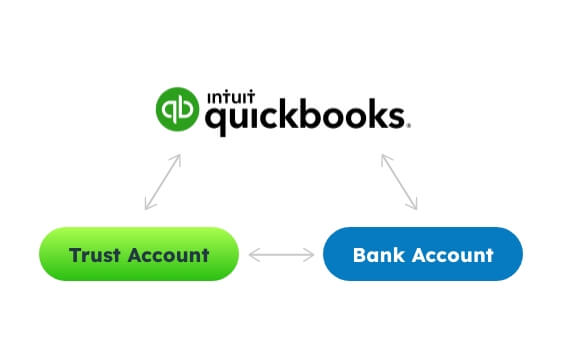

Interest on Lawyer Trust Accounts also serve as a way for law firms to keep their client funds separate from any operating accounts that the law firm has set up and allow for administrators in that firm to know exactly how much money is in each account at any given time.

How Does an IOLTA Work?

Lawyers sometimes handle money belonging to clients, such as settlement checks and/or payment of the fees for the service not being provided.

A lawyer may deposit money in client trust accounts which often bear interest for their clients.

Sometimes, however, a single attorney’s fees are very low or are only held for a short amount of time. This means that they won’t necessarily accrue much interest for their clients if these monies are placed into their own separate accounts.

This means that, when a law firm asks a client for a retainer for legal services not yet rendered, those funds need to be held in a way that will keep them secure but won’t allow those funds to be mistaken for operating expense funds.

It is against the law for a firm to use any unrendered client funds for anything other than legal services for that client.

Therefore, payroll expenses, rent or mortgage payments, or any other type of expense associated with running the law firm can not be paid with client money that’s being held in a lawyer’s trust account.

These expenses – usually referred to as operating expenses – must be paid out of a separate account from the one holding client money.

By placing short term client funds into an IOLTA account that the firm has opened, these funds can then be guaranteed to not be confused with other monies that the firm is in possession of.

Schedule a demo

And, since a law firm also can’t benefit financially from any interest earned on these funds, each state’s IOLTA program allows for any interest earned on these funds to be used for various purposes across each state. So if you’re setting up an account in New Jersey, you’ll want to know the NJ IOLTA account requirements.

For example, most states have decided to direct a large portion of the interest earned in an IOLTA interest bearing trust account toward providing civil legal aid to the underserved population in their state.

Some states also decide to direct these IOLTA funds towards scholarships, grants for local nonprofits, and other areas in the state or community that need financial assistance.

And, different states have different organizations that oversee the IOLTA program for that state.

Though many administer their IOLTA accounts through the state’s bar association, IOLTA accounts can also be monitored and managed by other entities as well.

One important thing to note: regardless of what organization is accountable for the management of the IOLTA accounts and the administration of the funds, it is each specific law firm’s responsibility to make sure that their client’s IOLTA account interest earned is being recorded, managed, and administered properly.

Failure of a firm to manage its client funds and/or IOLTA accounts in the correct manner can result in grave consequences for the law firm or the individual attorneys.

Some of the potential consequences include penalties, fines, and even disbarment from that state’s bar association.

How Do I Set Up My Firm’s IOLTA Account?

Setting up an IOLTA account for your firm is not complicated, as long as you follow certain guidelines to get you through the process and to make sure you’ve done everything appropriately.

First, reach out to the financial institution where your law firm currently does its banking.

Most larger financial institutions will have the ability to open and maintain an IOLTA account for you.

If your bank does not participate in your state’s IOLTA program, you will need to contact another financial institution in your state and ask them to set it up for you instead.

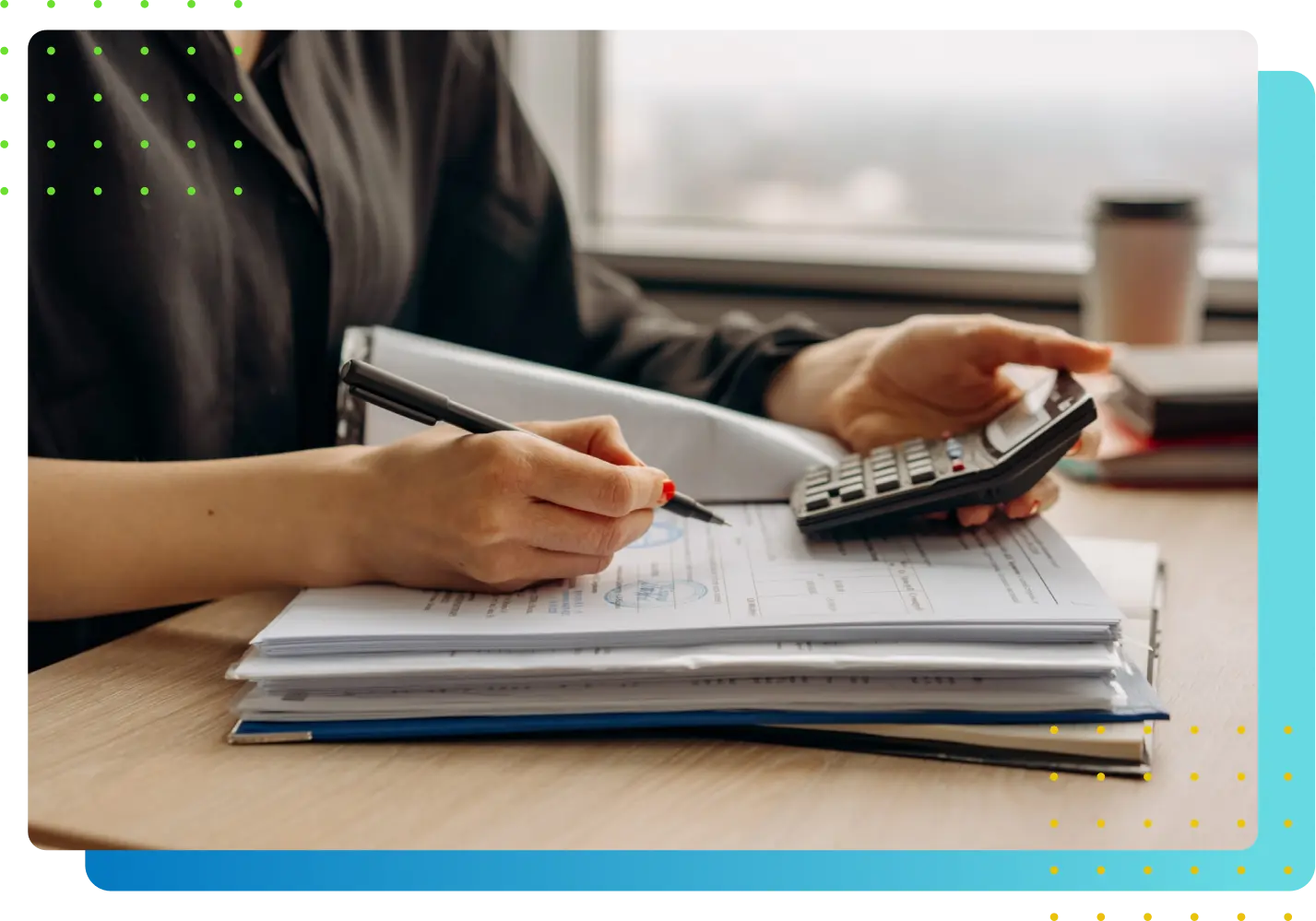

Once you’ve decided where to open your firm’s IOLTA account, you’ll have some paperwork to fill out that’s relatively standard and simple to follow.

One important thing to note is that you need to make sure that the IOLTA account number is not the same as any other account number your firm is currently using.

Making sure you have a separate account number for all of your various business accounts will help track all your client trust accounts as well as your operating ones.

Remember, your client funds will be deposited into this account, and interest earned will transfer from this account to your state’s IOLTA program, so you want to make sure it is very clear what this account is going to be used for.

Do You Need Help Establishing Your IOLTA Accounts?

If you’re ready to learn more about IOLTA accounts and how to set up interest bearing checking accounts in your state, consider reaching out to LeanLaw to help with any and all of your law firm’s accounting needs.

The approach to law firm accounting software is simple at LeanLaw.

By focusing on the most important aspects of your firm’s business, LeanLaw can help law firms get paid faster with invoice delivery and online payments.

You can also track profitability by attorney, client, or a variety of other ways. And so much more!

LeanLaw’s cloud-based billing software will also enable your team to run your firm efficiently, with features that will fit all your client’s needs.

If you are ready to take your accounting to a new level, request a demo from our online site today.