- Strict Colorado Rules: Colorado lawyers must follow specific trust accounting rules (Colo. RPC 1.15) to keep client funds safe. Mishandling a client trust account is one of the fastest ways to face discipline in Colorado.

- COLTAF & IOLTA Compliance: Colorado requires using IOLTA (Interest on Lawyers’ Trust Accounts) for short-term or nominal client funds, with interest sent to the Colorado Lawyer Trust Account Foundation (COLTAF). Firms must use approved banks and maintain detailed records and regular reconciliations to comply with ethical rules.

- Best Practices: Proper trust accounting means segregating client money, recording every transaction, reconciling accounts monthly, and avoiding common pitfalls like commingling funds or early withdrawals. Modern legal accounting software (like LeanLaw) can automate these processes and help ensure compliance with Colorado’s trust accounting requirements.

Trust accounting isn’t just an administrative chore – it’s an ethical obligation. In Colorado, even minor mistakes with client funds can lead to serious consequences. In fact, the Colorado Supreme Court’s Office of Attorney Regulation Counsel (OARC) explicitly warns that “Mishandling client funds is the quickest way to get disciplined in Colorado.” Colorado’s regulators are vigilant: banks must report any trust account overdraft to OARC, and each report receives immediate investigation. In 2023 alone, Colorado OARC investigated 103 trust account overdraft notifications. The message is clear – law firms must diligently manage IOLTA and trust accounts.

This guide will walk you through Colorado’s specific trust account rules (including the role of COLTAF and Rule 1.15), provide detailed steps for proper trust accounting, highlight common pitfalls (and how to avoid them), and share best practices to keep your firm compliant. We’ll also touch on how legal accounting tools like LeanLaw can support your trust accounting workflows. With the right processes (and a bit of technology), even small and mid-sized firms can master Colorado trust accounting with confidence and keep client funds secure.

Understanding IOLTA and Trust Accounts in Colorado

What is IOLTA? IOLTA stands for Interest on Lawyers’ Trust Accounts – a nationwide program where lawyers pool small or short-term client funds in a special interest-bearing trust account. The interest from these pooled accounts doesn’t go to clients (since each individual amount is too small to earn net interest); instead, it is used to fund legal aid and justice initiatives. In Colorado, the IOLTA program is administered by the Colorado Lawyer Trust Account Foundation (COLTAF), an organization created by the Colorado Supreme Court in 1982. COLTAF uses IOLTA interest to improve access to civil justice for Colorado’s residents, having granted over $50 million to legal aid and pro bono programs over the decades. In other words, Colorado’s IOLTA system not only safeguards client money but also benefits the community.

COLTAF Accounts: Under Colorado’s Rules, every private practice lawyer who holds client funds must have a trust account, and typically this will be a COLTAF trust account for pooled client funds. A COLTAF account is an interest-bearing pooled trust account for client funds that are “nominal in amount or expected to be held for a short period of time,” such that they wouldn’t earn interest for the client beyond the cost of setting up a separate account. All interest on COLTAF accounts is paid directly to the COLTAF foundation; neither the lawyer nor the clients can claim that interest. For example, if you receive a $2,000 retainer from a client for a matter that will likely be resolved in a month or two, you would deposit it in your COLTAF account. The interest accrued (maybe just a few cents) goes to COLTAF’s fund for legal aid, while the principal remains safely held for your client.

When to use separate trust accounts: If a client deposits a large sum or funds that will be held for a long time, such that the interest earned would meaningfully exceed the bank fees, Colorado expects you to go beyond COLTAF. In those cases, you should place the money in a segregated, interest-bearing trust account for that specific client (or matter), so that the client – not COLTAF – earns the interest. Colorado Rule 1.15B(h) outlines this requirement: any client funds not held in a COLTAF must be in a fully compliant trust account where all interest belongs to the client. Practically, the lawyer must use their judgment (and the rule’s guidance) to decide if funds are “nominal or short-term” (COLTAF) or large/long-term (separate account). If you ever mistakenly keep a large amount in COLTAF and later realize it should have earned interest for the client, Colorado has a fix: you can request COLTAF to refund the interest to benefit that client. COLTAF publishes a refund procedure for such scenarios – an extra reason to be diligent in evaluating where to deposit client funds.

Colorado’s IOLTA Bank Requirements: Not every bank can hold a Colorado COLTAF or trust account. Colorado lawyers must maintain trust accounts (including COLTAF accounts) only at Approved Financial Institutions. An approved institution is one that has agreed to Colorado’s protective measures: notably, the bank must report any trust account overdraft to OARC and comply with any subpoenas from regulators. Banks also must pay a comparable interest rate on COLTAF accounts (they can’t short-change the interest just because it’s for a foundation). The Colorado Supreme Court’s Regulation Counsel publishes a list of approved banks, so lawyers don’t have to guess – you just need to ensure your trust account is opened at a listed institution. Choosing an approved COLTAF bank is the first step to compliance. (Tip: Most Colorado-major banks and many local banks are approved; COLTAF even highlights “Leadership Banks” that go above and beyond in supporting the IOLTA program.)

Colorado Rules and Ethical Requirements for Trust Accounts (Rule 1.15)

Colorado’s Rule of Professional Conduct 1.15 is the heart of trust account ethics. It spells out how lawyers must handle client property (funds, securities, etc.) and imposes specific requirements for trust accounts. Here are the key Colorado-specific rules you need to know:

- Separate Trust Account – No Commingling: Client money is not your money. All funds entrusted to you (or your firm) must be kept in a trust account, separate from your personal or business accounts. This includes advance fee payments (retainres or flat fees paid before work is done) and advances for costs – those are not earned until you do the work, so they belong in the trust account. You cannot deposit client funds into your operating account, and you shouldn’t pay personal or firm expenses directly out of a client trust account. The only exception to the no-commingling rule is that you are allowed to keep a small amount of your own firm money in the trust account solely to cover bank service charges (e.g. monthly maintenance fees). Colorado explicitly permits a lawyer to deposit a bit of firm funds to cover such fees, but you must record those funds clearly in your records as belonging to the firm. Other than that nominal amount, none of your money should be in the trust account, and none of the client’s money should be in your business account.

- Account Labeling and Segregation: Every trust account in Colorado must be clearly labeled as a trust account (e.g., “Trust Account” or “Client Trust – Attorney Name”) on all records, checks, and deposit slips. If it’s a COLTAF IOLTA account, it should specifically say “COLTAF Trust Account”. This prevents any confusion and signals to the bank (and you) the account’s purpose. It’s also wise to have separate trust accounts for fundamentally different purposes if needed – for instance, some firms maintain a separate trust account just for settlement funds or for personal injury cases due to high transaction volume, but that’s not a requirement as long as your accounting tracks each client’s funds separately. The critical part is that within a pooled trust account (like COLTAF), you must internally segregate funds by client through your recordkeeping (more on that below). Each client’s money remains that client’s property; you’re merely a fiduciary holding it.

- Using COLTAF vs. Individual Trust Accounts: As explained, Colorado mandates that “All funds entrusted to the lawyer shall be deposited in a COLTAF account unless” they meet the criteria for a separate interest-bearing account. In practice, this means most routine retainers, advance payments, and small settlements go into your pooled COLTAF IOLTA. If you determine funds are large enough for the client to earn interest, you open a dedicated trust account for that client (often a separate savings or MMA titled “Client X Trust Account”) where interest will accrue for that client’s benefit. Remember: you need the client’s tax ID for that account interest and possibly to address any tax forms for interest earned. It’s good to spell out in your fee agreement how you handle interest on trust accounts, so the client knows (in Colorado, by default you follow the COLTAF rule unless agreed otherwise). Bottom line: Don’t let client money sit idle outside of an interest-bearing account – Colorado wants every dollar either earning interest for the client or contributing to the COLTAF fund.

- Approved Institutions & Overdraft Alerts: We touched on this above – Colorado requires that your trust account be in an insured, government-regulated financial institution that’s been approved by the Regulation Counsel. The approval hinges on the bank’s agreement to notify regulators of any bounced checks or overdrafts on the account. This creates a built-in alarm system: if you accidentally bounce a trust check or if the account goes negative for any reason, OARC will know about it (banks must send an overdraft report). Those reports get “immediate attention” from an investigator. Even if the bank honors the check (covering an overdraft), they still report it to OARC. In short, you cannot hide trust accounting problems – prevention is the only cure. The lesson for lawyers is to avoid overdrafts at all costs (we’ll discuss how in the pitfalls section). Also, if you ever change banks or open a new trust account, make sure the institution is on Colorado’s approved list (available via the Colorado Supreme Court or COLTAF’s website). Most common banks are, but credit unions or online banks might not be. It’s worth the extra check to ensure compliance with Rule 1.15E’s approved institution requirement.

- Proper Use of Trust Account Funds: Colorado’s rules strictly govern how you can withdraw or use client funds from trust. Rule 1.15C forbids certain practices outright. For example, you cannot use a trust account debit card or ATM card – cash withdrawals from a trust account are prohibited. Every withdrawal or transfer must be made by a lawyer (or a supervised employee) and only by check or electronic transfer to a named payee. You can’t write a trust check payable to “Cash” to yourself, nor can you withdraw cash from a teller. These limitations exist to maintain a clear paper trail for every penny leaving the trust account. When you do disburse funds, they should be for a proper purpose: paying the client, paying a third party on the client’s behalf (e.g. an expert or court fee), refunding the client, or transferring earned fees to your business account. Never pay personal or firm bills directly from a trust account, and never “borrow” from one client’s funds to pay for another matter’s expense (a classic misappropriation). Colorado also expects you to be prompt in handling trust money – Rule 1.15A says you should notify clients when you receive funds for them and deliver any funds they are entitled to promptly. For instance, if a settlement check comes in, deposit it to trust, then promptly pay the client their share and any third parties, rather than letting it sit indefinitely. Prompt, proper disbursement is part of your fiduciary duty.

- Detailed Recordkeeping (7-Year Requirement): Maintaining meticulous records is not just good practice – it’s required. Colorado Rule 1.15D mandates that you keep complete records of your trust account transactions and client balances for at least seven years after the event. What do these records include? Essentially everything: a ledger for each client showing all deposits and disbursements for that client (with dates, amounts, payor/payee, and purpose of each transaction); records of any other property (like stock certificates or originals of documents) you hold in trust; copies of retainer agreements or engagement letters that describe fees (so you can justify when fees are earned); copies of all client invoices and billing statements; and bank statements and canceled checks for the trust account. Your trust accounting system should be able to produce a report at any time showing each client’s balance and a running history of transactions. Colorado permits computerized records, of course, as long as you can print them on demand and they are kept in accordance with standard accounting methods. If you use QuickBooks or practice management software, make sure to regularly backup these records. In the event of an audit or if a client complains, you’ll need to produce these records to OARC. Failing to maintain the required records is itself a rule violation, separate from any shortage that might exist. The safest approach is to update your trust records in real-time (or at least weekly) and not rely purely on memory. Every deposit or withdrawal gets logged with detail. Developing a habit of thorough recordkeeping will save you from headaches down the road.

- Regular Reconciliation: Reconciliation is your number-one tool for catching mistakes. Colorado requires that trust accounts be reconciled at least quarterly at minimum, but best practice (and implicit expectation) is to reconcile every month. Reconciliation means you compare three things: (1) the balance in your trust bank account (per the bank statement), (2) the total of all client sub-account balances in your records (the sum of what you’re holding for each client), and (3) your own check register or ledger for the trust account. These should all match, and if they don’t, you investigate and resolve why. Colorado’s Rule 1.15C(c) specifically says a Colorado lawyer (or supervised person) must reconcile the trust account records with the bank statements no less than quarterly, both in the aggregate and per client. So, you must ensure not only that the total matches, but also each individual client ledger is accurate against that total. If you’re doing this only quarterly, you’re taking a risk – a lot can happen in 3 months. Most firms reconcile monthly (or even more frequently) so that any error (bank error, math error, transaction posted wrong, etc.) can be caught immediately. It’s wise to have a second person review the reconciliation if possible (e.g., the bookkeeper prepares it and an attorney signs off). Document your reconciliations (save the reports or bank rec statements) and keep them in your records – they’re part of that 7-year record requirement implicitly. Consistent reconciliation is truly the best way to protect yourself and your clients’ funds. If there’s ever a question, your clean reconciliation reports will demonstrate your compliance and diligence.

- Unclaimed or Unidentifiable Funds: Occasionally, a law firm might end up with money in trust that belongs to someone who can’t be found or who never cashed a check. Colorado has a rule for that too. Under Colo. RPC 1.15B(k), if you have unclaimed or unidentified funds in your COLTAF trust account that you can’t attribute to an owner (after due diligence to find them), you’re allowed to remit those funds to COLTAF as a last resort. This is a better outcome than just leaving money in the account forever or violating unclaimed property laws. However, you must make reasonable efforts to identify or locate the owner first. COLTAF provides an Unclaimed Funds Remittance form for this purpose. Keep a record of any such remittance for your files (and note that if the owner later comes forward, there is a procedure to get the money back from COLTAF for them). This rule ensures that stray funds eventually go to a public good if truly unreturnable, and it relieves you from holding money in trust in perpetuity. That said, unclaimed funds often result from poor recordkeeping – another reason to stay organized so you don’t lose track of whose money is whose!

By adhering to these rules – separate accounts, approved banks, proper withdrawals, detailed records, and regular reconciliations – you will meet Colorado’s ethical requirements for trust accounting. Next, let’s translate these rules into practical steps your firm can implement day-to-day.

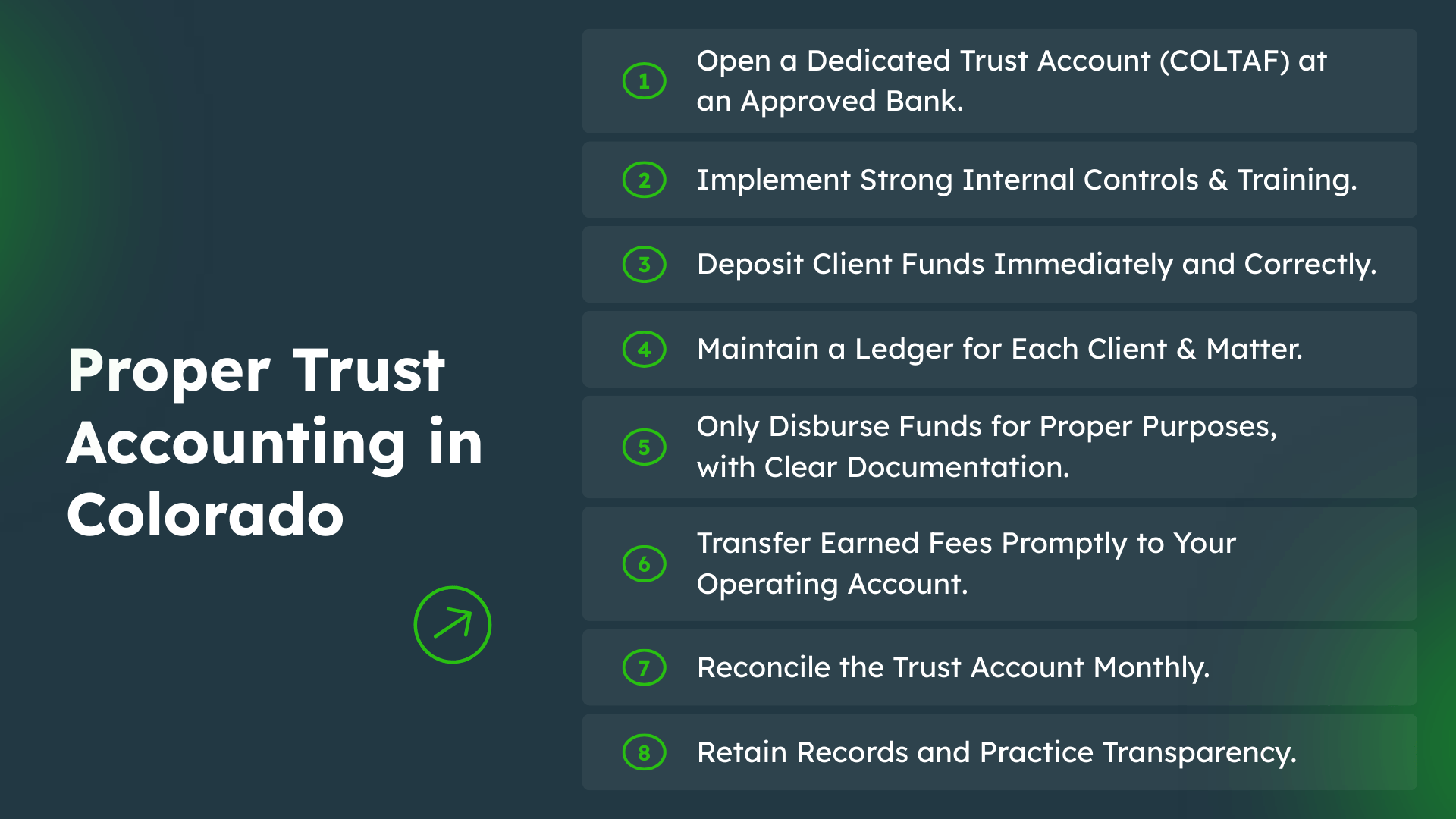

Detailed Steps for Proper Trust Accounting in Colorado

Following a step-by-step process can make trust accounting more manageable. Here’s a breakdown of how a small or mid-sized firm in Colorado should handle client funds from start to finish:

1. Open a Dedicated Trust Account (COLTAF) at an Approved Bank. If you haven’t already, establish a COLTAF trust account in your law firm’s name at a Colorado Regulation Counsel-approved financial institution. Contact your bank to ensure they offer COLTAF accounts (most will know what this means; you may need to fill out a COLTAF enrollment form). The account title should include your firm name and “Trust Account” or “COLTAF Trust Account” to clearly distinguish it. Do not use this account for anything other than client/third-party funds. Also set up any online banking with caution – disable ATM/debit card access for this account to prevent accidental cash withdrawals. If you expect to hold significant client funds for long periods, discuss with the bank about opening separate interest-bearing trust accounts for those clients (and get client consent as needed). At account opening, the bank will likely have you sign forms acknowledging the account is IOLTA and that interest will be remitted to COLTAF. Once open, treat this account with the care you’d give to someone else’s vault – because that’s essentially what it is.

2. Implement Strong Internal Controls & Training. Decide who in your firm will be authorized to handle the trust account. Colorado requires that only a lawyer admitted in Colorado or a supervised employee can be a signatory or make withdrawals. Limit access to only those who need it. Train any staff involved (paralegals, bookkeepers) in Colorado’s trust accounting rules – ensure they know not to commingle funds, not to disburse without attorney approval, and to never embezzle (obviously!). Set up a procedure for every trust transaction: for example, when a check comes in, the receptionist immediately alerts the bookkeeper or responsible attorney to log and deposit it that same day. When a disbursement is needed, require a written request or disbursement form that a lawyer signs off on. These controls create a system of checks and balances. Small firms might have one person doing it all – if so, that person must be extra diligent and perhaps have a second person (even an outside accountant) periodically review the records. It’s easier to prevent problems than to cure them, so build good habits from the start.

3. Deposit Client Funds Immediately and Correctly. Whenever you receive money that belongs (even in part) to a client or third party – whether it’s a retainer check, settlement draft, escrow deposit, etc. – deposit it into the trust account promptly. Don’t let checks sit on your desk or (worse) slip into your operating account. Colorado expects prompt action with client funds, and practical reasons do too (you want the funds available and accounted for). Fill out a deposit slip or create a deposit in your accounting system that lists whose money it is and why (e.g., “John Doe – $5,000 settlement advance” or “Acme Corp – $10,000 advance fee for contract case”). If the funds came by wire or electronic payment, likewise record the source and client. Each deposit must be attributed to the correct client ledger in your books. Pro tip: Never deposit one client’s money with instructions to split it later between trust and your fees – always deposit the full amount to trust, then do a separate withdrawal of earned fees (with an invoice) so the paper trail is clean. If you receive cash from a client (which is rare but possible), issue a receipt and deposit the cash to trust – do not use it directly. Ensure any credit card payments for advance fees go into the trust account net of fees or that your firm covers the processing fee so the client’s full amount ends up in trust (to avoid a shortfall). The guiding principle is to get the money into the trust account intact and record whose it is immediately. Colorado’s rule even suggests all deposits be kept with a detailed duplicate deposit slip for your records. Speedy deposits protect you from claims you lost or misused funds and start the accounting off right.

4. Maintain a Ledger for Each Client & Matter. Set up a trust ledger (individual sub-account record) for each client or case for whom you hold funds. Every deposit (from Step 3) gets entered on that client’s ledger with date, amount, and description. For example: “Jan 5, 2025 – Deposit $5,000 – Advance fee from John Doe for Case #1234.” This ledger shows the running balance for John Doe’s funds in trust. When you later pay something out on behalf of John Doe or transfer fees, you’ll record a deduction. Your ledger should always be up-to-date. Whether you use software or a manual spreadsheet, always identify who paid and what it’s for for each entry. Similarly, track any physical property (like a client’s stock certificate or settlement check before deposit) with a property log. This level of detail is required by Rule 1.15D and is your best friend if anyone asks, “Where is my money?” or if OARC audits you. It also prevents mistakes – if you’re about to withdraw funds for a client, you check their ledger to ensure they have sufficient balance. Good software can automatically maintain these client ledgers for you as you enter transactions. If you prefer manual, consider using a dedicated Excel sheet or a physical trust ledger book. Whatever the method, discipline yourself to log every transaction. At any given moment, you should be able to state: “Our trust account has $X, which is composed of $A for Client A, $B for Client B, $C for Client C, etc.” If these numbers aren’t at your fingertips, time to tighten your ledger system.

5. Only Disburse Funds for Proper Purposes, with Clear Documentation. When it’s time to use the client’s funds, follow the rules scrupulously. Only withdraw money from trust when it’s due to be paid – either to your firm (as earned fees or reimbursement of costs) or to the client or third-party (as a payout). Never withdraw just to “move money” or for an unspecified reason. Tie every disbursement to an invoice, settlement statement, or other backup documentation. For instance, if you are paying yourself $2,000 from John Doe’s retainer for work performed, make sure you’ve sent John Doe an invoice for those services and ideally get confirmation or at least wait a reasonable time to ensure no dispute. Then write a check or do a bank transfer from the trust account to your firm’s operating account for that $2,000, with memo “Earned fees – John Doe invoice #1001”. Record this withdrawal on John Doe’s ledger (bringing his trust balance down) and on the trust account register. Similarly, if you’re paying a filing fee for John Doe, you might write “Trust Account Check #101 – $400 to Colorado Courts, Filing Fee for John Doe case.” Maintain a copy of that check or payment receipt. By documenting every disbursement, you can show that no money left trust without a valid reason. Also, get in the habit of double-checking the client’s balance before writing any trust check – this prevents inadvertent overdrafts. If Client X only has $500 in trust, you cannot pay a $600 bill for them without an infusion of more funds from them.

6. Transfer Earned Fees Promptly to Your Operating Account. Law firms sometimes err by leaving earned fees in the trust account for too long. Colorado doesn’t want you to use the trust account as a savings account for your firm’s money – that’s technically commingling (your money mixing with client money). Once you’ve earned fees (concluded the work or reached a billing milestone under your fee agreement), you should withdraw those fees from the trust account in a timely manner. Many attorneys will bill at the end of the month and promptly transfer any earned amounts from trust to operating upon issuing the bill. Some might wait for client confirmation, but don’t wait indefinitely. By moving earned funds out, you keep the trust account purely for client money. Just be sure that the fee is truly earned per your engagement terms. (If a client disputes a fee, you should leave the disputed portion in trust until resolved.) The key is to regularly sweep out what’s yours, with proper notice to the client, so that the trust balance reflects only client-owned funds. This practice also improves your cash flow – you’re not leaving your income languishing in trust. Tip: Avoid writing checks from trust payable to yourself personally; instead pay to your law firm’s operating account, which creates a clearer audit trail and separation.

7. Reconcile the Trust Account Monthly. Reconciliation is not optional – it’s a necessity. At the end of each month (or more frequently), perform a three-way reconciliation: compare the bank statement balance for the trust account to (a) your own internal trust ledger totals and (b) your checkbook/register balance. All three should match. Identify any outstanding checks or deposits in transit (these explain differences between the bank statement and your records, but your adjusted balance should still match). In Colorado, you must do this at least every quarter, but monthly is strongly recommended. It’s much easier to remember and catch errors monthly. Document each reconciliation with a dated report. Many legal accounting software solutions will generate a reconciliation report, which is ideal. If doing manually, you can use a simple form or spreadsheet: list the ending bank balance, subtract any outstanding checks, add any deposits not yet shown, and you get an adjusted bank balance. Then list your total client balances – that sum must equal the adjusted bank balance. If not, find the discrepancy (maybe a transaction recorded twice, or bank error, or math mistake). Common causes of reconciliation issues include bank service charges taken (you should replenish those from firm funds if the bank dipped into client money), interest postings (COLTAF interest should sweep out to the foundation automatically), or deposits that bounced. The reconciliation is also a good time to review each client ledger for any negative balances (which should never happen) or stale balances that might need disbursement. By reconciling, you can be confident that your trust account is balanced to the penny. As one best-practice expert puts it: “Trust accounts, bank statements, and client ledgers should be in continuous sync” – that’s the goal of reconciliation.

8. Retain Records and Practice Transparency. After handling all these transactions, store the records securely. Keep copies of deposit slips, canceled checks (many banks provide images with statements), wire confirmations, client ledgers, invoices, and reconciliation reports. Colorado requires seven years of retention, so set up an organized archive (physical or digital). You might create a trust accounting binder or digital folder per year. This may seem like overkill, but if a client ever questions a transaction or if you face a random compliance audit, these records will be your defense. Additionally, it’s wise to maintain transparency with clients: provide trust account activity in their billing statements (e.g., “Your retainer balance is $X after this invoice”). In Colorado, while not explicitly mandated to provide periodic trust balance statements, it falls under good client communication to let them know the status of their funds. Upon the conclusion of a matter, promptly provide any remaining balance back to the client along with an accounting. If you follow these steps – deposit promptly, document thoroughly, disburse correctly, and reconcile regularly – you’ll have a smooth-running trust account and happy regulators (and clients).

By integrating these steps into your firm’s routine, trust accounting will become a standardized process rather than a panic-inducing mystery. Next, we’ll look at some common pitfalls that even well-meaning lawyers encounter in Colorado, and how you can steer clear of them.

Common Pitfalls in Colorado Trust Accounting (and How to Avoid Them)

Even with the rules and steps outlined above, mistakes happen. Here are some of the most common trust accounting pitfalls for law firms in Colorado, along with tips to avoid them:

- Commingling Funds (Mixing Client Money with Firm Money): This is the cardinal sin of trust accounting. Commingling can occur in two ways – depositing client funds into your business account (so the money is not safeguarded), or keeping your own funds in the trust account (beyond the tiny amount for bank fees). Both are violations. For example, using one bank account for everything because it’s “easier” is a huge no-no. Avoid it: Always maintain a separate, designated trust account. Deposit all client retainers or settlements into trust, never your operating account. And don’t leave earned fees in trust longer than necessary – once earned, transfer them out to the business account so the trust holds only client funds. By clearly separating what’s yours and what’s the client’s, you’ll steer clear of commingling issues. Remember, Colorado’s rules explicitly require a separate trust account, and auditors will check for any improper transfers.

- Misidentifying or Misallocating Funds: In a busy practice, it might be tempting to delay bookkeeping – e.g., you deposit a bunch of checks at once without carefully recording which client each check was for. This can lead to confusion or even using one client’s funds for another’s bills. If your records don’t clearly attribute every penny to a specific client, you risk a shortfall. Avoid it: Develop a habit to “know your client’s money” at all times. Immediately label each deposit and update each client’s ledger. If a trust deposit’s source is unclear, don’t guess – research it (ask your bank for copies or details if needed). Never assume that just because the total bank balance seems right that each client’s share is correct. Use a systematic approach (like one deposit per deposit slip) and avoid commingling clients’ funds in recordkeeping. Each client ledger should tell a complete story. This way, you won’t accidentally pay Client A’s invoice out of Client B’s money. Good software can prevent this by not letting you overdraft an individual client ledger.

- Failure to Reconcile Regularly: Some lawyers treat reconciliation as an afterthought – they might wait until year-end or only do it sporadically. This is a dangerous pitfall because small discrepancies can snowball into big problems. If you’re not reconciling, you might not notice that a check cleared for the wrong amount, or that the bank charged fees that you didn’t replenish, or that you recorded a deposit twice. Avoid it: Reconcile at least monthly, if not more often. Set a recurring calendar reminder and treat the reconciliation like a non-negotiable meeting. In Colorado, quarterly is the bare minimum, but monthly gives you 12 opportunities a year to catch and fix issues (versus 4). And if math isn’t your strength, use tools or get help – many modern legal accounting programs do three-way reconciliation automatically and flag inconsistencies. If you discover an error during reconciliation (say, the bank balance is $100 less because of a bank fee), immediately correct it (e.g., have the firm replace that $100 into trust if it was a fee taken out). Consistent reconciliation is your early warning system, preventing what could become an ethics violation if left unchecked.

- Overdrawing the Trust Account (Bounced Trust Checks): Writing a trust check that exceeds the available funds (either the total account or that client’s balance) is a critical mistake. Not only might the client’s payment bounce, but the bank will report the insufficient funds to OARC, triggering an investigation. Many disciplinary cases start with a lawyer accidentally overdrawing their trust account. This can happen if you forget about an outstanding check or if a client’s deposit hasn’t cleared yet when you disburse. Avoid it: Before every disbursement, verify the client’s balance and the account balance. Keep a cushion of firm funds only for bank fees, not for payouts. If you use accounting software, take advantage of features that warn or block you from overdrawing a client’s ledger. Also, be mindful of checks that haven’t cleared – keep a list of outstanding checks and factor them into your available balance. If you ever do make a mistake (it can happen – say a math error causes an overdraft), proactively contact OARC and your client to address it, rather than hoping it slides (it won’t, the bank will tell on you). But with prudent checks and good records, you can prevent overdrafts entirely. Treat the trust account with more care than your own bank account – it’s essentially a trust given to you.

- Paying Personal or Firm Expenses from Trust: Some lawyers have gotten in trouble for using the trust account as a petty cash or slush fund – paying office rent, personal bills, or unrelated expenses out of it, intending to “repay later” or thinking it’s okay if clients aren’t immediately needing the money. This is a huge ethical breach. Avoid it: Under no circumstances should you pay non-client expenses directly from trust. The flow should always be: move earned fees to operating, then pay firm expenses from operating. If you have a bona fide cost to pay for a client (e.g., a filing fee, expert witness), that’s fine – it’s on behalf of the client. But your office rent, salary, coffee, etc., never come out of client funds. It may seem obvious, but disciplinary records show that in moments of financial stress, some lawyers yield to the temptation of “borrowing” from the trust account – which is essentially conversion of client funds. The OARC and Colorado Supreme Court view intentional misappropriation as one of the gravest offenses, often warranting disbarment. So keep a bright line: trust account is only for client-related transactions.

- Inadequate Backup or Lost Records: Imagine an attorney who kept trust records in a single notebook or an old software file that got corrupted – and then can’t fully account for whose money is in trust. Failing to maintain the required records is not only a rule violation, it can lead to actual loss of funds or inability to know what’s what. Avoid it: Keep duplicate records and backups. Use a cloud-based system or at least back up your QuickBooks/Excel file regularly. Keep bank statements and invoices in an organized fashion. This isn’t just hoarding paper – in Colorado you must have those records for seven years. Also, if you retire or leave practice, ensure someone (or you) retains those records or arranges for a successor to handle any remaining trust funds. Many pitfalls happen when a lawyer is disorganized; robust record-keeping habits will save you.

- Not Handling Client Disagreements or Unclaimed Funds Properly: Sometimes a client may dispute a fee or simply drop off the map, leaving money in trust in limbo. A pitfall is ignoring these situations – either withdrawing disputed funds for yourself (forbidden under Rule 1.15 in event of dispute) or letting unclaimed money sit indefinitely. Avoid it: If a client disputes your fee, isolate the disputed amount in trust until resolved (you can withdraw the undisputed portion). Document your communications about the dispute. For unclaimed funds, make diligent efforts to find the owner – send letters, check last known addresses. Colorado allows, after exhaustive efforts, sending unclaimed money to COLTAF where it can do some good until claimed. But you must keep records of that and be ready to refund if the client reappears. The key is to never treat unclaimed or disputed funds as yours. They are always client property unless a court or agreement says otherwise.

By being aware of these common pitfalls, you can establish safeguards to avoid them. Many are prevented by routine habits: segregate funds, document everything, reconcile often, and double-check before acting. In Colorado’s climate of strict enforcement, an “innocent mistake” might still land you in hot water if not promptly corrected. However, a conscientious attorney who has good systems and seeks guidance when unsure will usually be fine. OARC even offers a Trust Account School for lawyers and staff, which can be a great resource if you want additional education (and it’s sometimes required as a diversion for those who slip up).

In the next section, we’ll compile a handy compliance checklist and best practices summary for Colorado trust accounts – a quick reference for law firm administrators and bookkeepers who want to ensure everything is in order.

Best Practices and Compliance Checklist for Colorado Trust Accounts

Staying compliant with Colorado’s trust accounting rules is much easier when you incorporate best practices into your firm’s everyday procedures. Below is a practical checklist you can use to audit your trust accounting practices and ensure nothing falls through the cracks:

- ✅ Use Dedicated, Approved Trust Accounts: Maintain your client trust funds in a COLTAF-designated trust account at an approved Colorado bank – never in your operating account. Verify that the account is titled properly (e.g., “XYZ Law Firm COLTAF Trust Account”) and that the bank will report any overdrafts to OARC. Do not use this account for any personal or firm funds (except minimal bank fee reserves) to avoid commingling.

- ✅ Keep Operating and Trust Funds Separate at All Times: Ensure that firm money and client money are always segregated. Don’t deposit client payments for future fees into your business account. Likewise, don’t pay firm bills out of the trust account. Every dollar in trust should be attributable to a client or third party. Periodically review the trust account for any funds that belong to the firm (earned fees that haven’t been moved) and transfer them out timely.

- ✅ Educate Your Team and Enforce Procedures: Make sure anyone handling trust transactions understands Colorado’s rules and your internal protocols. Use written procedures for tasks like deposits, disbursements, and reconciliations. For example, require a two-person review for each trust check, or have the managing attorney review the reconciliation monthly. Creating a culture of compliance is one of the best defenses against mistakes.

- ✅ Record Every Transaction with Detail: Adopt a robust record-keeping system that logs all deposits and withdrawals with who, when, why, and for whom. For each client, maintain a separate ledger showing their deposits, payments, and current balance. Track even small transactions like bank interest or wire fees. Retain copies of supporting documents (deposit slips, canceled checks, invoices). Colorado requires these records for 7 years, so organize them for easy retrieval. If using software, make sure you can export or print records on demand.

- ✅ Perform Three-Way Reconciliation Monthly: Reconcile the trust account every month (don’t wait for the quarterly requirement). Compare the bank statement with your client ledgers and your check register. If any discrepancies arise, investigate and correct them immediately. Document the reconciliation and have a principal sign off. Regular reconciliation is one of the strongest indicators of sound trust management (and it will satisfy auditors that you’re on top of things).

- ✅ Never Disburse More Than a Client’s Balance: Before cutting a check or transferring funds, verify that the client has sufficient money in trust and that the total account balance can cover it. Avoid writing checks on uncleared funds. This prevents accidental overdrafts and the chain reaction of ethics issues that would follow. Use software alerts or a manual check system – whatever it takes to ensure you never go “in the red” for any client.

- ✅ Promptly Address Account Fees or Errors: Monitor your trust account for any bank fees, check printing charges, or errors. If the bank deducts a fee from the trust account, replenish it from the firm’s money promptly (so the clients’ balances aren’t affected). If you spot a bank error (it happens), contact the bank immediately. Keeping the account whole is your responsibility, even for small amounts.

- ✅ Replenish and Distribute Funds in a Timely Manner: Develop a routine for moving funds as needed. For example, if you bill monthly, also withdraw earned fees monthly from trust to operating (with proper documentation to the client). Likewise, if a case is over and a client is owed a refund, don’t wait – cut the check and deliver it with a final accounting. Stale funds in trust are a magnet for confusion and possible rule violations. By clearing out what shouldn’t be there (earned fees out, client refunds out), you keep the trust account “lean and clean.”

- ✅ Plan for Unclaimed or Remaining Funds: If you have funds that can’t be returned to a client (unable to locate them, etc.), follow Rule 1.15B(k) procedures. Generally, that means holding the funds for a while as you attempt contact, then eventually remitting to COLTAF as unclaimed property (with records of your efforts and the remittance). Don’t just leave unclaimed money forever in the trust account – it complicates your reconciliation and could violate unclaimed property laws.

- ✅ Use Technology to Your Advantage: Consider using specialized legal accounting software or features in QuickBooks tailored for trust accounting. For instance, software that supports three-way reconciliation and real-time tracking of client trust balances can reduce human error. Many solutions (like LeanLaw, Clio, etc.) will prevent common mistakes by design – for example, warning if a disbursement exceeds the available balance. They also simplify generating reports and audit trails. While software is not mandatory, it can greatly streamline compliance and free up your staff’s time for other tasks.

- ✅ Conduct Periodic Self-Audits: Every so often (say, annually or semi-annually), do a mini audit of your trust procedures. Use a checklist (like this one) to verify you’re following each step. Review a random client’s ledger and ensure you have all backup for their transactions. Make sure your trust account is included in any firm-wide financial audits or reviews. It’s better to catch a lapse yourself than to have a regulator or unhappy client catch it.

By following this checklist, firm administrators and bookkeepers can create a strong safety net around the trust account. These best practices not only keep you compliant with the Colorado Rules of Professional Conduct but also enhance overall client trust in your firm. A well-managed trust account means clients’ money is safe, which is fundamental to your reputation.

Finally, let’s look at how modern legal accounting software, such as LeanLaw, can support your trust accounting and IOLTA compliance – acting almost like an automated assistant to ensure you meet all these requirements with ease.

How Legal Accounting Software (Like LeanLaw) Supports IOLTA Compliance

Managing a Colorado trust account manually can be time-consuming and nerve-wracking. Fortunately, technology can shoulder much of that burden. LeanLaw, for example, is legal accounting software that integrates deeply with QuickBooks Online to simplify trust accounting for law firms. Here are ways software tools like LeanLaw can help your firm stay compliant with IOLTA and trust accounting rules:

- Automated Three-Way Reconciliation: LeanLaw’s trust accounting features include built-in three-way reconciliation that continuously syncs your bank balance, trust ledger, and QuickBooks records. This means at any given moment, you can see that your books match the bank and each client’s balance is accurate. The software essentially performs a mini-reconciliation each day as transactions occur, and it can generate reconciliation reports on demand or on a schedule. By automating this process, LeanLaw helps ensure you are “well positioned for your weekly or monthly three-way reconciliation” with minimal effort. Regular reconciliations become less of a chore and more of a by-product of everyday usage.

- Error Prevention and Alerts: Good legal accounting software enforces the rules we’ve discussed. For instance, LeanLaw will not let you overdraft a client’s trust balance when entering a disbursement – it will flag an error if you attempt to record a payment that exceeds the available funds for that client. It also keeps your operating and trust funds segregated within the system, so there’s no accidental commingling of transactions. Some software can even notify you if a trust balance is running low (prompting a retainer replenishment) or if funds have been sitting untouched for too long. These safeguards act as a second set of eyes, catching potential mistakes before they happen.

- Integrated IOLTA Accounting in Workflows: LeanLaw has IOLTA (trust) accounting built into the invoicing and payment workflow. For example, you can apply trust funds to pay a client’s invoice directly through the software. When you generate an invoice for a client, LeanLaw can show the client’s trust balance on the bill. With a few clicks, you can allocate trust money to that invoice, and LeanLaw will decrement the client’s trust balance and record the transfer to your operating account appropriately. What might be a multi-step, manual process in QuickBooks alone (writing a check, recording a journal entry, etc.) becomes a seamless part of billing. As LeanLaw’s team puts it, “What used to be a daunting 12-step trust accounting process in QuickBooks Online is now just a few clicks.” By streamlining these transfers, software reduces the chance of human error and ensures that trust withdrawals for earned fees are properly documented every time.

- Clear Audit Trail and Reporting: Every transaction entered through LeanLaw is tracked and tied to a client matter. You can easily pull reports showing all trust activity for a period, or a ledger report for a specific client, or even a list of all clients with current trust balances. If OARC ever asks for records, you can export the data with confidence that nothing is missing. LeanLaw also maintains the required details (date, payor/payee, purpose) in each entry, satisfying Colorado’s recordkeeping rules. Some software (LeanLaw included) allows attachments, so you can attach a scanned copy of a check or deposit slip right into the transaction record. Having this level of organization frees up your staff’s time – instead of manually compiling information, they can generate it in seconds, and they know it’s accurate.

- Compliance with Colorado-Specific Settings: Because LeanLaw and similar tools work with many law firms, they often incorporate state-specific requirements. For instance, LeanLaw knows that Colorado requires using COLTAF for IOLTA – so the software might label the account accordingly and even include fields relevant to COLTAF’s needs. It’s also aware of the seven-year record requirement and can help you archive older data properly. Essentially, it’s designed “to allow you to not only stay in compliance with industry standards but also ensure that you are meeting state bar rules and regulations when handling IOLTA trust accounts.” LeanLaw’s approach is to embed compliance in the workflow, so you don’t have to be constantly thinking, “Am I doing this right?” – the software guides you.

- Integration with Banks and Online Payments: Many modern legal accounting platforms integrate with payment processors or bank feeds. LeanLaw, for example, can integrate with online trust payment portals (so clients can deposit retainers via e-check or credit card directly into your COLTAF account). This integration means when a client makes a payment, it’s automatically recorded to the right client ledger. Bank feed integration allows downloaded transactions from your bank so you can match them in the software. By reducing manual data entry, you eliminate transcription errors. And when a trust payment or deposit occurs, the system can automatically generate the appropriate entries in QuickBooks, keeping everything consistent.

- User-Friendly Experience for Staff and Accountants: One often overlooked aspect is that if the software is easy to use, your team will actually use it (and use it correctly). LeanLaw prides itself on being lawyer-friendly and bookkeeper-friendly. The lawyers can work in the LeanLaw interface (logging time, creating invoices, initiating trust transfers) while the accounting folks work in QuickBooks, and the data syncs in real time. This means your bookkeeper can see the trust account transactions and reconcile them even if the attorney was the one who initiated them in the front-end. Having everyone on the same system reduces miscommunication. Also, because LeanLaw is purpose-built for law firms, it uses terminology and flows that match legal practice (like distinguishing trust retainers from revenue). This reduces the learning curve and chances of mistakes from someone misunderstanding the process.

In summary, a tool like LeanLaw acts as a compliance partner. It reinforces best practices (like monthly reconciliation and detailed recordkeeping) and takes care of much of the heavy lifting in trust accounting. This doesn’t mean you can “set it and forget it” – you still need to review and supervise – but it dramatically lowers the risk of human error and saves valuable time. Many small and mid-sized firms in Colorado find that with LeanLaw’s trust accounting, audits become uneventful and straightforward, because everything is organized and in-line with the rules by design.

LeanLaw in particular is a popular choice for Colorado firms because of its QuickBooks integration and focus on trust accounting. (It’s even recognized as a top legal app in the QuickBooks Online app store.) Of course, whether you use LeanLaw or another solution, the key is that technology can help you sleep at night knowing your COLTAF and trust obligations are being met. It’s like having an assistant bookkeeper who never gets tired or forgets a step.

By now, we’ve covered a lot: Colorado’s specific trust account rules, the role of COLTAF and IOLTA, step-by-step processes, pitfalls to avoid, best practice checklists, and the role of software in compliance. Managing client trust funds in Colorado is undoubtedly a serious responsibility – but with knowledge and the right tools, it’s very achievable for a small or mid-sized firm to do it correctly.

In the end, trust accounting is about justifying the trust clients place in you. When you manage their money with transparency and fidelity, you uphold the highest standards of the legal profession. Colorado’s strict rules and OARC oversight might feel onerous at times, but they exist to protect you and the public. Many lawyers have said that once they established a reliable trust accounting system, it became second-nature – just another part of running a successful, ethical law practice.

Use this guide as a reference whenever you’re in doubt about handling client funds. And remember, when in doubt, don’t guess – consult the Colorado RPC 1.15, reach out to OARC’s resources, or even consider LeanLaw’s knowledge base or support for guidance. With careful attention, you can ensure that your firm’s IOLTA and trust accounting not only complies with Colorado’s rules but also reinforces your firm’s reputation for integrity and professionalism.

Now let’s address some frequently asked questions about IOLTA and trust accounting in Colorado to solidify our understanding.

FAQ: Colorado IOLTA and Trust Accounting

Q1: What is an IOLTA account and do I need one in Colorado?

A: An IOLTA account (Interest on Lawyers’ Trust Account) is a type of pooled trust account that lawyers use to hold client funds that are small in amount or kept short-term. In Colorado, IOLTA accounts are generally mandatory for private practice lawyers who handle client money. The interest from IOLTA (pooled) accounts is sent to COLTAF, which funds legal aid programs. If you hold any client funds that are not immediately earned, you need to deposit them into a trust account. For most routine client funds, that will be your COLTAF IOLTA account. Only if the amount is large enough or will be held long enough to earn net interest for the client should it go into a separate interest-bearing account for that client. So yes – virtually every Colorado firm that holds client money needs an IOLTA account. It’s both a compliance requirement and a way to contribute to a good cause.

Q2: What is COLTAF and what does it do?

A: COLTAF stands for the Colorado Lawyer Trust Account Foundation. It’s the entity that administers Colorado’s IOLTA program. When you deposit client funds in a COLTAF account, the bank forwards the interest to COLTAF. COLTAF then uses that money to provide grants to Colorado legal aid organizations, pro bono programs, and other access-to-justice initiatives. COLTAF was established by the Colorado Supreme Court in 1982 and has since distributed tens of millions of dollars for legal services for the poor. In practical terms for lawyers, COLTAF is who you register your IOLTA with (through the bank), and they set rules in coordination with the Court (like approved banks, interest rate requirements). COLTAF also handles special situations like unclaimed client funds: Colorado Rule 1.15B(k) allows you to send truly unreturnable funds to COLTAF after diligent efforts. Thus, COLTAF is both a funding mechanism for charity and a component of Colorado’s trust account regulatory system.

Q3: What are the key rules in Colorado RPC 1.15 that my firm should know?

A: Colorado RPC 1.15 is extensive, but the critical points are:

- Segregation: Keep client funds in a separate trust account, not with your own funds. No commingling allowed (except a tiny amount for bank fees).

- IOLTA vs. separate accounts: Use a COLTAF IOLTA account for most funds. Use a separate interest-bearing trust account for client funds that are significant enough to earn interest for the client.

- Approved institutions: Your trust account must be at an approved bank that will report overdrafts to OARC.

- Proper withdrawals: No cash withdrawals or checks to cash from trust; only withdraw via check or transfer to specific payees, and only for proper purposes (client refunds, payments, or moving earned fees to your firm).

- Recordkeeping: Maintain detailed records for each client matter (ledgers, deposit/disbursement info) and keep all records for 7 years.

- Reconciliation: Reconcile trust accounts at least quarterly (both the total and individual client balances) – though monthly is recommended.

- Prompt notice and delivery: Inform clients when you receive funds for them and promptly pay out funds they’re entitled to (don’t hold on to client money without authorization).

Following these rules will keep you in compliance. Any violation – even without bad intent – can lead to disciplinary action, so they’re taken seriously.

Q4: What are common mistakes that lead to trust account trouble in Colorado?

A: Frequent mistakes include commingling funds (e.g., depositing a retainer in the operating account by accident, or leaving earned fees in the trust too long), recordkeeping errors (not tracking each client balance, resulting in confusion or overpayment), and failure to reconcile (which means you don’t catch errors or shortages in time). Another common issue is inadvertent overdrafts – for instance, cutting a check before a deposit clears, or math errors that cause one client’s disbursement to dip into another’s funds. Mislabeling accounts (not clearly marking an account as “trust”) can also cause issues, as can not using an approved bank (rare, but if a lawyer uses a small bank that isn’t approved, they’d be in technical violation). In Colorado, even unintentional misuse of trust funds – like an associate using the trust account for convenience or a bookkeeper transferring money the wrong way – can result in discipline. The Office of Attorney Regulation Counsel sees many cases each year arising from sloppy trust accounting. That’s why they emphasize that mishandling client money is a fast track to sanctions. The good news is these mistakes are avoidable with proper systems: double-check your work, reconcile frequently, and train everyone on the do’s and don’ts.

Q5: How can software like LeanLaw help me manage my COLTAF trust account?

A: Legal-specific accounting software can be a game-changer for trust account management. LeanLaw, in particular, is designed for law firms and has features to ensure trust accounting compliance. It automates many tasks: for example, LeanLaw will automatically update client trust ledgers when you receive payments or pay invoices from trust. It also provides three-way reconciliation tools, meaning it can match your bank balance with your client balances and QuickBooks ledger continuously. LeanLaw integrates with QuickBooks Online, so you get the robustness of QuickBooks plus the specialization of LeanLaw (they call it a “financial operating system” for law firms). With LeanLaw, you can do things like request electronic trust deposits from clients, track every transaction by client matter, and generate reports that prove your compliance. Essentially, it reduces the manual work and chances for human error. One of LeanLaw’s benefits is that IOLTA accounting is built into the workflow – when you create an invoice, the software knows if the client has trust funds and can apply them with a click. This ensures you don’t accidentally bill a client and forget to use their retainer. It also means moving funds from trust to operating (when earned) is properly recorded. Overall, software like LeanLaw serves as a safeguard: it’s like having a knowledgeable assistant reminding you of the rules at each step and doing the heavy lifting of calculations and tracking. While you still need to understand the basics (software isn’t foolproof if used incorrectly), it significantly lowers the risk of mistakes and saves time. Many Colorado firms our size use LeanLaw or similar tools because it lets them focus on practicing law while staying confidently compliant with trust accounting obligations.

By following Colorado’s trust accounting rules, leveraging best practices, and possibly using technology to assist, your law firm can successfully manage IOLTA and client trust accounts with minimal stress. The key takeaways are: always put client interests first with their funds, keep excellent records, and reconcile often. Doing so protects your clients, your license, and your peace of mind.

For further information, you can refer to the Colorado Rules of Professional Conduct Rule 1.15 (sections A through E), the COLTAF website for lawyer FAQs, and resources provided by the Colorado OARC (like their Trust Account Handbook and School). And of course, don’t hesitate to consult with a legal accountant or utilize software like LeanLaw to keep your trust accounting on track.

Proper trust accounting may seem daunting at first, but with the guidance from this article, you’re well on your way to mastering it for your Colorado law firm. Happy (compliant) accounting!