Most attorneys take earning and maintaining their client’s trust very seriously.

They know that clients have plenty of options when it comes to choosing a law firm and that having a client place faith in their firm to handle their legal matters is something not to be taken lightly.

But most lawyers also know that they didn’t go to law school to become accountants and that handling client funds appropriately (in order to maintain that trust) is something they may have to get help with in order to do it well.

And that help will come through implementing good trust accounting software into their firm’s tech stack of practice management resources.

Key Takeaways

- Though business accounting may not be a strength (or an interest) of many attorneys, it is a necessary part of running a successful law firm.

- Having the right legal accounting software in place can make a big difference in simplifying your firm’s accounting needs while also ensuring that accuracy and accountability is easily maintained.

- Trust accounting is one facet of legal accounting software that can not be overlooked and must be prioritized for any lawyer or firm that handles client funds.

Proper attorney trust accounting is vital if an attorney wants to maintain transparency, integrity and accountability with their clients.

This type of accounting also ensures that client funds are being securely held and are used solely for the purposes for which they are intended.

In order to do this, an attorney must establish and maintain trust accounts that are separate from their operating account in order to keep their client funds safeguarded and to ensure that those funds are never commingled together.

By doing this, an attorney will then demonstrate to their clients that they are committed to protecting their trust funds while also avoiding any potential legal consequences that could arise if these funds aren’t handled properly.

This all sounds simple and straightforward enough, right?

Perhaps. But for an attorney working in a busy law office, keeping track of all the rules and regulations that surround trust accounting can often feel overwhelming, particularly as their client list grows and more expenses are generated.

It can be easy to forget some of the steps that are crucial to trust accounting when trying to juggle all the other necessary tasks with growing a law firm.

For this reason, many attorneys have learned that implementing good trust accounting software into their firm’s legal tech stack is going to save them hours of accounting work and potential headaches later on.

Not only can trust accounting software automate many of the tasks associated with managing client trust accounts, but it will also provide an attorney with the tools needed to make sure that mistakes are not made (or are caught early) and to be able to accurately report on client trust account balances, correctly record account balances, conduct three-way bank reconciliations, many of the other aspects that are associated with good trust accounting practices.

If you are thinking of upgrading your firm’s legal management software system to include better and more accurate trust accounting software, let’s make sure you understand the basics before you begin.

Even though you’re not interested in being an accountant, knowing the fundamentals of a good trust accounting software system will pay off in the long run and will help you get back to doing what you do best…practicing law.

The 10 Basics of Legal Trust Accounting

You don’t have to be an accounting expert or a bookkeeping wiz to be able to maintain and manage your client’s funds successfully.

That said, the entire trust accounting process will be significantly easier (not to mention more compliant) if you learn and follow these 10 most basic steps when it comes to your client’s money and the management of it.

1. Account Management: One of the most basic rules of trust accounting that a lawyer or law firm must adhere to is making sure that all trust account funds are held in separate accounts from the firm’s operational accounts.

A client’s funds are never to be confused with the law firm’s operating funds until a service has been rendered and an invoice has been paid.

Lawyers have found themselves facing severe consequences for using a client’s money for operational expenses, like paying rent or payroll.

For this reason, having clear bank accounts that separate these funds is a crucial part of your law firm’s best practices.

Trust accounting software allows you to create and manage separate trust accounts for your clients, keeping their funds segregated and ensuring compliance with accounting rules and regulations.

With this feature, you can easily track and monitor the balance and activity of each trust account, which will not only provide transparency but peace of mind as well.

2. Transaction Recording: A firm that chooses to use trust accounting software will be more organized and better able to track all financial transactions that are related to each client’s money.

From depositing client payments to disbursing funds for payments or expenses, trust accounting software can make it almost effortless to be able to accurately document each transaction as it’s happening.

With trust accounting software that is also synched with your other accounting resources, you will always be able to maintain a clear audit trail and simplify the process of reviewing and reconciling transactions.

Trust accounting software takes any guesswork out of the system and makes it easy for anyone in your law firm to be able to accurately report on each client’s financial balance in real time and with confidence.

3. Bank Reconciliation: No matter what your profession, balancing your business bank accounts is crucial to your overall financial health…and lawyers are no exception to this.

Trust accounting software streamlines the process of reconciling trust account balances with bank statements and good trust accounting that is in sync with the rest of your accounting software will allow for three-way reconciliation to happen as regularly as you wish.

Trust accounting software automatically compares your recorded transactions with the bank’s records, helping identify any discrepancies and ensuring accurate account balances.

This feature saves your entire staff valuable time and greatly reduces the risk of errors that may arise from manual reconciliation.

4. Matter-Based Accounting: Trust accounting software can be specially designed to organize all of your firm’s financial transactions and balances by matter or by client, allowing you to allocate funds to specific cases or matters.

For example, let’s say your law firm is handling multiple matters for a specific client.

Step-By-Step Process for Attorneys & Law Firmsto Buy Law Firm Software

Understand who needs what and prioritize features as you investigate new software. Download Buyers Guide eBookWith matter-based accounting, you can create separate accounts within the trust accounting software for each one of those matters so that it can be easy to see which funds are being allocated to which.

Then, when a client makes a payment or provides additional retainer funds, the trust accounting software can record the transaction and allocate the funds to the corresponding account.

This allows you to accurately track how much money is held in the client’s trust account for each case, how much has been disbursed for expenses, interest earned or fees, and what the remaining balance currently is.

By organizing the financial activity on a matter-by-matter basis, you can easily generate reports and gain insights into the financial status of individual cases.

This matter-based accounting feature provides a clear overview of each client’s financial activity, making it easier to track the movement of funds and accurately allocate expenses and payments as needed.

5. Automated Calculations: One excellent advantage of implementing rust accounting software into your firm’s tech stack is the automation features it brings to your accounting department.

From calculating interest on client’s held money to tracking deposits and withdrawals, trust accounting software can automate many of the tasks that were traditionally done by hand.

This automation can greatly reduce the potential for human errors and save valuable staff time by eliminating many of the manual computations that had to be done in the past.

By leveraging pre-designed, built-in formulas and rules, the software handles complex calculations effortlessly, reducing the potential for errors and ensuring compliance with interest calculation requirements.

6. Compliance Tracking: Staying compliant with the rules and regulations that govern trust accounting in your jurisdiction is crucial to your trust accounting management and your firm’s overall success.

Any trust accounting software that you consider implementing should be specifically designed to include features that keep your firm compliant with those trust accounting rules and regulations.

It should be designed to provide alerts and reminders for required actions and deadlines, such as filing reports or conducting regular trust account audits.

This type of proactive compliance tracking functionality helps you avoid any penalties or other consequences that could arise if your client funds aren’t handled correctly…even if your mishandling wasn’t intentional.

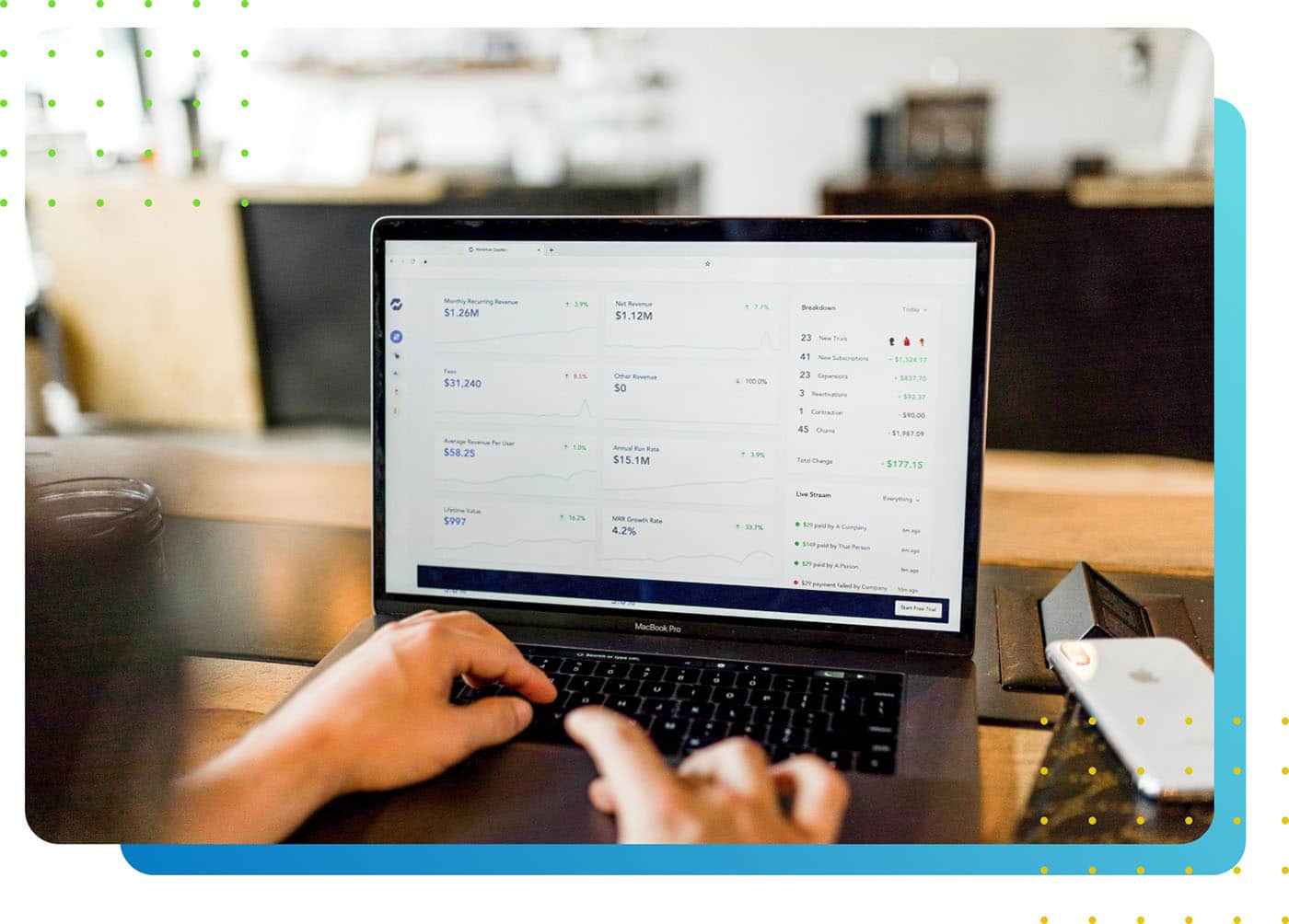

7. Reporting and Analytics: The right trust accounting software should be able to generate comprehensive reports when you need them and provide strong analytics capabilities, giving you valuable insights into your trust account balances, transaction history, and financial performance.

It’s not only important to handle your client funds correctly…it’s also important to be able to communicate with them the status of their account balances and give them up-to-date information quickly and without concern for errors.

Not only that, but trust accounting software will also allow you to generate the needed reports for internal analysis or regulatory compliance purposes. The analytics tools will be able to help you identify trends, monitor your firm’s overall financial health, and make data-driven decisions to optimize your trust accounting processes.

8. Auditing and Compliance: The word “auditing” is less than exciting for most of us, but good trust accounting software makes the process much less painful and much of it automatic.

Trust accounting software facilitates the auditing processes by generating detailed audit trails, maintaining comprehensive transaction logs, and offering tools for generating compliance documentation.

These features take the guesswork out of auditing responsibilities and streamline the entire process, ensuring transparency, accuracy, and adherence to regulatory standards.

9. Integration with Billing Systems: Trust accounting software that integrates with your billing systems is going to make your firm’s entire accounting process significantly easier.

Schedule a demo

This type of integration will allow for seamless invoicing of your clients and automatic recording of fees and expenses from all of your bank accounts.

By eliminating manual data entry and enabling automatic synchronization between trust accounting and billing systems, you can improve efficiency, accuracy, and ensure consistent financial records across both functions.

10. Data Security: Making sure that stored data is safe will make a big difference in how much trust your clients have in your firm.

We all know that data breaches are on the rise across all industries and many of us have been the victim of one in either our personal or professional lives.

The most reputable trust accounting software on the market will prioritize data security and will recognize the need to protect sensitive client financial information as well as any personal information that may be stored as well.

From strong data encryption to access controls and user permissions, good trust accounting software will safeguard against any sort of unauthorized access and data breaches.

By adhering to industry best practices for data security, the software ensures the confidentiality and integrity of your trust accounting data.

Ready to Learn More? LeanLaw Can Help

If you want to improve the way your firm is handling its trust accounting needs, check out what LeanLaw has to offer you.

LeanLaw is billing and accounting software that was designed specifically for law firms and the unique types of financial needs that practicing law presents.

From managing trust accounts to automating time tracking and invoicing, LeanLaw offers a whole array of comprehensive billing and accounting features that have been tailored to meet the financial requirements of law firms.

With LeanLaw, law firms can streamline their billing and accounting processes, improve accuracy, and gain better control over their financial data.

Try our free demo today. And see how much simpler trust accounting can be.