For a law firm that is in the process of establishing their first IOLTA account, certain rules are quite clear, and others you may need to dig a bit deeper to find.

IOLTA accounts in and of themselves are not difficult to understand.

But, because each state has a slightly different approach to the initial set up and the ongoing maintenance and reporting of these financial accounts, it is imperative that whoever serves as your lead accountant or practice management advisor is fully aware of the rules and regulations surrounding an IOLTA trust account in your state.

Not only that, but they need to also be well versed in any potential legal ramifications that could be brought against your law firm and/or the individuals associated with it.

Most state IOLTA accounts have very specific guidelines as to how these funds need to be directed as well as managed. Failure to comply can result in a firm or attorney being heavily fined or even disbarred from the state bar. After opening your IOLTA check frequently to ensure you’re in line with local and federal regulations.

Worse, even if the mishandling of your IOLTA account was not intentional, consequences can still be imposed.

Below are some of the most important rules that need to be followed when establishing and overseeing an IOLTA trust account, as well as some rules that may not be as obvious that still must be adhered to.

1. IOLTA Accounts Must Be Set Up in a Specific Way

One of the first and most important rules around establishing your firm’s IOLTA account is to make sure that you understand how to appropriately set up the account, and the procedure to deposit client funds according to your state’s rules around its IOLTA program.

IOLTA stands for Interest on Lawyer Trust Accounts and is aptly named as these accounts serve a very specific purpose.

Schedule a demo

Created in the early 1980s, IOLTA accounts allow a lawyer or law firm to deposit client funds (often called retainers) into an interest bearing trust account until the agreed upon service is provided by the lawyer or law firm.

At that point, some (or all) of a specific client’s funds can then be moved to the law firm’s operating account, usually after an invoice has been issued for that service.

Because IOLTA accounts are set up to hold client funds until services are rendered, it’s very important that a firm follow certain guidelines when establishing one.

Many financial institutions in every state are capable of opening an IOLTA account for a law firm. In fact, many firms will begin by inquiring at the bank or financial institution that already hold their other accounts.

Do not try to open an IOLTA account on your own. There is specific paperwork that needs to be completed and certain documents that need to be filed and regularly maintained.

If your financial institution is not familiar with how to properly establish and manage an IOLTA account, find one that is.

2. Interest Earned on an IOLTA Account Must Be Transferred and Distributed Appropriately

There is a very good reason why it’s important to set up and establish an IOLTA account with a financial institution that understands the rules surrounding them.

And that reason is this: the interest earned on these types of client trust accounts must be handled in a very specific way.

IOLTA accounts are created to hold short term client funds for several of a law firm’s clients at the same time.

(Clients who have an ongoing relationship with a firm or are providing a particularly large retainer will oftentimes have their own, separate account set up with the firm’s financial institution.)

But for the client’s funds that are most likely going to only be held for a short period of time, pooling these funds into one IOLTA account makes sense.

Then, the interest earned on these trust accounts is transferred to the state’s IOLTA program where it can then be used for a variety of purposes.

Most states choose to use the net interest received from IOLTA accounts to help fund civil legal services, grants for local nonprofits and even scholarships for underserved students attending law school or other legal profession degrees.

A firm that doesn’t take the correct measures to ensure that the interest earned on their IOLTA trust account is transferred appropriately to the state IOLTA program can find themselves facing some serious fines or legal consequences.

3. Client Funds that are Held in an IOLTA Account Should Never Be Used for Operating Expenses

Remember, a firm can never – under any circumstances – use client funds or interest earned on client funds for their own operating costs.

For example, let’s say that your firm’s IOLTA account has a debit card attached to it.

Schedule a demo

Under no circumstances should you, or anyone in your firm, use that debit card to withdraw funds to pay for a service for your firm.

Even an unintentional misuse of IOLTA account funds can have some dire consequences for a firm and those involved in any mismanagement of a client trust account.

Therefore, it’s imperative that you work with a banking institution that understands how IOLTA account earned interest must be transferred and that you have legal accounting software in place that can record these transfers accurately.

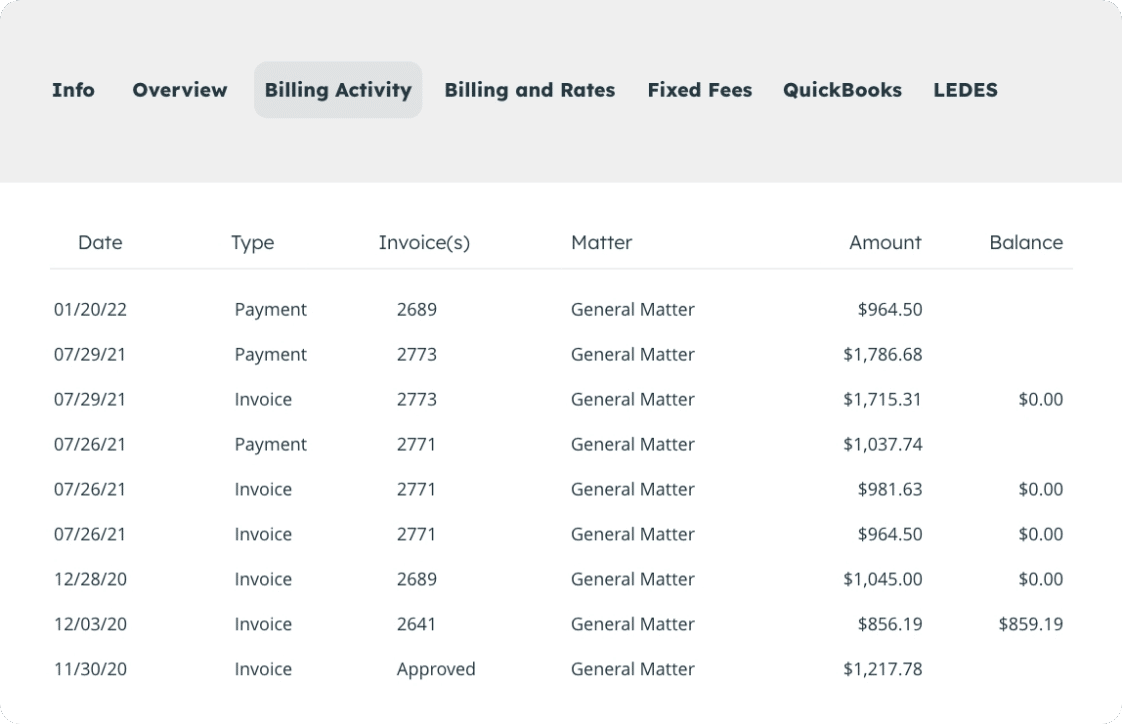

4. An IOLTA Account Must Comply with Three-Way Reconciliation

As stated above, not only is it important that you work with a financial institution that is fully cognizant of and compliant with your state’s IOLTA account rules, but it’s also important that your firm’s accounting software is capable of correctly recording IOLTA account transactions and providing you with accurate reports to ensure that nothing is being overlooked or mistakenly mishandled.

One of the key components for doing this is through an accounting system called three-way reconciliation.

Three-way reconciliation means that the balance shown in your trust accounts will sync with your firm’s operating account and also your accounting software balance.

This type of synching of all accounts is going to be crucial when it comes time for monthly or quarterly reconciliations of all your accounts.

Finding the right software is going to be crucial in the three-way reconciliation process.

In fact, three-way reconciliation is probably one of the most important features in making sure your IOLTA trust account is accurate and being managed appropriately, since you’ll be able to see that the data you are looking at is in sync with all of your other accounts.

This type of real-time accounting will give everyone at your firm the peace of mind that your financial institution and your accounting department are all depositing, recording and transferring funds appropriately, particularly funds that are being held in your IOLTA trust account.

5. Keep Accurate Accounting Documentation on Every IOLTA Account Transaction

Finally, even if you have found a reputable bank to set up and handle your IOLTA account, and even if you’ve implemented the best legal accounting software to help track and report any and all transactions that are occurring, it’s critical that you make sure that how you now document all of these happenings is done in a timely and accurate manner.

Having the right resources and tools in place is going to go a long way in making your firm’s accounting practices solid. But, without the proper documentation, it is going to be a much bigger challenge to prove your accounting accuracy if the need ever arises.

A reputable law firm will pride itself on its efficiency and transparency. Prioritizing appropriate, consistent and accurate recordkeeping and documentation will go a long way in helping to achieve that.

Remember, even the smallest transaction in and out of your IOLTA account must be recorded and accounted for, regardless of the size. Not only that, but if you are ever asked to supply specific transaction reports to a client or your state’s bar association, you should be able to do that upon request.

LeanLaw: Your Answer for the Best Rule-Following Accounting Software Available

Running a law firm is a complex job. From keeping track of accounts receivable and payable to managing staff needs, there is an endless list of items that need to be taken care of…and accuracy and efficiency are always going to be a high priority.

LeanLaw is a leader in the world of legal accounting software. Our business was created with one goal in mind: to help your firm be more efficient, collaborative and profitable through smarter financial operations.

In fact, LeanLaw was engineered and designed by experts who know first-hand how law firms actually work!

Using the highly popular and accurate QuickBooks Online platform, our legal software can provide a seamlessly integrated, complete financial solution for any mid-sized law firm that is looking to reduce overhead and find workflow efficiencies.

With an easy-to-integrate three-way reconciliation system, you will have complete peace of mind, knowing your accounts are all in sync and that the numbers you see match with real time balances in each and every one of your accounts.

Are you ready to simplify your firm’s accounting procedures, while also making them something you can be confident and proud of? Reach out to LeanLaw and schedule a free demo today!