A busy law office has so much more on its plate than just making sure its clients receive the best advice they need and the counsel they deserve.

From navigating the ever-changing staffing needs to overseeing multiple lawyer trust accounts and other types of accounting responsibilities, managing a law office must be done with as much accuracy and efficiency as possible, while always concentrating on the financial bottom line.

Not to mention, there are also strict rules and regulations that must be followed in certain areas of any practice in order to stay in compliance with local and federal laws, as well as your state’s bar association.

For example, one very clear law is that an attorney or their law firm can never mix operating accounts with any account that is holding client funds, no matter how big or how small.

That said, it is very common for a law firm to ask new clients for a retainer for services not yet rendered. When this is done, a firm must decide how those dollars are going to be safeguarded without depositing them into any of the already existing lawyers trust accounts that aren’t specifically earmarked as an IOLTA account.

What is IOLTA an Acronym for?

The term IOLTA stands for Interest on Lawyers Trust Accounts and has now been in existence for over forty years.

When an attorney asks for and receives a large sum of money (a retainer) from a client for future work they will do on that client’s behalf, the law firm will typically set up an interest bearing account for that client, from which they can withdraw money when services have been provided.

Schedule a demo

This allows the law firm to be paid promptly, and the money can easily be transferred from a client’s interest bearing account into the law firm’s operating account.

But many law firms also have clients whose retainer amount is not substantial enough to warrant establishing a separate account for these types of short term client funds.

This is usually the case when a client will only be using that law firm for a specific case or for a limited amount of time.

In situations like these, it makes sense to pool all the smaller retainers together into one interest bearing trust account from which a client’s money can be withdrawn when needed.

A combined client trust account makes sense for everyone because the interest earned on these funds will not be enough to benefit the individual client and it would be an enormous accounting challenge for a firm to try and keep track of that many various client trust accounts on an ongoing basis.

These are types of accounts that are referred to as interest on lawyers trust accounts, or IOLTA accounts for short.

What Happens with the Interest Generated from an IOLTA Account?

Remember, a law firm can not benefit from any interest that is earned on any client funds, regardless of whether or not they are funds that are pooled together, or being held in their own, individual accounts.

Clients who have larger retainers with a firm will have their own separate accounts, and the interest earned on those accounts will be earmarked for them.

But the interest earned on client funds that are pooled together in an IOLTA account will be transferred to that particular state’s IOLTA program.

The financial institution that holds the IOLTA account will be responsible for remitting the net interest on a monthly or quarterly basis.

Most state IOLTA programs are set up through that state’s bar association.

Though each state has the right to make its own rules and regulations around how the IOLTA program is going to be run and how the net interest will be used, most states have IOLTA programs that use the generated funds to award grants to nonprofit organizations and provide civil legal services for disadvantaged families and children.

How Do I Know if I Need an IOLTA Program?

If you are a law firm that is practicing in any of the 50 states and are holding short term client funds, you will need to set up an IOLTA account with a partnering bank or financial institution.

Most firms set up their IOLTA accounts with the banking institution that holds their operating accounts, but your bank will be able to confirm with you whether or not they have the ability to help you establish an IOLTA fund.

Once the IOLTA account is open, it is imperative that proper records are kept and accurate bookkeeping is done. Understanding IOLTA account rules on a federal level and in your state is essential to you and your clients benefiting from these accounts.

Most states have stringent rules and regulations around IOLTA accounts and the state IOLTA program they benefit from. An attorney and/or law firm can find themselves facing some dire consequences if these funds aren’t handled properly, from heavy fines to even potential disbarment, depending on the severity of the situation.

How do I Guarantee My IOLTA Account is Being Run Properly?

Because of the sometimes complicated nature of IOLTA programs, it’s going to be in your firm’s best interest to do what is necessary to make sure that your IOLTA account is set up correctly and is being run accurately.

The best law firms are those that are known for transparency, efficiency, and integrity.

With an accounting software program like LeanLaw, your law firm can spend less time focusing time and talent on the operational side of your business and spend more time cultivating relationships and generating income for the firm.

LeanLaw is the top-rated legal app in the QuickBooks online marketplace, and for good reason!

Our team has designed a software program that will make sure all of your firm’s legal accounting is done with the accuracy and efficiency that will be easy to navigate, analyze and reconcile.

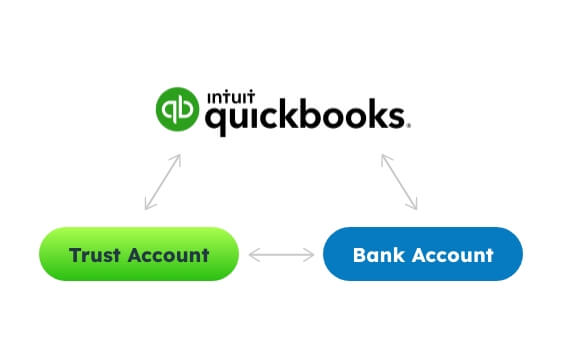

Trust account tracking is complicated, but LeanLaw’s software can help eliminate potential errors and make sure that anyone reading a financial statement will have a clear understanding of what’s transpiring. And, thanks to our three-way reconciliation program, your QuickBooks online software will always be in-sync with all of your bank accounts and be up-to-date and accurate at any given time.

If you’d like to know more about how LeanLaw can help your law firm move to the next level of efficiency and ease, while also improving your firm’s billing and accounting workflow, ask us for a free demo today!

Let 2023 be the year that your accounting department breathes a new sigh of relief!