It is common practice in most law firms to collect a retainer – or payment in advance – from new clients.

Usually, retainers are considered to be any sort of specific payment that a client gives to an attorney or their law firm to guarantee that certain services will be received at a later date.

By asking for a retainer, an attorney can then feel confident that payment is secured for any services they or their firm will then render.

Asking for advance payment in the form of a retainer is quite normal for most legal services and is completely legal and ethical.

But…how an attorney or law firm handles that retainer can end up being problematic – and even illegal – if certain steps aren’t taken as soon as funds are received.

How Do I Handle Client Funds?

When you have a client that gives you a retainer for services in advance, it will be important for you to make sure those monies are placed in the proper type of account.

For example, an attorney or law firm never wants to put client funds into their operating banking or financial account until that client has already been billed for the services rendered.

Placing client funds into a law firm’s operating account prematurely can result in large fines and potential disbarment from their state bar association.

Instead, a reputable firm will want to make sure that all client funds are kept separate from the law firm’s operating account.

Schedule a demo

They can do this by opening a bank account for a specific client’s retainer once it is received.

Money can then be transferred out of that account and into the law firm’s operating account after services are rendered and invoices have been sent and approved.

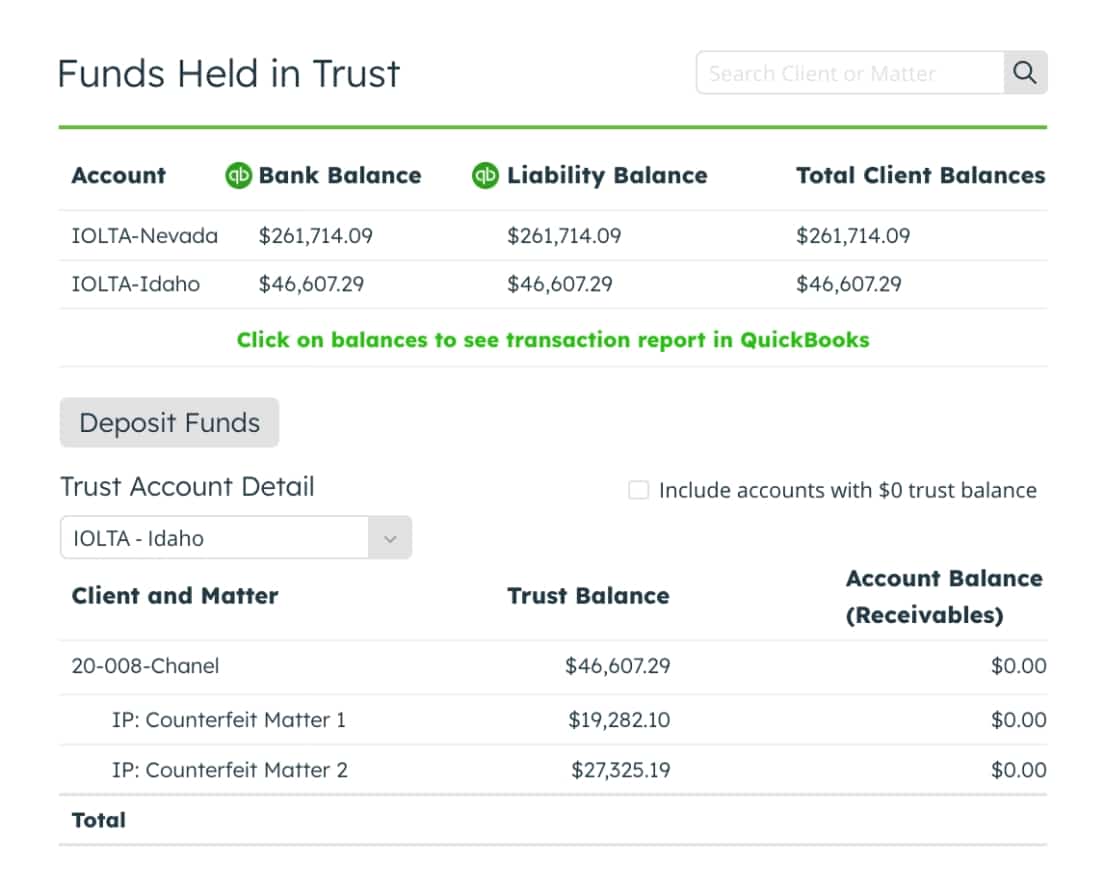

The other option is something that most law firms must implement because they receive small retainers from many clients, making it infeasible to open a separate account for each client.

In a case like this, a law firm will want to combine a new client’s money with other, already-established clients’ money. And this can be done with an IOLTA account.

The History of IOLTA Accounts

For most of our country’s legal history, law firms and their lawyers have been given relatively loose protocols and guidelines when it came to client trust accounts and the various ways they were expected to be managed.

But by 1981, we saw new laws surface regarding lawyer trust accounts, client trust accounts, and how short-term client funds would be handled in the future.

Up until the early eighties, law firms were required by federal law to deposit all short-term client funds into bank accounts where there was no possibility for interest earned on that account.

Up until the early eighties, law firms were required by federal law to deposit all short-term client funds into bank accounts where there was no possibility for interest earned on that account.

The reason for this, remember, is that an attorney or his/her law firm can’t benefit from client money or any interest earned on it.

But IOLTA programs changed all of this when they allowed law firms to place their client’s money into banking accounts that allow for net interest to be earned.

What Happens to the Interest Generated on an IOLTA Account?

When an individual client has a large enough retainer to justify having their own lawyer trust account (sometimes also called a client trust account) then that specific interest bearing trust account will be easy to account for, since only one client’s funds will bear interest from that account.

But when multiple client retainers are to be held in a single trust account, then the interest earned on the account will be transferred to that state’s IOLTA program.

Remember, attorneys and their law firms cannot benefit from any interest bearing accounts that are held in a client’s name.

Therefore, in 1981 state bar rules were passed that stated a law firm could place their client’s money into accounts that would indeed earn interest, but that interest would be transferred to the state IOLTA program as specified.

What Happens to IOLTA Account Money?

When a law firm opens and sets up an IOLTA account, many rules and regulations will have to be taken into account, depending on which state a law firm is located in. Understanding these rules along with the fundamentals of what is IOLTA accounting can help avoid mishandling client funds.

(Each state has its own bar rules that govern its IOLTA program, though many are quite similar and can be applied almost anywhere.)

One of the best things that come from a state’s IOLTA program is that the money can help a large number of people.

Most states’ IOLTA programs are run through the state bar association. The bar decides where to use the incoming IOLTA dollars.

Some of the main usages for these IOLTA programs dollars are:

Do You Want to Get Started on Your IOLTA Today?

LeanLaw is a company founded by an attorney who was tired of endless hours of manual work spent on back office functions like figuring out billing software, bank statements, and account receivable reports.

Schedule a demo

LeanLaw’s industry-specific software can now do all of that for you, plus a lot more.

From invoice preparation to three-way bank statement reconciliation, LeanLaw will take the guesswork and frustration out of your day-to-day activities and allow you to get back to doing what you do best!

Come see what LeanLaw has to offer your practice today.